by Eddy Elfenbein, Crossing Wall Street

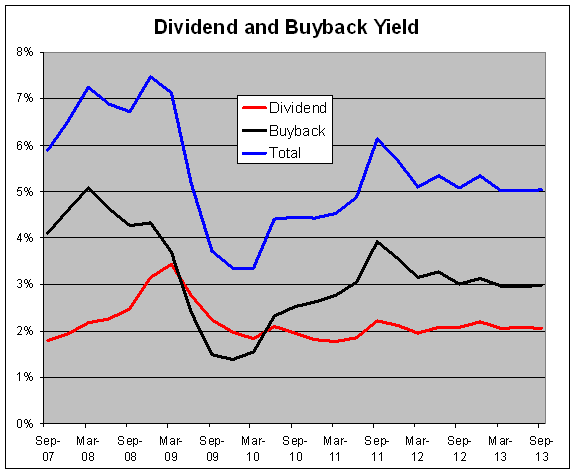

S&P just ran the numbers and found that share buybacks hit $128.2 billion. That’s up 23.6% over last year’s Q3. In the last 12 months, the S&P 500 has shelled out $445.3 billion to repurchase its own stock.

“Companies have significantly increased their shareholders’ returns through higher buybacks and regular cash dividends. These two expenditures combined, reached $207 billion in the quarter — the highest level since the fourth quarter of 2007 and almost three times the $71.8 billion level we saw in the Q2 2009 bear market,” notes Silverblatt. “Of the 394 issues which reported buybacks over the past year, 331 companies paid a cash dividend, with the buyback portion growing faster than dividends.”

Buyback programs have significantly increased over the last year, notes Silverblatt. “Just keeping up with the current bull market means that companies have to pay 25% more for the same number of shares they repurchased last year. However, we are starting to see excess buying, where the repurchases outnumber the issuance, and therefore reduce the share count. The lower share count leads to higher EPS, and the market likes higher EPS,” adds Silverblatt.

The data also shows that 263 issues reduced and 188 increased their diluted share count in Q3, compared to 225 decreases and 242 increases in Q2. Significant changes (generally considered 1% or greater for the quarter) favored reductions, as 106 issues reduced their count by at least 1% and 28 issues increased them by at least 1%.”

With low interest rates and decent valuations, it’s been a no-brainer for companies to buy back shares. By extension, the lower share count increases earnings-per-share even though it doesn’t affect operating income.

Posted by Eddy Elfenbein on December 23rd, 2013 at 11:14 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Copyright © Crossing Wall Street