by Sober Look

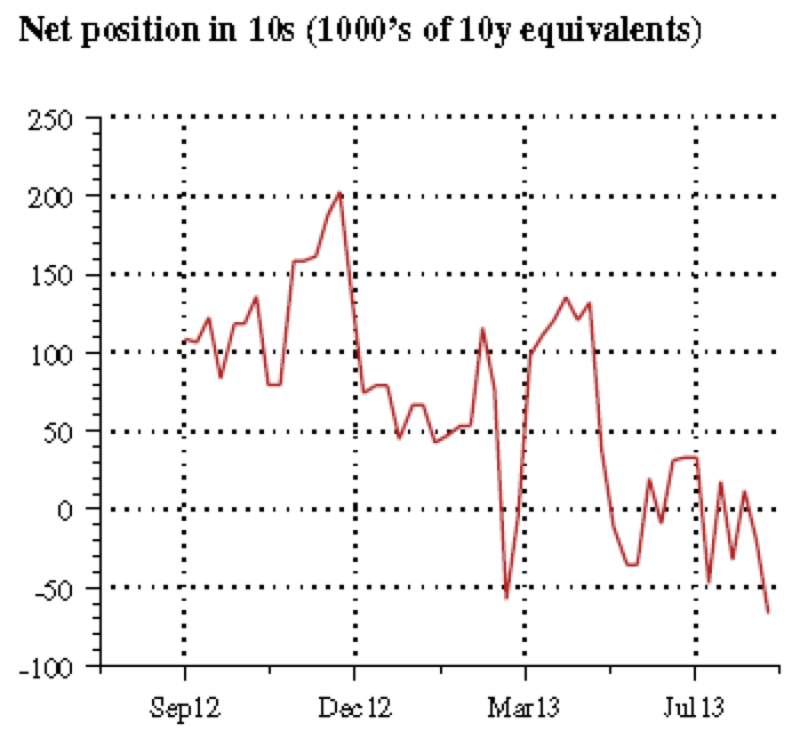

Speculative money has become visibly short rate products. As discussed this weekend (see post) there still seems to be a broad bearish sentiment on treasuries - in spite of the massive selloff. The charts below show speculative net positions in LIBOR futures ("ED") and the 10yr note futures ("10s"). LIBOR futures are often used to take a speculative view on long-term interest rates (usually via a "strip" of futures extending out a number of years - effectively mimicking a rate swap). The 10yr note future is the most common way of betting on rates in the futures market.

In the last couple of months positions flipped from net long to net short. If the economy or the Fed were to disappoint, the resulting treasury rally could prove painful for these investors.

Source: JPMorgan

Copyright © SoberLook.com