Wells Capital Economic and Market Perspective - November 27, 2012

"Gearing for Growth"

by James Paulsen, Chief Investment Strategist, Wells Capital Management

Download PDF

Due to positive revisions of several economic reports including international trade, construction spending, inventories, and consumer spending, many economists have recently increased estimates for third quarter growth closer to 3 percent. Should this prove accurate when it is revised on November 29, trailing fourquarter real GDP growth will be 2.6 percent—the second best annual growth rate of the entire recovery.

Despite some of the “best growth” of the entire recovery, consensus expectation for economic growth in 2013 is only 2 percent. While there remains plenty to worry over—the ongoing fiscal cliff negotiations, fallout from additional fiscal tightening next year, ongoing weakness among emerging world economies, and a recession in the euro zone—we believe there are six solid reasons to anticipate an improvement in real GDP growth next year to about 3 percent. Such growth would be nearly 1 percent faster than the current consensus expectation and would represent the fastest growth rate of the entire recovery!

1. U.S. Economic Recovery Has Geared!

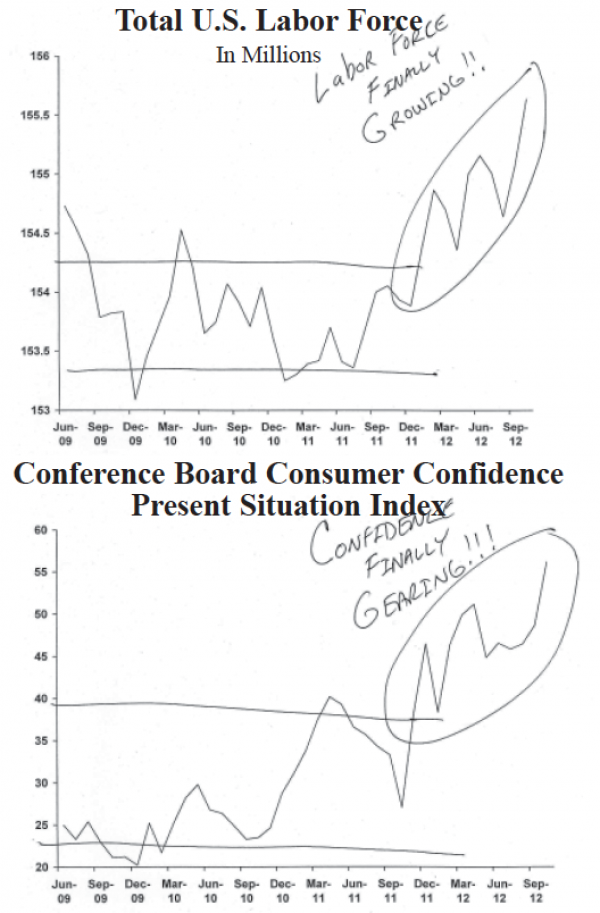

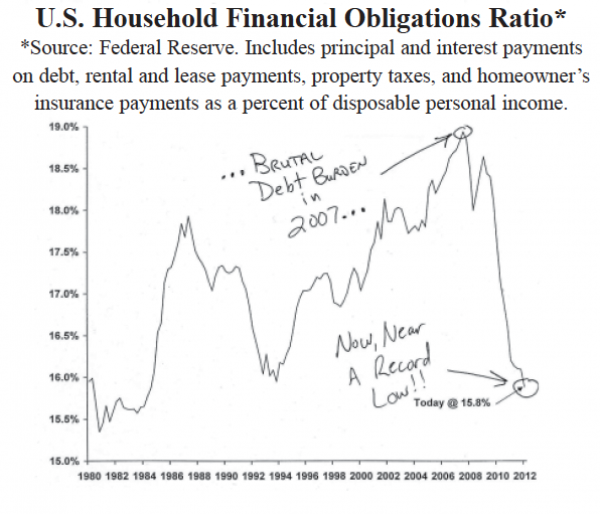

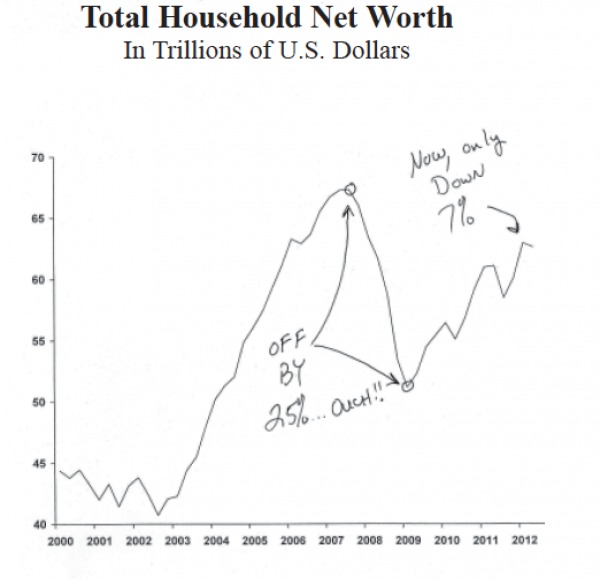

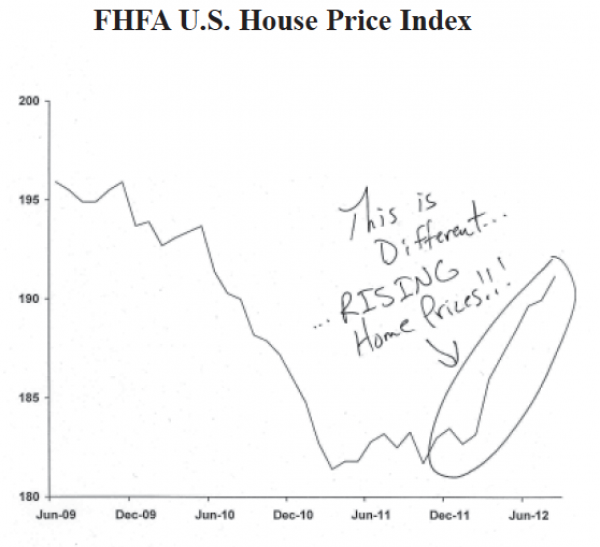

Like the last two economic recoveries, while entering its fourth year, the contemporary recovery has finally “geared.” The early 1990s recovery did not really gear until it reached its third-year anniversary in 1994 and the early 2000s recovery was not perceived as fully engaged until 2004. Although current economic growth is still frustratingly slow, the character of the recovery has broadened significantly in the last year and it is now firing on more cylinders than ever. The following list illustrates how much the “character” of this recovery has improved in the last year (See Exhibit 1).

• Monthly household job gains have averaged 257K in the last year compared to only an 11K monthly average earlier in the recovery.

• The unemployment rate has fallen by 1.2 percent in the last 14 months, its largest decline of the recovery.

• The labor force has finally been growing (averaging 132K new entrants a month) in the last year compared to virtually no growth earlier in this recovery.

• Consumer confidence, after waffling about post-war lows, has surged this year to a four-year high.

• After suffering a record-setting 25 percent collapse in the 2008 recession, household net worth has been almost fully restored.

• While reaching an all-time record high of 19 percent of disposable personal income in 2007, the household debt service burden (financial obligations ratio) has declined again close to a record low below 16 percent.

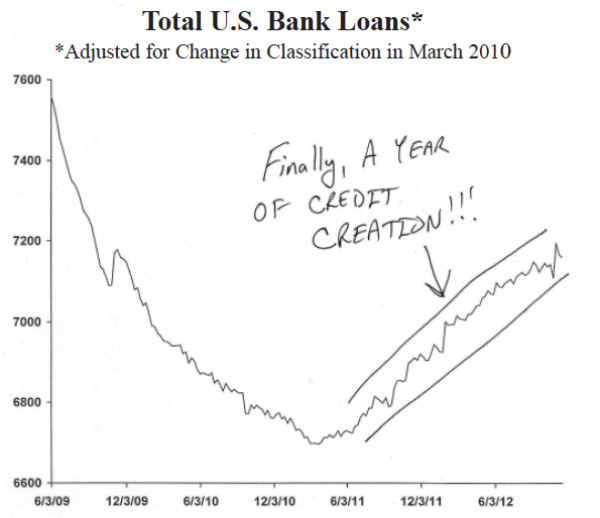

• While declining throughout most of this recovery, U.S. bank loans have risen persistently in the last year.

• Housing activity, nonexistent until last fall, has risen in the last year.

• Home prices are no longer declining but rather rising steadily this year.

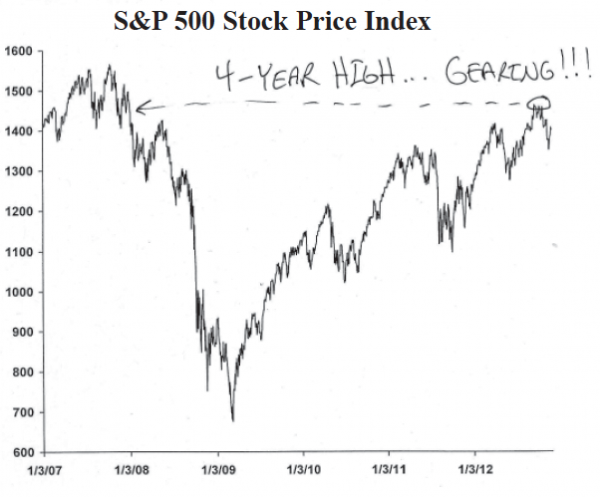

• The S&P 500 Stock Price Index recovered to a 4-year high a couple months ago and came within 100 points of an all-time record high.

• Aggregately, state tax collections recently rose to an all-time record high.

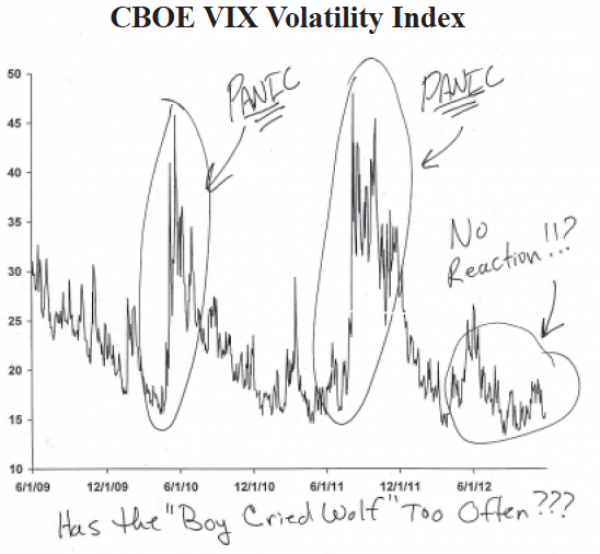

• Finally, while problems remain, panics have lessened considerably. Investor sensitivity to “Armageddon stories or crisis” has diminished as reflected by a low and stable stock market VIX Index this year despite ongoing euro zone, election, and fiscal cliff concerns.

While the pace of economic growth is not fast enough to please anyone, in the last year the character of the recovery has broadened considerably, become much more sustainable, and consequently less vulnerable to external shocks. That is, the recovery has finally geared! The combination of a falling unemployment rate, reviving housing activity, rising home prices, a revitalization of lending, a recovering stock market, and much improved balance sheets should continue to boost confidence helping lift the “pace” of economic growth in 2013.

Exhibit 1

Economy is Gearing

2. Economy is Still Being Juiced!

Although fiscal conditions will likely worsen in the coming year, several other economic policies remain conducive to economic growth and should help minimize a more restrictive fiscal environment.

Growth in the M2 money supply remains robust, mortgage yields hover near all-time record lows (keeping refinancing activities, housing activity and home prices rising), gasoline prices have declined just in time for holiday shopping, the U.S. dollar has declined by about 5 percent since the summer and by about 10 percent from recovery cycle highs and finally, consumer price inflation has decelerated from about 4 percent last fall to 2.2 percent helping to boost real income growth.

Most forecasters seem obsessed with the potential economic fallout from current fiscal negotiations and may be underestimating the positive impact the economy continues to enjoy from ongoing accommodative policies.

3. Revival of Emerging World Economic Growth!

The 2013 U.S. economic outlook will likely be much more impacted by whether emerging world economies reaccelerate than by the fiscal circus in Washington. Already economic conditions in this part of the world are beginning to show signs of revival, which if sustained, could provide a big boost to both global and U.S. economic growth.

We believe the Chinese (and broader emerging economies) economic slowdown was self-induced by restrictive policies implemented between 2010 and early 2012 aimed at avoiding an overheated recovery. By contrast, emerging world economic policies have turned increasingly aggressive in the last year which should orchestrate a resurrection of the recovery in 2013.

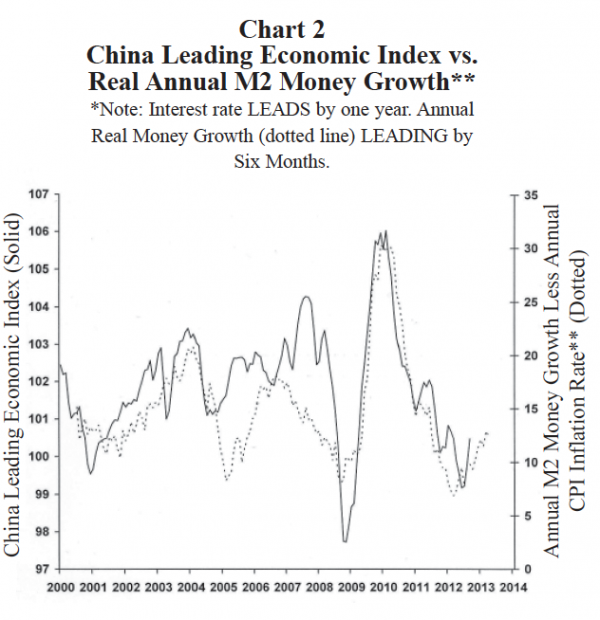

The relationship between two key policy instruments (interest rates and money supply growth) and China’s leading economic index is illustrated in Exhibit 2. The solid line in both charts is the leading economic index recorded on the left scale. As the charts show, Chinese economic momentum peaked in mid-2010 (when the solid line rolled over) and economic activity slowed significantly by late-2011. Chart 1 compares the leading economic index with the Shibor short-term policy interest rate. The policy interest rate is illustrated on an inverted scale and is pushed forward (leading) by one year. While the relationship is far from perfect, it does appear changes in the policy interest rate tend to inversely impact economic activity with about a one-year lag. Chart 2 shows a similar relationship between growth in the real money supply and subsequent (six months later) economic growth. Combined, both charts clearly demonstrate why the boom in the Chinese economy was so strong following the 2008 recession and also why the economy slowed so profusely in the last year.

The “boom-bust” policy approach employed by Chinese officials (30 percent real money growth and a 1 percent interest rate followed by 7 percent money growth and a 6.5 percent interest rate) has produced a volatile recovery. Looking ahead, however, the economy appears headed for another boom cycle (or at least a period of faster growth again). Interest rates have declined since mid-2011 and significantly since early-2012. Similarly, growth in the M2 money supply has risen sharply since the spring 2012. Both aggressively lowered interest rates and faster monetary growth suggest improved Chinese economic momentum as we head into 2013.

Better growth in emerging world economies would help the U.S. recovery in a number of ways. First, it would likely dissolve global recession fears (with both U.S. and emerging economies growing the global recovery would appear sustainable) helping to boost business confidence and adding to overall U.S. growth. Second, a revival in emerging world growth would reduce concerns about ongoing problems in the euro zone. With a sustained recovery in emerging economies, chronic problems emanating from Europe are simply less daunting. Lastly, an improvement in emerging world growth would restart the global manufacturing cycle. As emerging economies led the globe out of the 2008 recession, the manufacturing sector led the U.S. recovery. Similarly, once emerging economies slowed, so did the U.S. manufacturing cycle. Indeed, in the contemporary recovery, manufacturing in the U.S., Germany, and other developed economies has been tied closely to economic growth in the emerging world. Consequently, not only will improvement in emerging economies add directly to global growth, but it would also boost the pace of growth throughout the developed world (including the U.S.) by restarting manufacturing activity.

Exhibit 2

4. Euro Zone to Finally Improve?

Problems in the euro zone have become chronic and will likely persist for many years. However, policy officials in the region have noticeably altered their approach in the last year and their new approach has a much better chance of eventual success. Until the fall of 2011, the approach to euro zone fiscal woes was to enforce aggressive austerity programs. Predictably, tightening fiscal conditions on economies which were already failing simply worsened economic growth. Last fall, however, a newly installed ECB chairman promptly altered economic policy in the region from austerity to stimulus (see Exhibit 3). Policy interest rates have since been reduced three times, the ECB balance sheet has been aggressively expanded (similar to the approach taken by the U.S. Federal Reserve), a liquidity ring has been established about troubled financial institutions and the central bank has begun direct buying of periphery bonds.

For the first time since the euro crisis surfaced in early 2010, austerity (a contractionary program) has been replaced by “growth promoting” economic stimulus. Since the euro zone crisis was allowed to worsen for too long, it will not quickly be solved. However, while currently in recession, the recently adopted pro-growth policy approach should improve euro zone economic performance in 2013. Germany should directly benefit as global manufacturing improves and the rest of the region should exhibit some signs of economic improvement even if it only amounts to rising from 10 feet to only 5 feet under ground. Most importantly, economic fears surrounding the euro zone which have already lessened this year should calm even further in 2013. Perception of the euro zone issue is being successfully transformed from a crisis to simply a chronic problem. A growing U.S. economy, a revitalized emerging economic cycle and a less calamitous euro zone should help calm fears, accentuate business animal spirits, and perhaps awaken pent-up investment and hiring demands.

5. The “Cliff” Overstates Likely Fiscal Contraction

The consensus forecast for only 2 percent U.S. economic growth in 2013 is tied importantly to an expectation of significant fiscal tightening. However, the degree of fiscal drag next year is probably overstated.

First, the economic recovery has dealt with increased fiscal tightening each year since it began. It is not like a “grand bargain” before year-end will suddenly subject the economy to its first dose of austerity. Exhibit 4 shows the deficit as a percent of GDP has contracted each year of this recovery by about 1 percent annually. Despite persistent fiscal tightening, the recovery has persisted and broadened. While a legislated fiscal austerity action would represent a negative force for economic growth, it is really nothing new for a recovery which has been facing fiscal tightening every year of its existence and it must be weighed against other positive forces which also will be at work in 2013.

Second, the media popularized “Fiscal Cliff” has over-emotionalized and probably overemphasized the real risk it represents to economic growth. While a recession would be inevitable should complete congressional gridlock result, the odds of this outcome seem far more remote than widely portrayed. The much more probable outcome is the implementation of some austerity programs implemented slowly over many future years. Some additional fiscal tightening in 2013, not much more dramatic than what the recovery has already faced, should not overwhelm economic growth.

While fiscal tightening is almost ensured in 2013, will it really represent a fiscal cliff or will it be more like a fiscal molehill? When examining the outlook for 2013, the focus cannot be solely on fiscal conditions (even if media and political outlets suggest otherwise). Rather, any fiscal tightening must be weighed against several other forces, which only when combined, ultimately will determine the speed of economic growth in 2013.

6. A Calm after the Sandy Storm!

Super-storm Sandy makes interpretation of the economic data difficult during the next several months. It will lower fourth quarter economic growth but will also boost first quarter performance as the rebuild begins. The storm effectively will force wealth from the national balance sheet into the spending stream whereby the “multiplier effect” will boost growth (much like the money or fiscal multiplier) and help to improve confidence. In an economic sense, Sandy represents a joint private/ public sector fiscal stimulus in 2013, which while admittedly small, may be underestimated.

Summary

U.S. real GDP growth (probably about 2.5 percent in the last year) will likely approach 3 percent in the coming year, far outpacing the current consensus forecast of only 2 percent. Too much attention has been focused on the potential negative impact of the pending fiscal cliff and not enough recognition has been given to several positive forces which are likely to have substantial impact in shaping the economic environment next year.

Although fiscal policy will undoubtedly tighten next year, the degree of fiscal austerity actually hampering the economy in 2013 is probably grossly overstated. The widely feared fiscal cliff this year will likely resolve into a fiscal molehill in 2013. The economic recovery has dealt with persistent fiscal tightening every year since it began in 2009 and some additional mild fiscal austerity should not be overwhelming. Most important for the 2013 outlook may be the “gearing” of the economic cycle during the last year.

The recovery has finally broadened significantly, is now firing on more cylinders than ever and is therefore much less vulnerable to external shocks. Perhaps, the biggest challenge in this recovery has been persistent fear. The lack of confidence has kept animal spirits reserved. “Economic gearing” could continue to boost confidence in 2013 adding more to economic growth than currently appreciated. Outside of fiscal policy, most other economic policies remain accommodative. Rapid money growth, record low mortgage yields, lower gasoline prices, a weaker U.S. dollar, and a lowered inflation rate should continue to promote growth if only by offsetting fiscal restrictiveness.

Already emerging world economies are showing increasing signs of revival. As growth in China and other emerging economies reaccelerate in 2013 global recession fears should fade and both U.S. exports and the U.S. manufacturing sector should improve. Indeed, could 2013 represent the first time in the U.S. recovery when both housing and manufacturing activity rise together?

As we end 2012, the euro zone appears far less frightening—more a chronic problem than a crisis. If fears surrounding the impact of the euro zone on the global recovery continue to fade and confidence in a sustained recovery improves, business spending, and hiring decisions could strengthen significantly next year.

Finally, while Sandy will depress fourth quarter growth, it will act like a mild fiscal stimulus next year which because of the multiplier effect could last longer than most now appreciate. Investors may want to ponder how much stock market valuations and bond yields may rise next year if real economic growth proves to be 50 percent stronger than most now anticipate?

Download PDF

Copyright © Wells Capital Management