While U.S. stocks are no longer cheap, most valuation metrics refute the notion that global equities are in a bubble. However, further gains are somewhat dependent on whether the Federal Reserve can engineer a gentle exit. If not, then stocks, particularly in the United States, are at risk of disappointing.

by Russ Koesterich, Portfolio Manager, Blackrock

With the exception of emerging market equities, stocks are having an extraordinary year, particularly after accounting for the fact that global economic growth has disappointed this year. Given the magnitude of the gains, investors are increasingly concerned that global stocks are once again getting overvalued, if not in an outright bubble.

I last addressed this topic in mid-August. At the time, my view was that valuations were not yet an impediment to further gains. Since then, global equities have advanced roughly 7% to 8%. Yet despite the additional gains, I still don’t believe it’s accurate to describe stocks as in a bubble. Consider these four facts:

- Valuations are no longer cheap, but they are still a long way from the peaks seen in previous cycles. U.S. stocks trade for around 2.5x book value and for 16.5x trailing earnings. Looking at the last three major market peaks – 1987, 2000 and 2007 – price-to-earnings (P/E) ratios were respectively 23, 30 and 17.5. The price-to-book ratio, meanwhile, peaked at close to 5 in 2000 and 3 in 2007.

- As I discussed in August, valuations look more reasonable outside of the United States. Based on price-to-book measures, international stocks are 30% to 40% cheaper than U.S. stocks.

- On a relative basis, the earnings yield on stocks still compares favorably with the fixed income alternative. Compared to bonds, which have been bid up through central bank intervention, stocks still look cheap.

- Despite strong in-flows year to date, many investors are still underweight equities.

Unfortunately, this is not the whole story. Traditional valuation metrics miss three nuances:

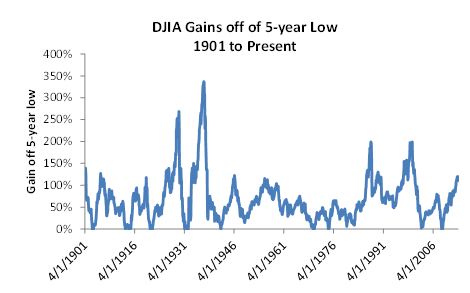

The speed of the rally. While valuations are not at extremes, stocks rarely record the types of gains witnessed since the 2009 lows. Over the past 40 years, there have only been two other instances in which stocks have rallied this far this fast: the run-up to the 1987 crash and the late 1990s, as the figure below shows.

- The dependence on margins. One reason that stocks look reasonable is that, thanks to low interest rates and slow wage growth, margins are at historic highs. If rates or wages rise, margins will compress, driving earnings lower. This will make stocks look more expensive (this is why stocks look more expensive based on the Shiller P/E ratio, which implicitly assumes some mean reversion in margins).

- The extent to which low rates are propping up valuations. Low rates don’t just support margins, they also support multiples. With bonds offering no competition, stock valuations are higher than they would typically be in a slow-growth world.

In summary, today’s valuations are largely dependent upon the continuation of an unusual set of circumstances.

Where does this leave investors? Probably in the same position they were in back in August. Stocks can still move higher, assuming rates stay low and margins high. I’m assuming both…. for now.

Russ Koesterich, CFA, is the Chief Investment Strategist for BlackRock and iShares Chief Global Investment Strategist. He is a regular contributor to The Blog and you can find more of his posts here.

Sources: Bloomberg

Copyright © Blackrock