Is the Flattening Yield Curve Good For Stocks?

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

October 7, 2010

Key points

- The flattening yield curve has investors asking questions about what it means and whether it is bad for stocks.

- We're not concerned: Historically, a narrowing of the yield curve has been tied to stocks performing reasonably well.

- Helpful information for more sophisticated investors.

I've been getting a lot of questions on the flattening yield curve. Historically, steep yield curves (points above zero on the chart below) have signaled healthy economic growth, and inverted yield curves (points below zero) have been precursors to recessions.

So with the yield curve currently flattening, people are wondering what it means, and whether it's bad for the market and economy. The spread that's commonly measured and analyzed is between the yield on the three-month Treasury and the 10-year Treasury.

Narrowing yield spread

Click to enlarge

Source: FactSet and the Federal Reserve, as of October 4, 2010.

What is the yield curve?

The yield curve depicts the interest rates of bonds with the same credit quality, but different maturity dates—usually the three-month, two-year, five-year and 30-year US Treasury debt. In general, the curve is:

- Steep when longer-term interest rates are higher than shorter-term interest rates (a "normal" environment).

- Flat when longer- and short-term term interest rates are similar.

- Inverted when shorter-term interest rates are higher than longer-term interest rates.

During the past six months, the yield curve has been flattening because longer-term interest rates have moved down while short-term interest rates have remained stable.

The move down in longer-term rates is partly a function of the prospects of a second round of Federal Reserve purchases of assets like Treasury bonds, or quantitative easing. But it also could signal that the risk of rising inflation is low, given that longer-term rates typically rise as inflation risk increases.

The financials sector has been one of the primary victims of the drop in the yield curve, as Bespoke Investment Group (B.I.G.) recently noted.

This year, the slope of the yield curve peaked on April 5 at 383 basis points. Fewer than 10 days later, on April 14, the S&P 500® index financials sector traded at its high for the year and has drifted lower ever since. When banks can borrow on the short end of the curve at near-zero rates and buy longer-term Treasury bonds at higher rates, a 35% decline in long rates can hurt profits.

That said, it may be surprising to learn that, historically, a flattening yield curve has not been a problem for the stock market overall—quite the contrary.

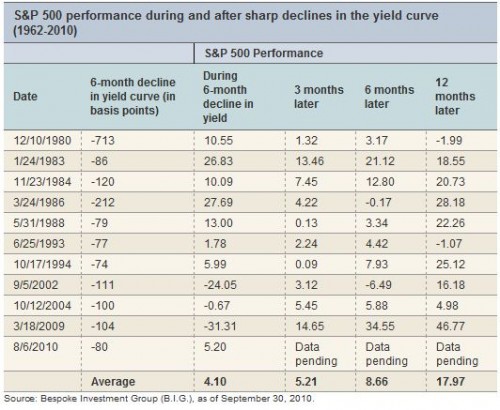

Since 1962, there have only been 10 other periods when the slope of the yield curve declined this swiftly from such high levels. As you can see in the table below, the S&P 500 averaged a gain of 4% during the initial six-month decline in the yield curve. And during the following three-, six- and 12-month periods, returns were quite robust.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative (or "informational") purposes only and not intended to be reflective of results you can expect to achieve.