by R.P. Seawright, Above the Market

We have all heard the arguments about the flaws of active management and we all should have looked closely at the underlying data. Over any random 12-month period, about 60 percent of mutual fund managers underperform. Lengthen the time period examined to 10 years and the proportion of managers who underperform rises to about 70 percent. Even worse, equity managers who underperform do so by roughly twice as much as the outperforming funds beat their chosen benchmarks and the success of the outperformers doesn’t tend to persist. The SPIVA Scorecard from S&P demonstrates this phenomenon regularly and routinely.

Institutional investors fare no better. On a risk-adjusted basis, 24 percent of funds fall significantly short of their chosen market benchmarks and have negative alpha, 75 percent of funds roughly match the market and have zero alpha, and well under 1 percent achieve superior results after costs—a number not significantly different from zero in a statistical sense. Pension funds, hedge funds, endowments and private equity funds all provide similar outcomes in slightly different settings.

Meanwhile, and not surprisingly, assets are following performance. Just a decade or so ago, passive investing was a relatively small slice of the investment universe. On November 1, 2003, just 12 percent of all U.S. open-end mutual fund and ETF assets (not including fund-of-fund or money-market assets) were invested in passively managed products, according to Morningstar. Today that percentage stands at 27 percent and is growing fast. In the equity markets, fully 35 percent of all investments are now held in passive vehicles.

The obvious conclusion from all this data is that active management has lost. Sure, most money is still placed with active managers (at least for now), the story goes, but active management is like Nazi Germany after D-Day. The war wasn’t won (yet) and a lot of work remained to be done, but the outcome was inevitable. That narrative is prevalent throughout the investment world.

However, and to the contrary, I think active management is an absolute necessity.

As an obvious starting point, investing successfully – investing at all – requires the active management of one’s life. The decisions to save, how much to save and how consistently to save must all be actively taken. Figuring out one’s hopes, dreams and goals, developing a plan around them and implementing that plan is decidedly active management. Evaluating risks and opportunities and acting on them is, by definition, an active endeavor. Determining a course, adjusting course as one’s situation changes and staying the course all require action. Staying smart when the markets are going nuts takes active involvement and management, at least with respect to one’s emotions and biases. For all of these crucial matters, passivity and inertia are the enemy. Active management is an absolute necessity.

But I recognize that this argument is more than a bit disingenuous. It isn’t using “active management” in a consistent way or in the way it is most commonly used in our industry. Fair enough. So let’s dig a bit deeper.

As the vast majority of readers will already know, a passive investor most typically looks to hold every security in the market, with the most prevalent of such approaches looking to have each security represented in the same manner and to the same extent as in the market, in order to achieve market returns, usually via index funds. It is a buy-and-hold approach to money management. It guarantees a heavy concentration in the largest, most overly hyped and inflated stocks while requiring that one buy high and sell low but, as John Bogle concedes, “that’s the market.” Even so, indexing beats that vast universe of underperforming active managers.

On the other hand, an active investor is one who is not passive and thus seeks to “beat the market” either in an absolute sense or on a “risk-adjusted” basis. It is often the art of stock picking and market timing, but not always and less-and-less so as time goes on. Because active managers have typically acted on perceptions of mispricing and because these misperceptions change relatively frequently, such managers tend to trade more often – hence the use of the term “active.”

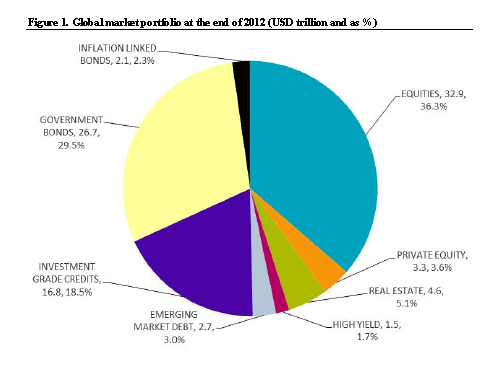

The overall portfolio of a truly passive investor — one who strives to “own” the world market on a cap-weighted basis — will look something like that illustrated below (from here).

But of course making the decision to use such a portfolio and to allocate sector weightings by market capitalization require an active decision. Adjusting this portfolio for risk management or for other purposes or other reasons requires active management. For example, deciding to add real estate more accurately to reflect the extent of real estate ownership worldwide or reducing real estate exposure because of home ownership requires active management.

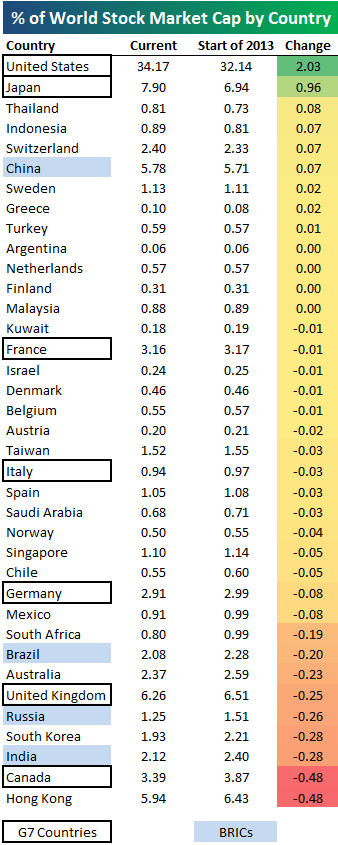

The equity portion of the portfolio will be allocated something like the table (from Greenwich Associates) at right (more here). Bonds will be allocated along these lines. But almost nobody does so (how many American investment portfolios have just a 10-12 percent allocation to domestic equity, for example?). As Jason Zweig reminded me this week, Northern Trust used to have a fund built in this way but it folded several years ago. Many years ago Brinson sold an open-end fund of this sort through UBS, and Vanguard had something similar for a few years too. But these ventures have all been discontinued due to a lack of investor interest.

The equity portion of the portfolio will be allocated something like the table (from Greenwich Associates) at right (more here). Bonds will be allocated along these lines. But almost nobody does so (how many American investment portfolios have just a 10-12 percent allocation to domestic equity, for example?). As Jason Zweig reminded me this week, Northern Trust used to have a fund built in this way but it folded several years ago. Many years ago Brinson sold an open-end fund of this sort through UBS, and Vanguard had something similar for a few years too. But these ventures have all been discontinued due to a lack of investor interest.

However, the more that investors seem to want passive management, the more the fund industry has reacted to that change (sometimes, but not necessarily, for the better). For example, increasing attention has been paid to alternative indexing approaches — so-called “smart beta” – that are built around specific factors (stock price/earnings ratios, company performance, share-price volatility, to name a few). Equal-weighted index investing is also increasingly popular. Choosing any of them is activism, obviously, even if the investment vehicles are quasi-passive (i.e., rules-based, yet the applicable rules must be selected actively).

Similarly, the sorts of approaches that have been shown to work persistently (such as value, size, momentum and profitability) require activism if they are to be utilized. DFA and its very good “asset class diversification” funds and strategies are probably the most prominent examples in this regard. These approaches work (for example, Larry Swedroe’s “structured portfolios“) but aren’t market portfolios of any sort, even if and when the selection mechanisms are rules-based and/or the underlying vehicles are index funds. It’s active management of a different sort.

Unfortunately, most actively managed funds are actually highly diversified and thus cannot be expected to outperform. The more stocks a portfolio holds, the more closely it resembles an index. The average number of stocks held in actively managed funds is up roughly 100 percent since 1980, according to data from the Center for Research in Security Prices. See Pollet & Wilson, “How Does Size Affect Mutual Fund Behavior?” Journal of Finance, Vol. LXIII, No. 6, p. 2948 (December 2008). Large numbers of positions coupled with average turnover well in excess of 100 percent (per William Harding of Morningstar) effectively undermines the idea that such funds could be anything but a “closest index.”

Numerous studies show that funds which are truly actively managed and more concentrated outperform indices and do so with persistence. See, e.g., Kacperczyk, Sialm & Zheng, “Unobserved Actions of Mutual Funds” (2005); Cohen, Polk & Silli, “Best Ideas” (2010); Wermers, “Is Money Really ‘Smart’? New Evidence on the Relation Between Mutual Fund Flows, Manager Behavior, and Performance Persistence” (2003); Brands, Brown & Gallagher, “Portfolio Concentration and Investment Manager Performance” (2005); and Cremers & Petajisto, “How Active Is Your Fund Manager? A New Measure That Predicts Performance,” (2007). As summarized by Cremers and Petajisto:

“Funds with the highest Active Share [most active management] outperform their benchmarks both before and after expenses, while funds with the lowest Active Share underperform after expenses …. The best performers are concentrated stock pickers ….We also find strong evidence for performance persistence for the funds with the highest Active Share, even after controlling for momentum. From an investor’s point of view, funds with the highest Active Share, smallest assets, and best one-year performance seem very attractive, outperforming their benchmarks by 6.5% per year net of fees and expenses.”

Accordingly, it is possible to earn higher rates of return with less risk (particularly since risk and volatility are decidedly different things) via the judicious use of active management as traditionally defined. As the saying goes, nobody is managing the risk of an index. By combining a group of securities carefully selected for their limited downside (think “margin of safety”) and high potential return (think “low valuation” or, better yet, “cheap”), the skilled active manager has a real opportunity to stand out (think of investors such as Klarman, Buffett and Abrams). This approach has practical benefits too in that the resources devoted to the analysis (original and ongoing) of each specific investment varies inversely with the number of investments in the portfolio. And it isn’t so different from the factor-tilts used by DFA and others.

The passive revolution doesn’t mean the end of active management, merely an adjustment in its focus. It makes certain well-supported demands, surely, such as lower costs, better diversification, a more careful consideration of rules-based mechanisms and an approach that is comprehensively data-driven at every level. But active management’s death has been erroneously forecast and proclaimed. Good active management is an absolute necessity. Indeed, the greatest need in the financial planning and investment management universes today is good active management.

Copyright © Above the Market