I noted in a recent post that much of Northern Europe currently represents a good value for long-term investors.

Not only are these countries especially cheap right now, but they generally have better growth prospects than other developed markets and based on current credit default swap spreads, they are perceived as less risky than their southern neighbors.

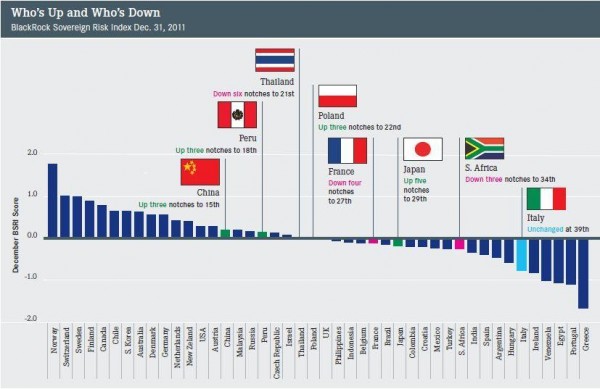

Now, a new BlackRock Investment Institute paper offers further evidence in support of the case for the Northern Europe. The paper, “BlackRock Sovereign Risk Index: Eurozone Revisited & Notable Movers,” contains the Institute’s latest quarterly update of its Sovereign Risk Index scores, which measure countries’ sovereign risk.

According to the latest ranking, “fiscally squeaky clean and economically robust” Northern European countries are at the low-risk end of the spectrum, while slower-growing Southern European countries plagued with debt problems dominate the higher-risk side of the index data.

It’s also worth pointing out that the Southern European countries tend to rank lower than most emerging markets, supporting my view that many emerging markets actually appear to be pictures of fiscal rectitude compared with much of the developed world.

In fact, a number of emerging markets moved up in the new quarterly ranking. As shown above, for instance, China and Peru both jumped up three notches due to new economic data showing better fiscal situations.

Source: The BlackRock Investment Institute