by Del Stafford, iShares

By now, you’ve probably heard about the benefits of a minimum volatility (or, “min vol”) strategy and the ETFs that seek to deliver it, but you might still be wondering how to use these funds in a portfolio. One common misconception is that min vol ETFs are a tool designed for volatile markets specifically, but this simply isn’t the case. In fact, the two minimum volatility ETF strategies we see our clients using most often are both strategic, long-term plays that have nothing to do with current market volatility. These two strategies are: 1) lowering overall portfolio risk or 2) increasing allocation to equities without increasing overall portfolio risk.

Lower overall portfolio risk

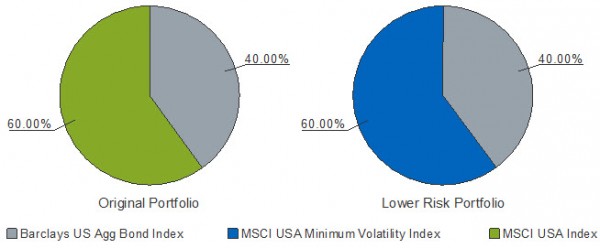

Investors who are trying lower their overall portfolio risk can simply replace their existing market capitalization based equity investment with the corresponding minimum volatility ETF. For example, let’s say a client’s portfolio consists of 60% equity and 40% fixed income. Let’s use the MSCI USA Index to represent “equity” and the Barclays US Aggregate Bond Index to represent “fixed income”. The client would replace the 60% allocation to the MSCI USA Index with a 60% allocation to the MSCI USA Minimum Volatility Index.

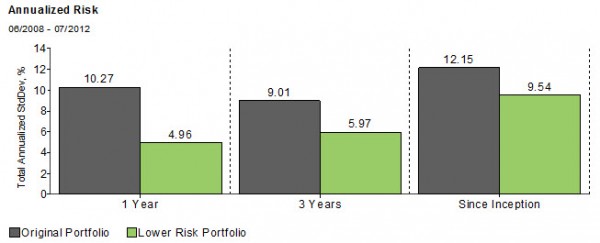

This strategy would result in a ~20% reduction in portfolio risk since inception of the analysis (June 2008) and an even greater reduction in risk in the nearer term (see below).

This strategy would result in a ~20% reduction in portfolio risk since inception of the analysis (June 2008) and an even greater reduction in risk in the nearer term (see below).

Increase allocation to equities without increasing overall portfolio risk

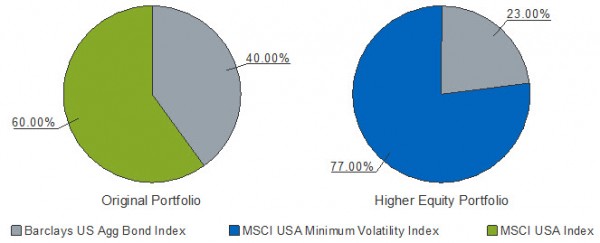

Like the example above, an investor looking to employ this strategy would start by replacing their existing market capitalization based equity investment with the corresponding minimum volatility ETF, but then they would also increase their allocation to the minimum volatility ETF while decreasing their allocation to fixed income. After replacing the MSCI USA Index with the MSCI USA Minimum Volatility Index, the investor would increase their allocation to the MSCI USA Minimum Volatility Index and decrease their allocation to the Barclays US Agg Bond Index until the total portfolio risk reaches the level they desire. For example, they may seek a level of portfolio risk that is just below the since inception risk of the Original Portfolio, which is 12.15%.

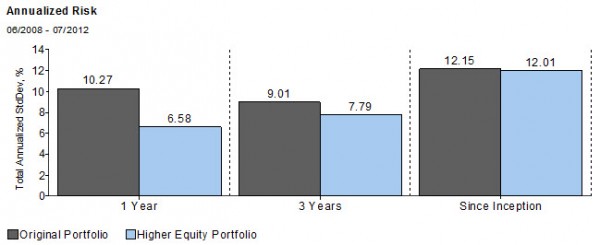

This strategy allows the investor to increase their allocation to equity by 17% while obtaining a consistently lower level of risk than the Original Portfolio (see below).

This strategy allows the investor to increase their allocation to equity by 17% while obtaining a consistently lower level of risk than the Original Portfolio (see below).

While there are certainly other ways to employ minimum volatility ETFs in a portfolio, our team has found that these two strategies are the most commonly used among our clients.

Source: Markov Processes International (MPI)

Del Stafford, CFA is the iShares Head of Product & Investment Consulting and a regular contributor to the iShares Blog. You can find more of his posts here.

The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying index’s strategy of seeking to lower volatility will be successful.

Copyright © iShares