by Steven Visscher, Mawer Investment Management

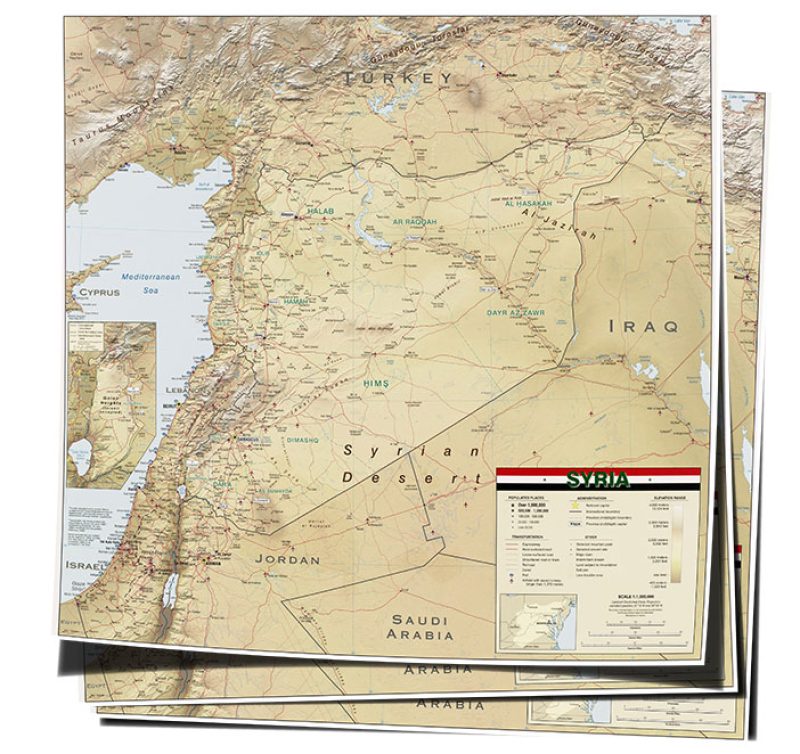

The atrocities in Syria have put the world on alert, including investors. Many of our clients and readers have asked what impact military action in Syria might have on the capital markets. To be honest, we just don’t know how events will unfold or how investors will react.

What we do know is that investors fear the unknown and crave certainty. Unanswered questions over whether the U.S. declares war, when that might occur, who might join them, and how Syria could respond have created a landscape that lacks clarity. One might expect heightened market volatility until such questions are answered. Given the phenomenal returns of late, selling pressure may escalate as investors lock in profits and opt to observe events from the sidelines.

But that would simply be a short-term market reaction. We believe there are three reasons why the longer-term market impact is likely to be immaterial.

First, Syria is a relatively insignificant contributor to the global economy. Aside from a modest amount of oil production, they are not a key cog in the global economy. We are not going to see companies like Pepsi, Unilever or BMW announce disappointing earnings because of reduced consumption in Syria.

Second, few countries appear ready and willing, both financially and politically, to engage in a lengthy military campaign. We would expect any military action to be swift, but brief. Nobody wants another prolonged occupation as we’ve recently observed in Afghanistan.

Finally, the history of capital markets is, regrettably, intertwined with a constant manifestation of human violence and war. World War I. World War II. Korea. Vietnam. Cyprus. Bosnia. Somalia. Rwanda. And the seemingly constant state of conflict between Middle Eastern countries such as Israel, Syria, Egypt, Libya, Lebanon, Iraq, and Iran. However, not a single geo-political event to date has interrupted the long-term rise in capital markets. Human ingenuity, innovation, and the quest for a better world have continued to push the global economy forward despite the frequent occurrences of human violence. We have no reason to believe the outcome of this conflict will be any different.

Steven Visscher

Copyright © Mawer Investment Management