With the election season upon us, have you been wondering what the stock market will do in a presidential election year? To be sure, no one has the answer, but looking at stock market performance during election years can provide some helpful insight.

Election year market cycles

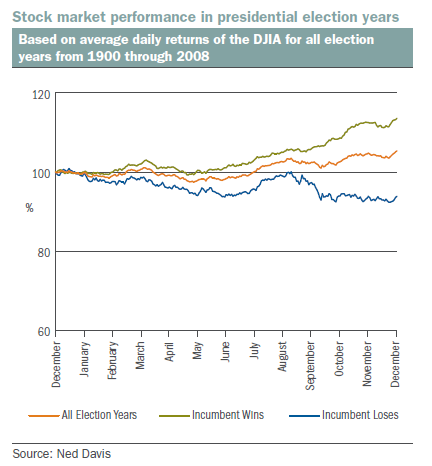

Historical data suggest that the stock market and presidential election years follow predictable patterns and traditionally result in better performance if the incumbent party wins. A look at the historical returns of the Dow Jones Industrial Average (DJIA), the oldest equity market index that tracks 30 significant stocks, helps illustrate this point.

Over the past 29 presidential election years since the Dow was first published in 1896, the index has delivered an average return of 7.18%, slightly off from the average of 7.35% seen in a non-election year according to Dow Jones Indexes. Keep in mind that this data represents past performance and there’s no guarantee that patterns and results will continue in the future.

The political landscape

Generally, investors haven’t suffered big losses during election years. However, the market did decline as recently as the last U.S. presidential election in 2008 during the financial crisis and subsequent bear market. While historical analysis offers an interesting snapshot, it’s important to remember that each election year brings its own unique characteristics. Currently, the economic outlook for 2012 holds a tremendous amount of uncertainty with many factors up in the air ranging from corporate earnings to unemployment. In addition, the European debt crisis continues to weigh on global markets and the effects will remain unknown while problems go unresolved. All of these factors can potentially have a bigger impact on the market and your portfolio than the presidential election itself.

Politics and your portfolio

The political environment and upcoming election can certainly influence the stock market, as ultimately, the president plays a crucial role in directing the nation’s economic policy, tax rates, budgets, etc. But making any financial decisions based on election year market cycles is not a prudent investment strategy.

Stick with your long-term asset allocation strategy. Don’t let an election year influence your financial decision-making or your investment goals.

Copyright © Columbia Management