by Gershon Distenfeld and Jørgen Kjærsgaard, AllianceBernstein

For high-yield investors with large US credit exposures, these are uncertain times. The pricing of securities is becoming more volatile, spurred by interest-rate volatility, and companies are borrowing more, causing concern about their future creditworthiness. The solution, in our view, is to diversify—and we regard the European high-yield markets as attractive.

A telling way to compare high-yield markets is to look at their positions in the credit cycle. Theoretically, the cycle begins with companies deleveraging after a recession and generally behaving conservatively. As the cycle progresses and recession eases, the companies stop deleveraging. As the economy recovers, they become more confident and start to borrow again.

Credit investors typically monitor the cycle, buying and holding during the early stages as interest rates fall (and the outlook for bond prices is positive) and balance sheets are strengthened. Once the cycle passes its mid-point and companies take on more debt, investors naturally look for more conservative opportunities, such as markets that are still in the early stages of the cycle.

This is where the US and Europe are now, relatively speaking, with the US much more advanced in the cycle.

In terms of quarterly real GDP growth this year, Europe has improved but remains in negative territory as many countries still struggle with recession, persistently weak demand and fiscal austerity. Quarterly real GDP growth in the US has picked up again recently and is currently just short of 2.0%. So, on this macroeconomic measure, the US is clearly far more advanced than Europe.

We expect this disparity to continue for a while. For next year we forecast 3.2% growth for the US (on a fourth-quarter comparison basis) and just 1.1% for the euro area. There are bright spots on the horizon in Europe, however, with strong growth this year from key leading indicators, such as Purchasing Managers’ Indices and economic sentiment.

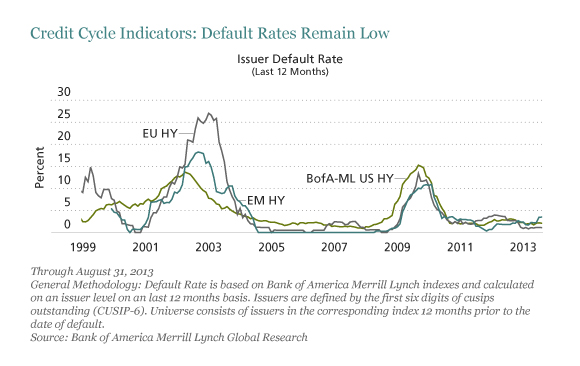

As far as the credit cycle is concerned, important indicators for high-yield investors are those detailing default rates and borrowing trends. As shown in the chart below, default rates among European high-yield issuers are trailing well behind those among US and emerging-market high-yield issuers. This suggests that credit risk—the single biggest risk for high-yield investors—is lower in Europe.

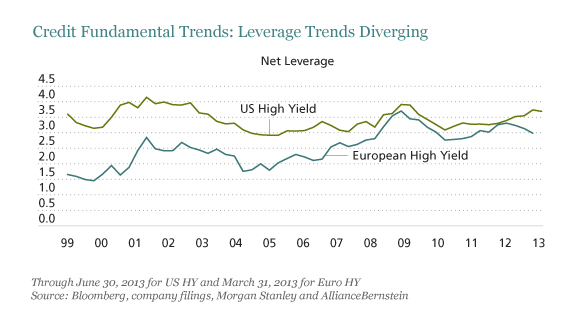

The second display, below, confirms this trend: net leverage among European high-yield issuers is falling, but it is rising among US issuers.

To some extent, the growing leverage among US companies is linked to a much higher level of merger and acquisition activity than that experienced in Europe. As well as stretching company balance sheets, such activity can be disruptive for bond holders if companies in which they are invested are acquired by third parties.

Aggregate leverage among European high-yield issuers is also lower than it is for US issuers, so clearly, from a risk perspective, Europe is more attractive—and this is likely to remain the case for some time, with the region’s recovery lagging so far behind that of the US.

This is not all, however, because European high-yield bonds are more attractively priced, too, with the yield on single-B credits 96 basis points higher, on an option-adjusted spread basis, than those on the equivalent US securities.

Perhaps the biggest doubt at the back of investors’ minds when considering diversifying into Europe is the risk of another flare-up in the sovereign debt crisis among peripheral euro-area countries. We believe that the risk remains but is muted, and that supportive government policies—together with the cyclical improvement flagged by the leading indicators—will help to contain it.

To put this in perspective, it’s important to remember that the European high-yield market consists mainly of debt issued by companies from developed-country economies. The investor base is also less retail-oriented than in the US, which helps to explain why European high-yield bonds performed much better than US securities during recent global interest-rate volatility.

Taking into account all these factors—plus the ease with which the euro can be hedged—we think now is a good time for US high-yield investors to consider diversifying into Europe.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Gershon Distenfeld is Director of High-Yield Debt and Jorgen Kjaersgaard is head of European Credit Portfolio Management, both at AllianceBernstein.