by David Rosenberg, Chief Market Economist, Gluskin Sheff

I LOVE GOLD, BUT....

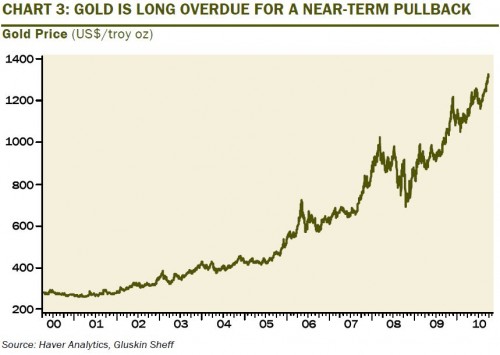

....The recent surge is the same chart as in March 2008, November 2009 and May 2010 ... followed by meaningful corrections ... that were to be bought. This market is long overdue for a near-term pullback, in our view.

It would seem as though investors are putting down their money on a big inflation bet.

- Gold is up 20% this year alone.

- The gap between the long bond yield and the 10-year note yield has widened to an eight-year high of 129bps from 92bps just six-months ago. This is the third highest spread in the past three decades.

- Since the end of August, 10-year TIPS breakevens have risen from 1.5% to 1.8%.

There is no doubt that we have commodity prices firming, a weaker U.S. dollar and a monetary policy that seems aimed at reloading the gun. These are inflationary tailwinds. But we also have contracting bank credit, a 6% (and rising) personal savings rate, a 6.5% output gap and core inflation already south of 1%. These are warning signs, and the Treasury market refuses to sell off, which has thus failed, to ratify the great inflation trade.

There are now, according to the latest Commitment of Traders report, 79,796 short contracts on U.S. Treasuries on the Chicago Board of Trade, and there are 78,361 long contracts. So how is that a bond bubble exactly?

There are now 70,638 speculative long contracts on the Chicago Mercantile Exchange for the euro, versus 35,308 net short positions. Come again? There are twice as many bullish positions on this piece of you-know-what as their bearish contracts? Yikes! The dollar is hugely oversold here.

And there are now 297,272 net speculative long positions in gold on the COMEX compared with 39,623 net shorts. This has become a very crowded trade, my friends. Silver is far less on the radar screen.

There are also nearly twice as many speculative bulls as there are bears with respect to copper. The global boom trade is on.

This note is an excerpt from today's Breakfast with Dave. A free and worthwhile registration is required.

Copyright (c) Gluskin Sheff