Its time to be selective about commodities, says BCA Research in its daily notes this July 13. The service recommends keeping a "moderately positive" view on the resource complex.

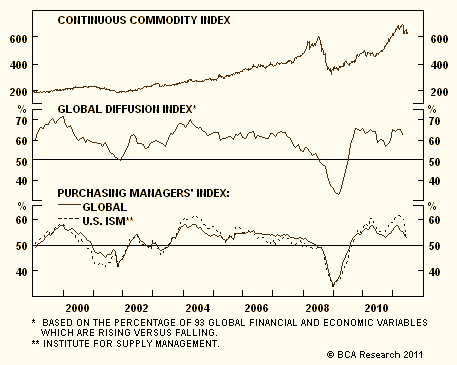

Numerous global macro economic indicators have become slow and soft. There's been little variance in the Global Diffusion Index since the deflation/reflation rollercoaster ride of 2008/9 bust-then-boom. And, although the Global PMI has fallen below its post-2008 levels, it remains much higher than Lehman bust 2008 and 9/11 lows. Concurrently, yield curves in the G7 remain sloped upwards, and this has normally been supportive of commmodities, but not as pronounced as during the last 2 years, during some of the more extreme periods.

BCA has noted in its previous Insights, that when there is no apparent growth or liquidity catalyst, finding a way to generate some alpha, will be as much a priority as maintaining beta positions within a commodity investing strategy.

Despite this, BCA's Commodity and Energy Strategy service, believes that growth forecasts for the coming quarters have become overly pessimistic. Therefore, it reasons that we could be in for some positive economic surprises, even within the context of economic 'mushiness' in the U.S., Europe and Japan, and even a soft landing in the Chinese economy.

Commodities such as Copper and Crude Oil would be the beneficiaries in this backdrop. Gold and Silver could give up some of their lead for a little while, even though the next 1-3 years outlook remains 'encouraging'.

Source: BCA Research