by Seth Masters, Chief Investment Strategist, AllianceBernstein

Individual and institutional investors alike have been shifting their capital from stocks to cash and bonds at a rapid rate in recent years, despite extraordinarily low interest rates. But if investors stop to weigh the importance of two different types of risk, they’ll see they still need stocks.

It’s tempting to give up on stocks after more than a decade of high volatility and low returns from stocks—and lower volatility with higher returns from bonds. But we think that 10 years from now, investors who do so will wish they had stayed in stocks—or added to them.

That’s not to say we think investors don’t need bonds. Despite extremely low current yields, we think bonds should still play their usual roles in the portfolios of most long-term investors: providing income, preserving capital and providing protection in times of stock-market distress (because bond prices tend to rise at such times). Bonds will be especially important if the market outcomes are at the extreme low end of our forecast range of potential outcomes.

But most investors are likely to need stocks to feel confident that they will have enough to live on, despite the high volatility of recent years. Remember that volatility isn’t the only type of risk. There’s also shortfall risk: not having enough money to meet your spending requirements. Investors must weigh both types of risk when making strategic asset-allocation decisions.

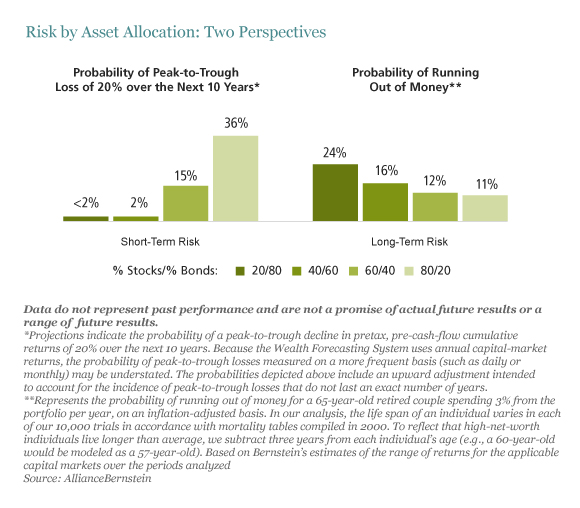

If you’re just thinking about market volatility, bond-oriented portfolios may look very appealing, especially today. We estimate there is less than a 2% chance that a portfolio with a 20% allocation to stocks and an 80% allocation to bonds will suffer a 20% peak-to-trough loss at some point over the next 10 years, compared with the 15% chance of such a loss for a portfolio with 60% in stocks (Display, left), as the left side of the display below shows. But if you’re just thinking about shortfall risk, a portfolio with 60% in stocks looks more attractive (Display, right).

We estimate that a 65-year-old retired couple planning to withdraw only 3% of their portfolio, grown with inflation, has a 12% chance of running out of money if they invest in the portfolio with 60% in stocks. That may not sound great, but it is materially better than the 24% odds of running out of money if they invest in a portfolio with 20% in stocks.

Today, uncertain macroeconomic conditions make large stock-market drops more likely than usual, and very low bond yields provide a thinner cushion. As a result, market risk can’t easily be avoided. And trying to avoid market risk is not a good strategy if it increases shortfall risk too much. A 20% loss is certainly painful, but it doesn’t hurt as much as running out of all of your money. Many investors who are currently focused on market volatility should be paying at least as much attention to shortfall risk.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Seth J. Masters is Chief Investment Officer for Asset Allocation at AllianceBernstein and Chief Investment Officer of Bernstein Global Wealth Management, a unit of AllianceBernstein.

The Bernstein Wealth Forecasting System,SM driven by the Capital Markets Engine, uses a Monte Carlo model that simulates 10,000 plausible paths of return for each asset class and inflation and produces a probability distribution of outcomes. The model does not draw randomly from a set of historical returns to produce estimates for the future. Instead, the forecasts (1) are based on the building blocks of asset returns, such as inflation, yields, yield spreads, stock earnings and price multiples; (2) incorporate the linkages that exist among the returns of various asset classes; (3) take into account current market conditions at the beginning of the analysis; and (4) factor in a reasonable degree of randomness and unpredictability.

Copyright © AllianceBernstein