by Stephen Perlberg, Business Insider

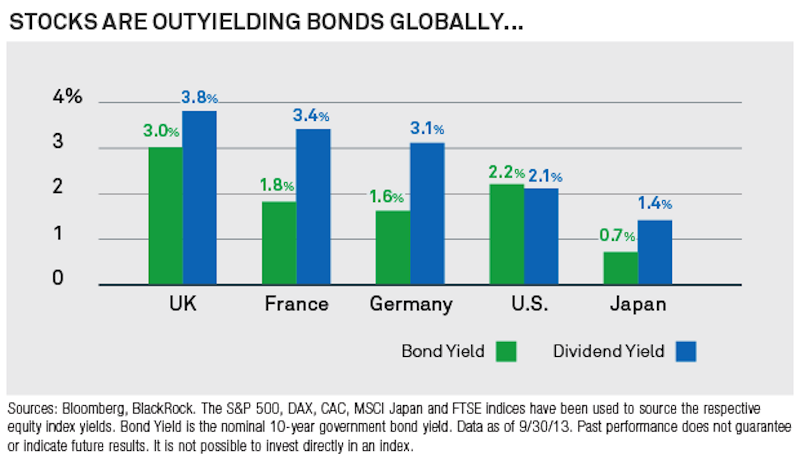

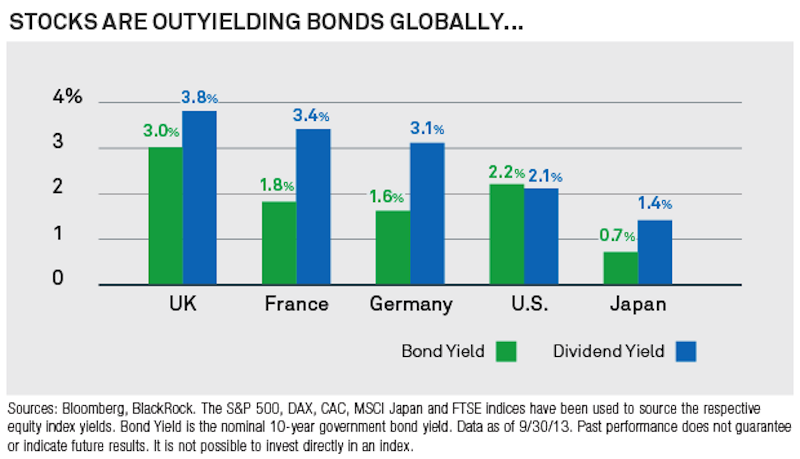

Here's a good chart from Blackrock showing bond yields versus dividend yields across the globe.

"Some of the traditional sources of yield such as government bonds and money market funds are delivering negative returns after inflation," Blackrock writes.

"So, what are your options? Well, the yields on international stocks are higher than those available from many government bonds today and offer greater protection in the face of rising rates."

Basically, Blackrock wants investors to know that investing in (the right, "highest quality") stocks will help them generate income in this global low interest rate environment.

Take a look.

Blackrock

Blackrock[button class="btn_smallred" url="http://www.businessinsider.com/chart-stocks-are-crushing-bonds-2013-11#ixzz2mKhnf6K7" text="Read more"]