According to the Globe and Mail, it appears to large hedge funds (looking for something to short) that our boring, tried and true, and relatively stronger Canadian banks have become "expensive" relative to their less well run global peers. It might be a good idea to keep an (objective) eye on Canadian bank shares' short interest levels.

Here are some highlights:

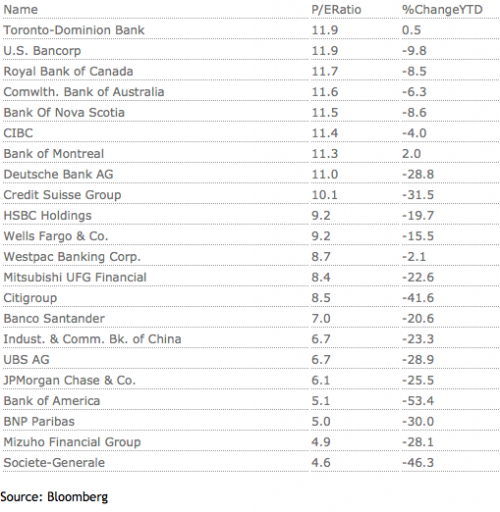

- The country's five biggest banks trade at some of the highest price-earnings multiples in the global banking industry. That's partly because their shares have held up relatively well this year, while their peers worldwide got clobbered on concerns related to Europe's debt crisis and a possible recession in the U.S.

- "The hedge fund community has shown an increased interest in shorting Canadian bank shares of late," RBC Dominion Securities Inc., the brokerage unit of Royal Bank of Canada, said in a research note this week. "While we recognize downside risks in a recessionary scenario, we ultimately believe Canadian banks will hold up relatively better than other sectors in the event of a downturn."

- "The key investment concern from U.S.-based investors is the Canadian consumer's health, and the level of indebtedness in the mortgage market," said Cheryl Pate, a New York-based analyst with Morgan Stanley, which has a "neutral" rating on Canada's banking industry. "We are looking broadly for a slowdown, but I would say it's a slowdown to a normalized level."

- While the banks may look expensive against their global counterparts, other measures show their valuations haven't deviated from historical trends. Canadian banks now trade at an average of 11.5 times earnings, versus an average of 11 for the past decade.

- Veritas Investment Research, an independent firm in Toronto, evaluated the bank stocks by looking at their current prices against their average inflation-adjusted earnings over the past 10 years. This price-earnings gauge, developed by the economist Robert Shiller, strips out the effects of the business cycle on profits.

- "History suggests that investors with a five-year or longer time horizon have generally made very good returns buying the Canadian banks at the kind of Shiller P/E ratios available today," Ohad Lederer and Yuting Liu said in a report last month.

- "The Canadian banks are great companies with very durable business models, but we would be careful with the idea that the Canadian banks are immune to global events," said Rob Wessel, managing partner at Hamilton Capital, a Toronto-based fund manager specializing in financial services stocks.

Global Bank Valuations

Source: Hedge funds take aim at Canadian banks, Nicolas Johnson, The Globe and Mail, October 14, 2011