by Sober Look

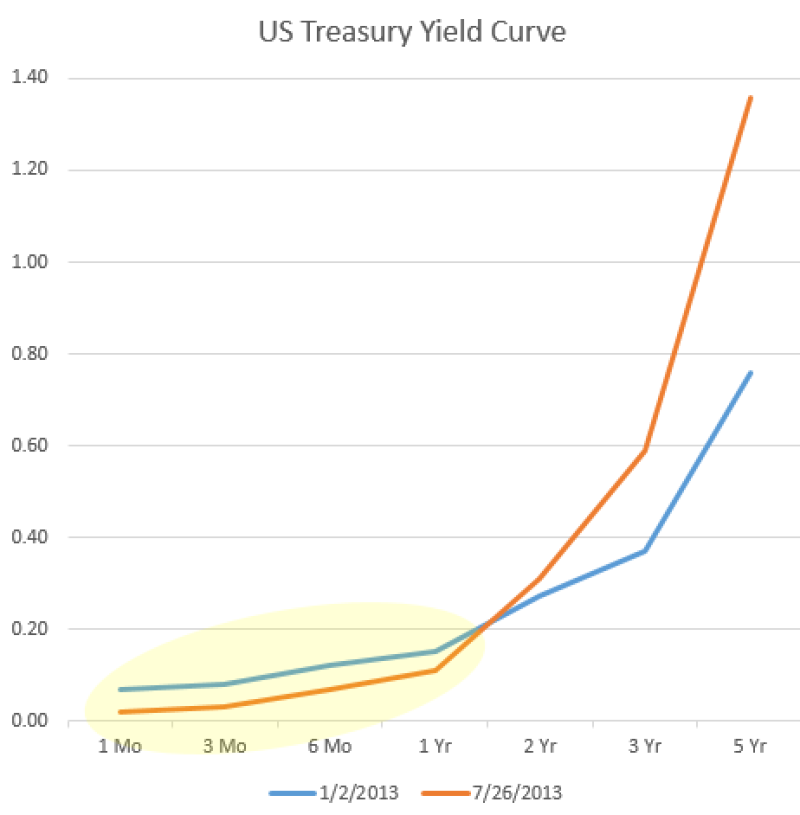

Since the beginning of the year the US treasury curve has steepened substantially, with yields on the short-end actually declining.

There are two key reasons for treasury bill rates staying at such suppressed levels.

1. In a rising rate environment, durations are cut and demand for treasury bills increases. Investors want to stay liquid without taking rate risk, and there isn't much else out there that can provide both.

2. There are simply fewer treasury bills out there. The supply of bills relative to the overall pool of treasury securities is at record lows. The US Treasury has focused on issuing more longer-term paper to lock in the ridiculously low rates that the Fed and others have been willing to take.

Source: DB

Copyright © SoberLook.com