by Seth J. Masters, AllianceBernstein

Seth J. Masters and Jon Ruff

Several prominent pension funds have slashed their commodity futures investments for delivering poor returns with higher volatility than usual, while failing to diversify equity exposures as expected, The Wall Street Journal recently reported. If inflation rises, they may regret it.

Our research shows that commodity futures have performed poorly in recent years for two reasons that we’ve seen before: new technology has disrupted pricing for key commodities, and fears of deflation, rather than inflation, have dominated the market for much of the last five years. We don’t expect either condition to last.

Commodity future indices have been and are likely to remain highly sensitive inflation hedges that provide their benefits in periods when they are needed most—when rising inflation depresses stock and bond returns.

Thus, we think many investors would benefit from a strategic allocation to a diversified set of real assets that includes commodity futures.

Technology Drove Poor Returns

Investor dismay with the returns from commodity futures in recent years is understandable. The annualized return of the Dow Jones-UBS Commodity Index (DJ-UBSCI), which reflects a broad basket of commodities, was seven percentage points below inflation, as measured by the Consumer Price Index (CPI), over the five years ending in December 2012. By contrast, the index’s annualized returns were five percentage points above inflation in the 17 years ending in December 2007.

Like all risk assets, commodities futures indices traded down sharply during the financial crisis in 2008. Their failure to rebound with stocks, high-yield bonds and some types of real estate in the subsequent years can be traced to very poor returns for two futures contracts: WTI Crude Oil (down 16.1% a year, annualized for five years) and Natural Gas (down 41.1% a year!).

Why? Technology is the enemy of commodities. In this case, the introduction of hydraulic fracturing, horizontal drilling and other technologies that sparked the US shale revolution drove oil and gas supplies up—and returns for the futures contracts down.

We expect returns for oil and gas futures to normalize as storage and distribution infrastructure for oil and gas improves and as end-market demand increases to absorb the new supply. Overall, we expect the annualized returns of broad commodity indices to normalize at around CPI plus 2% over the long term, with much of the 2% real return coming from passive rebalancing within the index.

High Correlations when Inflation Low

The correlation of the DJ-UBSCI to the S&P 500 has also been disappointing: It rose to +0.5 in the past five years from essentially zero from 1992 to 2007. In part, this jump mirrors the higher correlations across risk assets during and after the financial crisis. But the jump in correlations also reflects expectations of bouts of deflation within a long period of low inflation. Historically, such expectations have led to negative short-term returns for stocks and commodities, and strong positive returns for bonds.

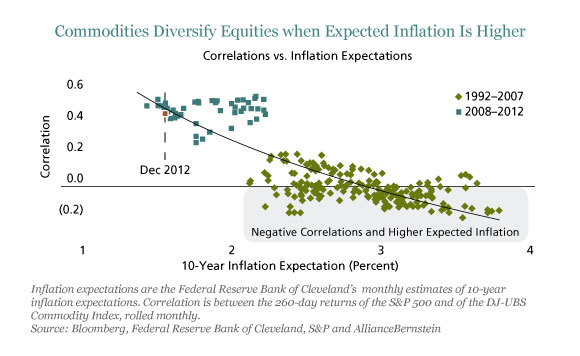

The display below shows the relationship between long-term inflation expectations and the correlation between commodity and stock index returns over trailing one-year periods. The blue squares show that over the past five years, long-term expected inflation was quite low (in the 1% to 2% range) and the correlation between the DJ-UBSCI and the S&P 500 was high (mostly between 0.4 and 0.6). The green diamonds show that from 1992 to 2007, inflation expectations were in the normal range (2% to 4%) and the correlation between the stock market and commodity indices was either low or negative.

We expect the correlation between equities and commodities to fall as inflation expectations normalize. That is, we expect commodity index investments to provide diversification benefits when they are needed—when fear of inflation hurts returns for both equities and bonds.

Commodities Are Inflation Sensitive

Many investors confuse “real” or inflation-adjusted returns with inflation sensitivity. Equities have had high real returns over the long term. But over shorter time periods, equities, like bonds, tend to react negatively when long-term inflation expectations rise above, say, 3%.

Commodities have had lower real returns than equities over the long term but have reacted positively to expectations of higher inflation. That’s a rare and valuable trait for investors whose liabilities grow with inflation—including retirees, foundations and endowments, and pension funds that pay benefits with cost-of-living adjustments.

We don’t expect commodity futures indices to deliver high returns in the near term, but we do expect their returns and volatility to normalize, offering significant benefits as an inflation hedge.

That said, commodity futures indices aren’t the only or necessarily the best form of inflation protection. In our next post, we will discuss two others—real estate and shares of commodity-related firms—and why we think they work best in combination with each other and commodity futures.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio- management teams.

Seth J. Masters is Chief Investment Officer of Bernstein Global Wealth Management, a unit of AllianceBernstein, and Chief Investment Officer of Defined Contribution Investments and Asset Allocation at AllianceBernstein. Jon Ruff is the lead Portfolio Manager and Director of Research for Real Asset Strategies at AllianceBernstein.

Copyright © AllianceBernstein