Warning: This conversation may alter your perspective on investing and portfolio construction.

When your clients think about risk they most often recall or imagine losing money or enduring volatile markets. You, as an advisor, however, have to widen your perspective on risk to include your clients’ feelings about their investments, and the potential decisions they may make as a result.

Your clients’ greatest risk is the probability they won’t meet their financial goals – it rests upon you, their advisor, to minimize this risk. How do you do that? What actions, what decisions, what conversations are required in order for you, as an advisor, to minimize the possibility that your clients won’t achieve their objectives?

Here, in this podcast episode, we take a deep dive into this dilemma, which may change some of your perspectives about how to tackle market risks as well as the key risk facing your clients and by proxy you, and to shed some light on how to overcome and succeed.

Mike and Rodrigo like to ask, “When it comes to investing, would you rather be comfortable, or successful?”

“When it comes to investing, would you like to be comfortable, or successful?”

Skip to: 02:27“We have extremely low yields, and we have high valuations, for North American stocks, which are broadly what most people are invested in, and so, if we think about the numbers, the average Canadian has about 70 percent of their portfolio in Canadian stocks…””

What is the key?

Skip to: 05:14“So the piece, ‘Getting comfortable with being uncomfortable, Part 1,’ really takes you through a spectrum of ways that you can move towards improving your situation…”

How’s the reaction from clients to this?

Skip to: 09:15“What’s the reaction [from clients] – like I imagine when you’re face to face with clients, when you’re talking about this idea, and you put it to them verbally – What’s the reaction like to that question?”

The advisor is at the nexus of their client’s success

Skip to: 17:01“A hundred percent – at the nexus of, if we just isolate to the investment advisor world, where we have an professional advisor dealing with a retail client, without a doubt, that individual is at the nexus of the client’s success, and behaviourally, that is going to be the majority of the battle. Without a doubt. So you’ve got this level of discomfort. What is the best, optimal portfolio for an individual? It’s the portfolio that they’ll stick with, given their behavioural vulnerability, and then…”

How many $400,000 mistakes can you make?

Skip to: 21:19“Let me break it down for you, and give you a small example, of how impactful this can be, these moments in time can be. In 2009, March, the market bottoms. Obviously, we all know in Canada, that’s our RSP season. I had a family member, who I dealt with for many years, and he calls me up and he says, “I’m not gonna make my $25,000 RSP contribution this year because, you know, I have no returns to show for in my portfolio. Of course, we’re going through a Poppa Bear market, where you’re down 50% across the board … “

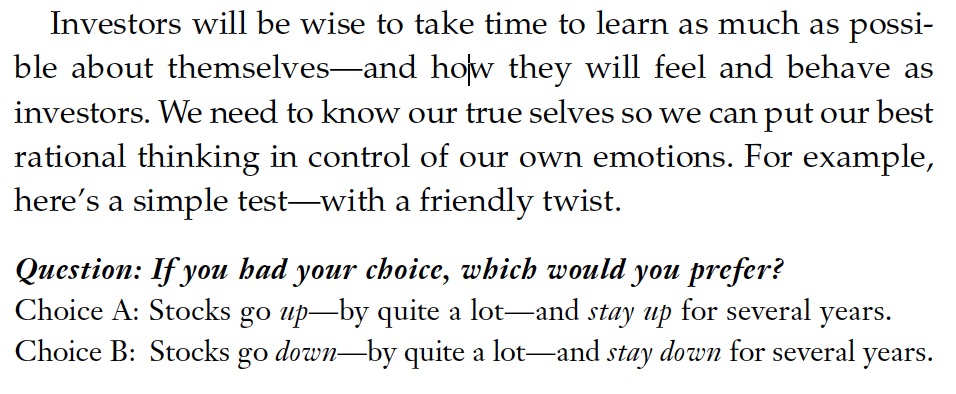

Charley Ellis’ friendly quiz, from “Winning the Loser’s Game”

If you don’t have the tough conversations, you’re missing an opportunity to make your mark

Skip to: 26:07“Every time, when there’s the most opportunity, it’s the toughest time to put money in and make it work…”

An alternate approach to alternative investing

Skip to: 31:37“I find that the vast majority of advisors are comfortable looking for the strategy that’s not going to lose their clients money. They’re looking for the low volatility, safe – a line item in their portfolio they can point to, in 2008, and be able to say, yeah, we lost 40% across the board, everywhere else, , but remember that market neutral strategy, that was up 3%. I told you that fund wasn’t going to lose money. But the reality is, what impact does that 5-10% allocation to a low-volatility mandate have to your portfolio?“

On Capital Efficiency

Here, Rodrigo references this Capital Efficiency piece (donwload it), “Capital Efficiency Trumps Fees.”

What is ‘Capital Efficiency?’

Skip to: 33:26“We want to advocate, we want to educate, we urge advisors to read the capital efficiency piece that we wrote, because it is that extra level, that much better return that you’re gonna inch up your clients’ portfolios, so that they don’t have to work longer, or to save that much more – it’s thinking about the client [and the risk to them] at the portfolio level”

“If you’re at a funeral, you’d rather be in the coffin than giving the eulogy.”

Skip to: 34:44“What do you want to do? When it comes to investing, do you want to be comfortable, or do you want to be successful?”

What should we be doing today?

Skip to: 38:42“What should we be doing today? We should be rebalancing away from the S&P, into the CTAs that are down 50%, and they’ve been down, call it 10% per year for 5 years. So, is that uncomfortable? [pause, sigh] …But when the proverbial shit hits the fan, yet again, I don’t when that is, one year, two years, five years? that high volatility piece of your portfolio that is designed to create those returns at that period in time, is going to be the source of returns that you use to buy BMO, for example, when it had a 10% dividend. Where’re you gonna get – I would buy a 50% decline. With what? “

Where do you start?

Skip to: 42:21“In the absence of value, of course we should discuss cost. But we’re now at 3 bps, we’re at free for beta, so how might we add value to the portfolio? One thing I would offer, as a starting point for advisors, for allocators, for individuals to consider is: What is your reference portfolio?“

After the Warren Buffett bet with Ted Seides was done, Resolve laid out a reference portfolio in it’s piece titled, the “Resolve Buffett Bet Portfolio.”What do you do once you have a ‘Reference Portfolio’ to work from?

Skip to: 45:34“So you can see what our logic is, what our first principles are, what’s a passive portfolio, we talk about all these principles. What is a diversified set of strategies that you can use? What type of level of risk do you want to put on that portfolio to make sure you can actually compete with the S&P 500’s volatility, and risk that it takes?, and so on…”

The advisor’s job

Skip to: 51:33“It means that the job of the advisor is to get an investor through a period of time, 20-, 30-year period, where the chances of being wrong are minimized. [real] Diversification does that. It’s the explicit recognition of our ignorance.”

With costs under scrutiny, where is the retail advisory business heading?

Skip to: 52:34“Let me phrase it in a slightly different light, with a bit of a metaphor.”

The focus on cost has become an over-riding distraction – and paying for something worthwhile has become heresy

Skip to: 59:05“That cost thing has taken the eye off the ball…”

How to actually use alternative investments in portfolios

Skip to: 64:04“If you’re just doing everything that everyone else is doing, how can you diff… It’s not just about differentiating for the sake of differentiating. It’s being able to say, “here’s why there’s a higher cost because we’re doing some things in here that are unconventional…””

How the industry views risk

Skip to: 67:46“From this conversation, what I get is that there’s possibly very little time being spent within the industry, by its practitioners, by advisors, on the subject of how much risk are you getting in any particular instrument, how much volatility, what the measures are, what does that cost, and how much of it should be in the portfolio? That’s one area, you know, pricing of risk, is not even discussed. I think its that people in the business are not going to their clients and saying, “this is how much risk we’re taking, and this is what it costs,” because the client wouldn’t understand it, possibly.”

Canadian pension plans could be the North Star, the epitome, of role ‘model portfolios’ for all investors

Skip to: 70:03“In Canada, we are in a position where we could do better, and very quickly. I travel around the world discussing the research we do, and I speak to pension plans, and every one of them says, “Man, does the Canada Pension Plan, Ontario Teachers, and Caisse have it right. They are the best, and their results show that. They are the gold standard. They are the benchmark. The Canada Pension Plan should have the ability to establish the benchmark, and educate the regulators, where it can trickle down to the banks, and then to the advisors, so that the final investor gets what they are getting, what we are all getting, from our pensions in CPP. They are doing all these things [that we’re talking about].”

Why do Canadians have 70% of their portfolios in Canadian stocks?

Skip to: 74:56“Why do you think Canadians have 70% of their portfolios in Canadian stocks? Because they, think they understand them. Because they drive by them every day…”

Diversification means ALWAYS having to say you’re sorry

Skip to: 77:10“Even if you become a discretionary PM, and you have autonomy over your clients’ portfolios, you still have to invest the time, at some point, at regular intervals, to educate your client on what’s happening. Not the nuts and bolts, but the outcome…”

How did you decide to go Quantitative?

Skip to: 81:59“We know that you don’t rise to the occasion. You sink to the level of your training. And this is at all levels; allocators, institutions. We know, institutions, we’ve seen the research. The managers they fire, going out, do better the next three years than the managers they hire. This is pervasive, this is across the board…”

Whatever you do, don’t quit

Skip to: 91:13“If you quit in the middle, you receive all the risk, and you don’t get the returns. And that’s kind of the crux of it. If you’re gonna take the risk, at least get the returns.”

When it comes to investing, would you like to be comfortable, or successful?

Copyright © AdvisorAnalyst.com