Gold Market Radar (June 2, 2014)

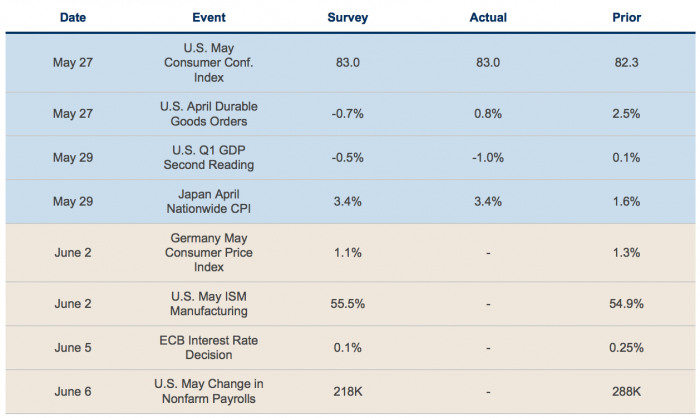

For the week, spot gold closed at $1,249.73, down $42.83 per ounce, or 3.31 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, declined 3.85 percent. The U.S. Trade-Weighted Dollar Index rose 0.01 percent for the week.

Strengths

- Palladium rose to the highest since 2011 as the South African strike reaches its 18th week. The fundamental outlook for the metal remains positive given that demand is expected to beat supply by 1.6 million ounces this year. Platinum on the other hand has not reacted as strongly despite having a similar fundamental supply-demand imbalance. With the South African strike affecting 40 percent of global production for over four months, the supply deficit is expected to reach 1.2 million ounces, the most ever according to Johnson Matthey, the world’s largest refiner. In addition, more and more platinum continues to be locked in ETF products, as demonstrated by the chart below. Given this scenario, and that of producers and refiners drawing from their six-month inventories, it is likely that the second half of the year brings either a shortage or a restocking period, both positive for the metal.

- With the London gold fix under fire following fines to Barclays for attempted manipulation, China is seeking to challenge the dominance of New York and London in gold price setting. The government-backed Shanghai Gold Exchange (SGE) has asked a number of international banks to participate in a planned global trading platform. The SGE is already the world’s largest physical exchange market, despite being domestic focused only. The new plan will open up an international platform for foreign brokers and producers.

- Midway Gold announced substantial resource growth at its Gold Rock Project in Nevada totaling 513,000 ounces of 0.79 gram per tonne ore. The company plans to pursue a preliminary economic assessment (PEA) to determine the viability of the project, which has the added benefit of being located a mere 10 kilometers from the Company’s construction-stage Pan Project. Calibre Mining announced that IAMGold has signed an option to earn up to 70 percent interest in the company’s Eastern Borosi Project in Nicaragua. Under the agreement IAMGold has to meet required exploration spending and a number of cash payments to Calibre over the next six years, as it advances the Borosi gold-silver-copper concessions.

Weaknesses

- Gold dropped the most in 10 weeks as U.S. macroeconomic data was supportive for economic growth. Despite a weaker than expected first-quarter GDP print, the markets focused on the unexpected rise for durable goods and the pick-up in consumer confidence. The yellow metal also weakened after April Hong Kong gold exports to China fell to 67 tonnes from the prior month’s 85 tonnes. It should be noted, however, that Hong Kong gold net exports to China in the first four months of the year rose 18 percent relative to the same period last year.

- Citigroup analysts in its Global Gold Book argue there are limited upside catalysts for gold prices in the near term, even with the ongoing tensions in Ukraine. The bank’s analysts were bearish on gold companies, arguing companies are focused on making ends meet in the near term, ignoring the fact that 75 percent of the industry is burning cash. "We conclude that odds are firmly against a gold company delivering long-term shareholder value," said lead analyst Johann Steyn.

- Gold Fields Ltd. halted most production activities at its South Deep mine in South Africa following the deaths of two workers. The work stoppage will last until the company reassesses operations at its underground workshops, where one of the accidents occurred. Gold Fields, which also operates the Tarkwa and Damang mines in Ghana, appealed to the Ghanaian government for tax relief as mines in the country struggle to turn a profit at current gold prices. The relief is unlikely to be granted given the government is currently battling a 10.8 percent fiscal shortfall.

Opportunities

- Investors should boost their exposure to gold equities according to the most recent report by Macquarie commodities team. In the most recent update, gold analyst Matthew Turner expects that 2014 will mark the trough in the gold price and anticipates annual gains of over 4 percent per year to $1,440 in 2017. Similarly, gold equities should make annualized price gains of at least 10 percent over the next 3.5 years according to the report. A contrarian recommendation to increase gold exposure makes sense at this time because the improving U.S. economic perspective is already priced in, and the consensus view of 3 percent or higher real GDP growth through end 2015 is too optimistic. The number of units in the Market Vectors Gold Miners ETF has been remarkably resilient this year, leading us to believe that gold stocks have found stronger hands and we are closer to a trough.

- Financial expert and best-selling author James Rickards’ latest book predicts we are closing in on the collapse of the monetary system. In his book, Rickards suggests the monetary policy mistakes have already been made, which have injected instability in the system, leaving us waiting for a catalyst to trigger the collapse. This catalyst could be anything from a natural disaster to a failure to deliver physical gold. On gold specifically, Rickards argues that the blatant gold price manipulation will continue until a physical shortage prompts a buying panic and a short squeeze.

- India’s central bank has relaxed restrictions on banks seeking to offer gold loans and permitted more entities to import the precious metal. Gold jewelers in the country argue this is the first in a series of measures the new government is taking to ease gold imports into the world’s second-largest consumer. The 10 percent import duty on gold has encouraged smuggling and driven up physical delivery premiums as high as 23 percent over the international price. After plunging 20 percent last year, Indian gold imports could rise 7 percent this year, thus exceeding the World Gold Council’s forecast.

Threats

- The U.S. dollar may be heading higher after European Central Bank (ECB) President Mario Draghi further reinforced the market’s belief that that the bank will take action to stave off deflation. The resulting market action has continued to compress E.U. yield spreads to the U.S. As a result, funds are likely to start flowing back to the U.S. treasury market, thus providing support for a stronger U.S. dollar. A stronger U.S. dollar has traditionally had a negative correlation with gold prices.

- South Africa new Mines Minister Ngoako Ramatlhodi, sworn in this week, is widely seen as an “Africanist” who strides for more of the economy to be transferred from white to black hands. With the decade-long mining chapter, which stipulates 26 percent black ownership for mining assets, coming up for revision, it is no surprise that Ramatlhodi is calling for a “better” target for black businesses. Ramatlhodi’s opinions on the matter are likely to create tensions with the mostly white executives in the mining industry, especially given his mediator role in the ongoing 18-week-long platinum strike.

- Iraq, whose gold amounts to 5 percent of its international reserves, has indicated it is entertaining alternatives to reduce or sell its gold holdings. One of the alternatives being entertained is a possible sale to the public.