Our wide-ranging conversation with Brian Wesbury, Chief Market Economist, at First Trust Portfolios, where we discuss the state of the U.S. economy, the consequences of the COVID-19 lockdown, what empirical data says about the true state of affairs. Recently, Wesbury has been quoted as saying “The recession is over,” and we discuss what he meant by that.

Show notes:

• What is your background?

• What are some of your most remarkable findings during this pandemic period?

• There’s never been a full-on shutdown of the economy.

• “The recession is over.” What did you mean when you said it?

• What weekly and monthly high frequency data are revealing

• “The virus has a virus.”

• We have borrowed against our children and grandkids to do this – one day we’ll look back on this and realize…

• Quantitative Easing and the COVID rescue are happening concurrently (in case you haven’t given it much thought since the lockdown)

• The COVID related economic rescue is likely to be inflationary

• How can the economy be so bad, and stocks so good?

• This year’s earnings won’t be as bad as originally forecast at the beginning of the lockdown.

• The true consequences of the lockdown are not yet known.

• Continue to be bullish on broad equities and commodities – gold is expensive relative to historical norms versus other commodities, e.g. gold/oil ratio. 45x vs. 16x gold per barrel.

• The worst thing that could happen this year?

• We are resilient. We will get through this.

• There’s a lot of skepticism and confusion surrounding the need for the lockdown

• Collection of Data about COVID-19 cases and deaths are not uniform and subject to a lot of error.

• What have you been reading, streaming, listening to during the lockdown?

Transcript:

Ep. 51 Brian Wesbury, First Trust Portfolios

Pierre Daillie: [00:00:24] Hello, and welcome to the Insight is Capital Podcast. I’m Pierre Daillie, Managing Editor of AdvisorAnalyst.com. Our special guest is Brian Wesbury, Chief Economist. at First Trust Advisors L.P.

Brian was a member of the Academic Advisory Council of the Federal Reserve Bank of Chicago from 1999 to 2007. And has been a regular attendee of the Economists Roundtable Luncheon at the Chicago Fed since 2007.

In 2012, he was named a fellow of the George W. Bush presidential center in Dallas, Texas, where he worked closely with its 4% growth project. His writing appears in various magazines, newspapers, and blogs, and he appears regularly on Fox Bloomberg, CNBC and BNN Bloomberg.

In 1995 and 1996, he served as chief economist for the Joint Economic Committee of the U.S. Congress. The Wall Street Journal ranked Brian, the nation’s number one, US economic forecaster in 2001 and USA today ranked him one of the US top 10 forecasters in 2004.

Brian began his career in 1982 at Harris Bank in Chicago. Former positions included Vice President and Economist for the Chicago Corporation and Senior Vice President and Chief Economist for Griffin, Kubik, Stephens, and Thompson.

Bryan received an MBA from Northwestern University’s Kellogg Graduate School of Management and a BA in Economics from the University of Montana. McGraw Hill published his first book, The New Era of Wealth, in October of 1999.

His second book, It’s Not as Bad as You Think, was published in November of 2009 by John Wiley and Sons. Without further ado, my conversation with Brian Wesbury.

It’s a pleasure to meet you.

Brian Wesbury: [00:02:06] And great to be with you.

Pierre Daillie: [00:02:08] We’ve been reading your, weekly notes and, they’re always very informative and very insightful. We’re delighted to have you on.

Brian Wesbury: [00:02:16] Thanks Pierre. It’s great to be with you. It’s crazy times, but, it’s I, we’re just, we’re stuck with it right now. There’s nothing anybody can do.

Pierre Daillie: [00:02:25] One of the things that we really like about your research, and you as an analyst is that you have a great way of combining, history and philosophy with the economy, the market, , I mean, you do it in such a way that’s very relatable. You point to parts of history and philosophical ideas , and, so I’m excited to have this conversation. Before we get started, I think it would be helpful if you talked about your background, how you developed your methodology, your analysis.

Brian Wesbury: [00:02:55] A little bit of my, I guess my history is I’ve been an economist, a forecasting economist for 35 years. My first job, was at the Harris Bank in Chicago, which was bought by the Bank of Montreal while I was there. And, I will tell you my first job, I was the assistant, to the assistant. So I worked from the bottom up, I started literally keeping data, by hand on cards and then making charts by hand that we sent to the printer. My boss was Bob Genetski . He was one of the original supply-siders, in the United States. I met Arthur Laffer, Larry Kudlow, Jude Wanniski , Jack Kemp, all of these original supply-siders way back in the early 1980s.

So a lot of my approach to economics came from them. Milton Friedman, was also very influential, in that office with my boss and with myself. And one of the books that I read that, changed my life was The Road to Serfdom, by Friedrich Hayek, a Nobel prize winner. He’s an Austrian economist. and, and basically when you lived in Austria in the 1930s, they had a firsthand view of the rise of Hitler and Germany, and the politics that surrounded that and so really what he wrote about was freedom. and why socialism didn’t work, et cetera. And that’s where I came up. So a lot of reading, a lot of, of, of a really tight knit communication with this group of supply-siders. and just to give you a, and anyone that listens, an idea of where I’m coming from and what supply side economics is all about is.

That Keynesian economists that’s the alternative really believe that demand spending drives growth, whereas supply- siders believe no it’s entrepreneurship,it’s invention, that new, things come into the economy and the growth of the economy is driven by entrepreneurs. And then there’s a law called Say’s Law.

Jean-Baptiste Say said that supply creates its own demand, and, we could go deeply into that, but that’s really where I’m coming from and my philosophy.

Pierre Daillie: [00:05:25] Brian we’re in this remarkable period right now. I mean we’re five months into this, pandemic and, I’ve had a chance to listen to a lot of the things that you’ve had to say about the economy and the state of the economy.

What are some of your most valuable findings, on the current state of the economy that you’ve had, in the context where we are today in the, we’re now, mid August, 2020. And like I said, we’ve had about five months, five full months of the pandemic, the shutdown, the reopening.

Now that we’ve had some time to digest the goings on, what are some of the things that you’ve discovered that are remarkable?

Brian Wesbury: [00:06:05] To go back to the very beginning, we always said, I guess I always said, when looking at the economy that this was not a normal, and this is obvious to anybody who’s looking or listening, it’s not a normal recession.

Normally, recessions are caused because the federal reserve raised interest rates too much, or, back in the 19 and 1930, we passed the Smoot Hawley tariff act, which caused a global, literally global trade war. and a shut down of global trade. Then this time. it’s all because we just shut down the economy.

We were hiding, from a virus, and we thought that the best way to do that, I think in retrospect, when we look back, from the future, We’re going to find out this was a big mistake because it’s going to hurt, longterm wealth creation, a great deal, but we’ll come back to that in a minute, but we always thought that this was going to be one of the deepest, but one of the shortest declines and economic activity that the world had ever seen, and it’s playing out that way.

The second quarter was just ugly. There’s no other way to put it. When you locked down businesses, when all of these people go on employment around the world, the numbers were awful. in the United States, we always report things here. Annualized numbers. so we had a 32.9% annualized decline.

And if you back out and just look at the quarter, it was a nine and a half percent drop in GDP. for the quarter. other countries saw very similar things. Sweden was a little bit better. The UK was worse. Canada was a little bit worse. it looks like even though we just have monthly data so far, but, and and then what, as we reopened the numbers have gotten, become a lot better.

Right now our forecast for the third quarter, in the United States is that we’re going to see somewhere between 15 and 20%. Annualized growth, which works out to somewhere between three, three and a half to 5%, for the quarter. So it’s been very quick, and it’s going to take time for us to get back to normal.

If we want to call 4% unemployment normal, we don’t think we’re going to get back there until 2023. And then let me just add one other thing about this. An economy is a very complex thing. If you think about just the price of a tomato, think of all the things that we have to do to get a tomato onto your kitchen table.

We need trucks. We need farm equipment. We need refrigerators. We need grocery stores. We need, there’s hundreds of millions of pieces of the economy that go in to getting that tomato. And when you turn off the economy, you destroy a lot of that information. We’re actually, we’re going to lose a lot of small businesses .

You end up killing cells, if you will. It’s like radiation to fix cancer. When we shut down the economy, we actually hurt, the economy, and it’s gonna take a long time to get back to normal. and I think that’s, when we look back on those, we’re going to see that this was a very damaging thing to do.

Pierre Daillie: [00:09:25] it’s unlike any other time in history, right? There’s never been a full- on shutdown of the economy.

Brian Wesbury: [00:09:31] Yeah. I, maybe back in the Spanish flu, we, there were certain cities where they put quarantines into effect. And if you go back to the bubonic plague and the they’re in the middle ages, they would block cities in behind the walls.

We’ve never seen in my knowledge of all of history of complete shutdown, like we have done this time. and what’s interesting is it’s really not a complete shut down. A lot of people look at the stock market and they go. how could it be doing so well? And yet here we are talking about all the damage from a shutdown and a lot of it’s because technology, we’re doing this right now.

We couldn’t have done this 20 years ago. Thank goodness for cell phones and remote, the ability to work remotely, but we also didn’t shut down, big stores. So in the United States, Walmart, Home Depot, Costco, all of these big, Target, they were all allowed to stay open and it was the mom and pop shops that really got shut down.

and so all of those scores that were allowed to stay open, actually companies really benefited, because their competition was told they couldn’t compete, so in fact, that’s one of the reasons why the stock market has done so well. It’s so it’s not a complete shutdown. But, for small business, this has been devastating.

Pierre Daillie: [00:10:50] It’s true, if you wanted to go out during the shutdown, the only places you could go where there was anything to do was, Home Depot or the Grocery Store, and so you can see where if the mom and pop shops were shut down while these big box chains were open, big box stores were open.

It’s been unfairly in their benefit and to the detriment of smaller businesses.

One of the controversial ideas that you’ve put forward is that the recession is over.

What did you mean when you said the recession is over?

Brian Wesbury: [00:11:23] Yeah, there’s a couple of things that we are looking at and I’m looking at that and I divide it into two different categories.

One is government-centric; in other words, if, if the politicians are allowing restaurants to open up and have 50% capacity, if they’re, if we’re going to open up schools, at least even remote learning, all of that increases economic activity. So as we reopen from a political point of view, that’s gonna, help economic data get better.

And that’s why we’re looking at growth in the third quarter. having a nice rebound. The second thing is that people. Just individuals. we want to be free. and we’re seeing more and more people traveling. If you look at, Google and Apple, they both have websites about, about traveling, some use it, by watching, your location.

And then they aggregate that data others by, if you’re searching for a. An address to go to on the map function, and and all of those show that we bottomed in terms of movement of people back in April. And were now way above where we were in January.

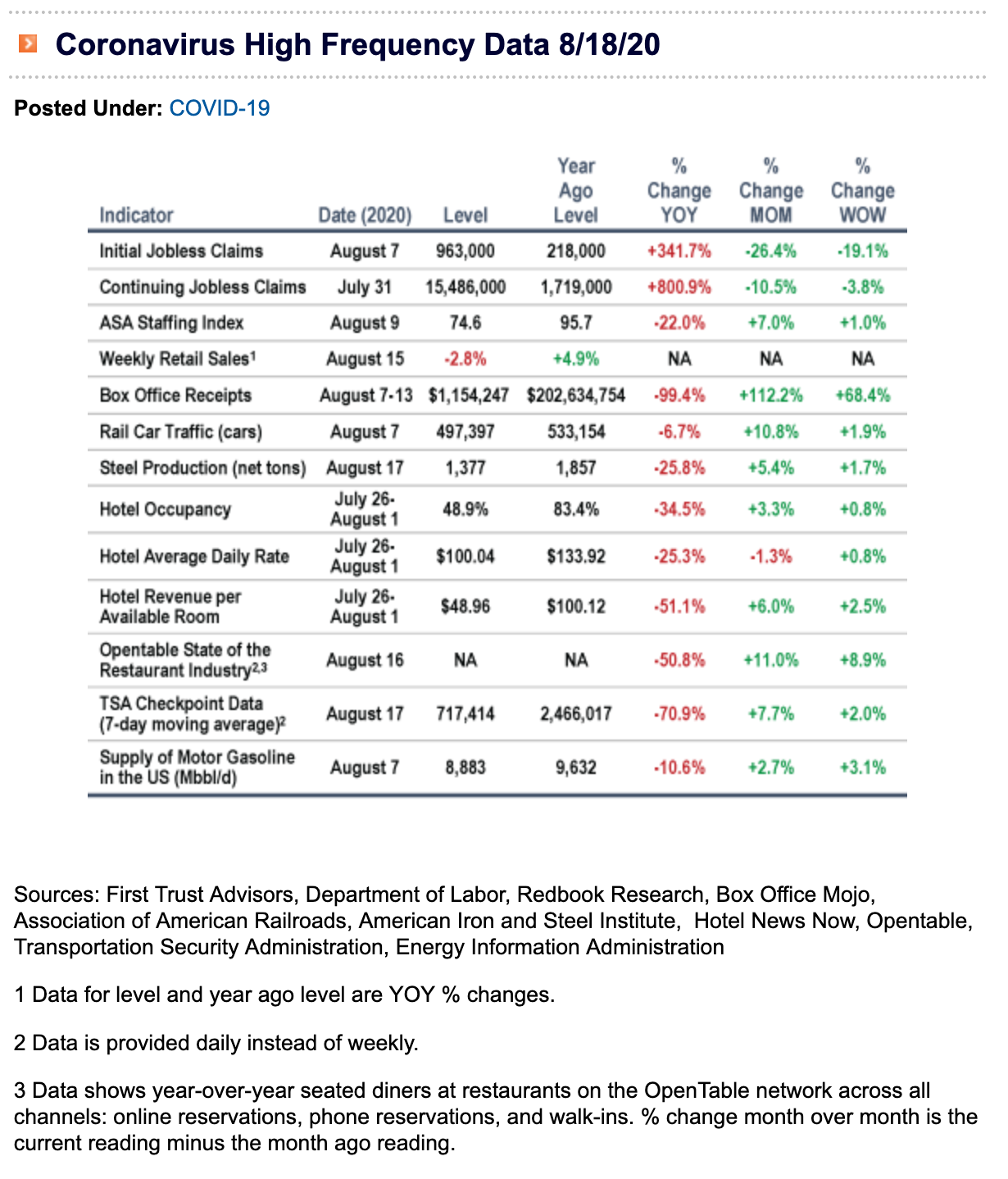

Pierre Daillie: [00:12:40] This is the high frequency data that you’ve been reporting, for example, airlines, hotels. And so can you talk about some of those ?

Brian Wesbury: [00:12:50] Yeah. The, it turns out we really, I, I knew some of these things existed, but we really went on a deep data dive, to find as much economic information about what about really about people and their actions, that we could, that comes out on either a daily or a weekly basis.

Because think about GDP. We. We didn’t get, April, may, June the second quarter until the end of July here here in the United States. So that’s all lagged. There’s TSA checkpoint data for the United States. How many people are going through the airport screening process? That bottomed at about 80,000 people a day.

We just had a day with over 800,000. So we’re up 10 fold from the bottom. Now here’s the point? It was two and a half million a year ago. So it’s still one third or less last of where it used to be. but it’s climbing, the, hotel occupancy. They report that on a weekly basis, open table when you make a reservation, they measure, activity that bottomed at minus a hundred percent.

Literally no activity. And now it’s down about 60% from a year ago. so that’s improving. There’s rail car, traffic, steel production. there are a bunch of economic data. We have, employment statistics, initial unemployment claims, all that stuff comes out on a weekly basis. And that’s where we saw green shoots start to appear, in the spring. So in may, those numbers really started to turn and that’s why we’re one of the reasons we’re saying the recession is over. one other quick thing, boy, there are some there’s some, we have never followed anything, like we’re following this pandemic, every new case, every new death, every new hospitalization, but you can download massive amounts of data. And we have all these tech people that they’re just bringing it in to spreadsheets. And one of the things we’ve been tracking is how many States, on a daily basis, and you can do this, have seen more cases in the last seven days of COVID then they did previous seven days.

And then yeah, and we take those States where that, where the numbers are going up. And then we look at there, GDP contribution in the United States. So right now there’s 14 States. This is as of yesterday, that have. seven day totals greater than the previous seven days, but they’re small States.

Hawaii is one of them. And it’s a great state. I don’t mean small as it’s not important, but all those 14 States you add them up. It’s only 15% of US GDP. So that means 85% of GDP, in the other, States that aren’t seeing increasing cases is actually what my belief is that the people that live in those States, they know these numbers, they may not be able to tell you them, but they know the news is getting better and this makes them want to travel more. Want to go out more? And boy, I’m in Colorado right now. And everywhere I go, there’s just people everywhere. Like restaurants are allowed to be 50% full. Try to get a reservation.

They’re packed. And, and so people want out. And as we watch these numbers, what we’re realizing is that, 80, 90, 75% of the country on any given day. is in pretty good shape. And those people are beginning to move. They’re beginning to fly, staying at hotels, going to restaurants.

And so that’s just gonna force in spite of politicians force the economic data to get better, even if they don’t open up completely.

Pierre Daillie: [00:16:35] I realized what you meant by the recession is over, is that in the context of the pandemic and the shutdown we’ve seen our worst days.

It was interesting. I don’t think we’ve heard it very much. And I think the idea scares a lot of people, which is that we just have to go through this thing in order to get free of it. It’s not going away. It’s not when we’re not going to be able to stop it. I think that was a remarkable thing to say, because I think a lot of people have way too much hope that some magic bullet solution will come along and solve this problem. When in fact the only solution is to.

Plod forward through it, As opposed to resisting it. The cure is worse than the disease. I think that came out at the beginning. And maybe to some degree it’s been politicized, but, if you really stop and think about it for a moment, it’s quite true. There’s a lot of truth in that statement, which is we’ve resorted to, draconian over-the-top measures to combat this problem, and, if we don’t do something alternative to what we’re doing now, economically things could get far worse ?

Brian Wesbury: [00:17:44] Yeah. I totally believe that my thought about this from the very beginning. and it is it’s actually, there’s a, there was a, an, Kind of a medical observer, a scientist in the 18 hundreds.

His last name was Farr, who observed the bell shaped curve that every pandemic, every virus, every, bug that’s come, contagious, goes through and it’s always a bell shaped curve. And Alex Berendsen, he, and I think a lot alike, he would, he says is that a virus has got a virus. And, and the way I always say it is you can’t stop a virus. and we see that.

Japan, they, gosh, they got their numbers way down that they opened up and now they’re accelerating. Hawaii. They really shut down and now their numbers are picking up and they’re an Island and you have to quarantine 14 days if you travel into Hawaii from anywhere in the States or anywhere in the world.

And so they have had draconian measures, like really hardcore and yet they’re still getting cases. And so the, I guess the only magic bullet that we might have is a vaccine and we’ll see, I’m not. I’m not a denier that we couldn’t get it. And by the way, one of the problems, one of the things that happens in this whole thing is you get called a denier.

If you’re not willing to go along with shutdowns and you, then you get, you get called bad names. and I’m not, I don’t believe it’s a hoax. I know it’s real. I know it kills people. I’m not saying I don’t agree with all of that. What I do believe, however, is that shutting down the economy, literally. destroying someone’s life work. Like they, they built a small business, and it’s gone, is that’s that has really longterm consequences and short term for the economy. And so when you have all this unemployment, We know that alcohol abuse, drug abuse, problems in the house. Now we have riots, and I’m not trying to make a political statement, in the streets.

And part of that is because people are so frustrated, and, and I get it. There’s other issues going on too, but when you look at all of the costs in those are short term costs, I’ve mentioned, but longterm. Because we’ve just taken away a lot of the wealth of the country. and we borrowed in the U S so far and we’re going to borrow even more.

We borrowed $3 trillion from our kids and grandkids in order to get through this today. And somebody has to pay that back. And so one of the things that I have tried to do in the last few months is, is to balance out the cost, the cure, versus the disease. and where is that balance? And I, unfortunately very few people are doing a true cost benefit analysis of this.

And I think it’ll take, we have to get into the future and look back before we’ll really know the true cost.

Pierre Daillie: [00:20:50] Have you reached any conclusions?

Brian Wesbury: [00:20:52] Yeah, I think Sweden did the right thing. they still had a big drop in GDP, but it was less than in the US, less than the UK, less than Germany, less than Spain, and I think that he did the right thing, and I know that this is hugely controversial. and, people just accuse you of wanting people that die. So far in the United States, the number 45 children I’m on, I think under the age of 14, don’t hold that against me.

If it’s well over 10 or something, but 45 children have died from COVID. and so far this year, the estimates are that over a hundred thousand children have died from other things, including the flu and pneumonia, and, child abuse and drowning and all kinds of other things. And we, I think we overreacted.

I really do. I. Aye. Aye. Aye. I get it. Aye. I don’t, I, one of the things that I think part of it is we have become so wealthy in the world that we’ve become scared of things. and we don’t always measure the danger versus the true, the fear. Like we have fear. When we, maybe shouldn’t, it’s almost like swimming in the ocean of somebody getting bit by a shark or killed by a shark are minuscule.

And yet ever since Jaws came out, people have been scared to go in the ocean and, and it’s a movie and then every time somebody gets bit, it’s on the news all over the world. and so it’s fascinating. And I think that that the cost, that in the long run. We’re going to, if you think about it, we just spent $3 trillion to get through five months.

And what if we need that money in five years for something way worse or, I don’t know what we’re going to have another world war are we, and we don’t now those resources we put them to use for this. And it was all done because of fear. And, and these models ended up being so wrong. 2.2 million Americans were going to die, and there’s no way, even if we would’ve stayed open, that would’ve happened.

It’s you know, any state, any data you look at, if you look at Sweden, if there’s no way that was ever true. And yet that was the number that caused us to shut down in the very beginning and then quickly it’s gone. All right. That in fact, the doctor who, the epidemiologist, who came up with that, Niall Ferguson, he renounced it.

He said I was wrong and all the data was wrong and, he actually ended up getting himself in some trouble. And I won’t, I don’t need to traffic in that, but he’s gone. He’s not even a part of the conversation anymore, and yet it was his model that caused us to do what we did and it was just wrong.

Yeah. it’s really been an eye opening period in time and just, you mentioned, the $3 trillion figure. does anybody actually stop and think. At what a staggering sum that is, It’s equal to the amount of quantitative easing right over seven, eight years.

One of the interesting things you said, I think was that. If we hadn’t reacted to 2008-2009, the way that we did or the government did. and the fed did that wouldn’t have paved the way for the way that we’ve reacted here.

Yeah. We look at the U S and what we did back in 08-09, almost overnight, we spent $700 billion and back then, that was an unheard of figure. And now you look back and that’s teeny, we got into this. We got into this mode of thinking, we’ll just spend as much as we need, and people think that there are no consequences for that. Partly because we did it in 08-09. But yes, I believe that did pave the road. That’s a great way to say it, for doing what we did today. and you know what, and boy, if you. The loss in income. If you go from, I think in June a year ago, I believe the unemployment rate was about 3.7%.

It was under a little bit under four. And today, in June of this year, it was 11%. All right. so that’s a huge loss of wages and salaries and the government pumped so much money in through unemployment benefits in the United States that we. We actually added more money into people’s pockets than they lost, by losing their jobs.

In other words, the drop in wages and salaries more than a hundred percent of it was made up with government money, which is borrowing from the future. It’s not free. There’s nothing, there’s no free lunch. Yeah, but we took that money from somebody in the future and we gave it to people today. and that’s why right now, retail sales in the United States.

And I think you can probably see data like this around the world. retail sales are up 1% in the United States from a year ago. So they’re actually above where they were, even though unemployment has gone from 3.7, to 10 or 11. and that’s like, how did that happen? it’s because we borrowed from the future.

What’s fascinating is because we’ve kept a lot of things shut down. Industrial production in the United States is down 10%. So we have higher spending, more demand and lower supply, less production, and that’s a recipe for inflation. And then when you add quantitative easing in there, you get, you that’s the perfect combustion of, of activity and money to create higher inflation in the United States.

And I think around the world.

Pierre Daillie: [00:26:40] So Brian, just to clarify, is quantitative easing still happening concurrently with the stimulus?

Brian Wesbury: [00:26:49] Absolutely. In fact, the federal reserve is. This is called what we could have a, this is a book. This is a long conversation. but there’s a thing called modern monetary theory, right?

I’m just gonna, it goes deep and I’ll, but I’ll give you the thumbnail 40,000 foot, talking points about it. And basically what people say is, Hey, if you’re the world’s reserve currency, especially if you’re the world’s reserve currency, you can just print as much money as you want. You can deficit spend as much as you want. The central bank can actually buy the debt that the government issues, which is what the fed is doing now.

And you can do it for like forever and there aren’t any bad consequences. That’s basically what MMT is. And I’m not trying to create a straw man, but basically they’re not, they don’t worry about deficits and they don’t worry about. Money printing. and my view is that’s just not true. And we’re going to find out that you’re going to get inflation.

You can’t just print money, Willy nilly with, and have it enter the economy without getting inflation. it’s never happened in history. So even in the United States, even with the world’s reserve currency. and so when you look at what’s going on today, One of the reasons that we’ve been able to get away with this is that the fed is buying the treasury bonds so that the government can spend this money, and then they earn interest; the fed does, and then they pay that interest back to the treasury. You’d get thrown in jail. If you did this at your own company. As a policy thing, it seems like we’re getting away with this, but we will find out we don’t. In fact, today, in the United States, we got the consumer price index yesterday. We had the producer price index and we have the highest increase on a monthly basis, 0.6% in core consumer prices.

And that means we take out food and gasoline. And I’m not trying to play games with that, but it’s. Though, since those are so volatile food prices and gas prices, we remove them just to look at a more smoothed out series. and it was a 0.6%. and that’s the highest since 1991 in the United States.

So I think we’re going to see more numbers like that. You can’t have demand higher than supply for long without ending up with higher prices.

Pierre Daillie: [00:29:17] This financial rescue, in reaction to COVID it’s different from quantitative easing in that in itself because of the sheer size of it and the amount of money that’s being pumped into consumer’s hands. It’s different in that it’s inflationary.

Whereas quantitative easing is absorbed largely by the bond purchases and the retiring of bonds, the recycling of paper. A lot of that inflationary pressure that people talked about 10 years ago has been absorbed by the way in which they’ve gone about doing these bond purchase programs. But this time around what’s very different is that they’ve put the money straight into the consumers hand, in order to shore them up, I, it, I remember, it feels like it was ages ago, but Andrew Yang talking about universal income, And thinking, what a crazy idea that was and here we are, we’re In the midst of a universal income program that, we really have no idea when it will terminate or how, and what the knock on effect of it will be, whether it’s inflationary, or it’s positive for the economy or it’s negative for the economy.

I’m sure you have ideas about that. but it, that is where this rescue differs from the financial rescue. This consumer rescue is really, what’s leading to some of the inflationary pressure that we’re starting to see that you just mentioned the rise in CPI. but also what’s fueling interest in commodities again. The price of gold has risen. That makes for some very interesting, outlook in terms of investing. it’s been fairly obvious that since the financial rescue began, that equities have rebounded, maybe not all of them, but certain ones. and certainly, because of the theoretical outlook for inflation, the price of commodities has gone up. So can you talk about your outlook, first of all, for equities and then for commodities?

Brian Wesbury: [00:31:18] Yeah, I think this is obviously it’s a conundrum.

How can the economy be so bad and stocks be so good? And I. We mentioned already. We talked about technology. Obviously they take in five years of future growth, put it into five months. also if you’re Home Depot or Walmart, you’re allowed to stay open. So Amazon, clearly, benefited because everybody’s ordering online, et cetera.

So we know why those companies have done so well and that’s obvious. And in fact, their earnings have gone through the roof. All the tech companies and those box type stores. They’ve had great quarters. Net, earnings are going to be down in the second quarter, but not as much as people thought, partly because a lot of it is partly because the government’s put all that money in, but also because we.

There’s a lot of people still, we it’s 10% unemployment, but that means 90, the present of people are still working and they’re working remotely, et cetera. And so the economy has been hit hard. but in terms of corporate profits, it hasn’t been hit as hard. And then when you look at the stock market, you always have to take whatever profits are, and then you have a discount rate, right?

So we, because a dollar’s worth of profits isn’t worth as much if interest rates are 10% then if interest rates are or one or a half or zero, then a dollar’s worth of profits is worth more if you have a lower discount rate. And so we’ve got two things going on.

Number one, profits.

We expect earnings to go up in Q three and Q4 and next year as well. And that’s, I think one of the things that the stock market is saying, but also we have to remember that we take whatever earnings profits are out there and we have to use a discount rate and the higher interest rates are the less future profits are worth.

So the federal reserve by cutting interest rates to zero, pulling the 10 year treasury yield down to 0.5%, 0.6%, 0.7% that really boosts the value of a dollar’s worth of earnings, and it allows PE ratios to be a lot higher. Now you can get to a place where the market is overvalued. People have worried for a very long time about quantitative easing, and they’ve called the market a sugar high, as a result of that, I’ve never, for the last 10 years, I did not buy into that because if you did that model, you take earnings and then discount them with the ten-year treasury, and then compare what you find to all of history. We kept seeing a market that was actually undervalued. it, it wasn’t fully pricing in that low interest rate.

It wasn’t ahead of itself on earnings. And that’s still true today. my view is that the market as a whole, and I’m really talking about the U.S., but I bet this is the case, around the world, is not over-valued today. How could the market be at a record high with the economy hurting this bad, but it doesn’t appear to me that we are overvalued today.

Partly because interest rates are as low as they are, but even if we use a higher interest rate, the market’s still undervalued because profits just didn’t get hit as hard as a lot of people feared early on. In fact, if you go back to the bottom. Of the market in March, April is really when we bottomed, the U S market was predicting an 80% decline in corporate profits. That’s what we determined, back using that model, but then going backwards. and figuring out what the market was expecting, and that was way over done. They’re going to end up falling maybe 20%, probably a little less than that this year, so the market was way oversold, in April, and that’s one of the reasons why it bounced back so hard.

Pierre Daillie: [00:35:12] The thing that confuses people is that we’ve had this shutdown, this unprecedented monster of a shutdown and, restaurants for example, are either losing money or they’re going out of business and they’re reopening to, 25% or 50% occupancy. And I think at the street level, people are having difficulties seeing, like, how does this thing turn around? Then when you go to the sort of macro level, when you look at, large companies, how is it that they haven’t been hurt more? I think we’ve covered some of that already, which is that You know, many of them were allowed to stay open. In the case of technology companies, which have become more like utilities these days.

they’ve just gone on they’ve gained from it, but it’s true I think that at the beginning of this crisis, at the beginning of this pandemic, earnings got written down pretty hard, at least all of this year’s earnings. but you say it’s not as, it’s not nearly as bad as that.

This year’s earnings are not a complete write off. They’re not as bad as they were predicted to be. But on the, on the corollary that it could take. Up to 2023, 2024 to recover that. I think that’s a really, personally, I think that’s a really reasonable outlook. I think some folks have said even longer.

So in terms of, the equity market, what areas do you see being overlooked right now that are being missed? It’s pretty clear that investors are chasing some of the high flyers, like Amazon, Apple, Tesla, you can go on a fairly long laundry list of companies that are blowing out the lights.

But. Some of the overlooked areas that you think are opportune, what would some of those areas being, or sectors.

Brian Wesbury: [00:36:55] I think energy is overlooked, in a big way. it’s come back. I, if you look at, some of these oil companies they’ve come back a lot from where they were, however, they’re still way below their peaks, and if I’m right about inflation picking up, that’s going to. it’s going to lift commodity prices, which includes the energy complex, and so I think they’re going to, they’re going to do a lot better. one of the, here’s an interesting thing. It just depends on your view about the pandemic, all of these things. But if we get a vaccine. think about what that does to all the cyclical companies that are out there. They’re gonna, they’re gonna explode because it’s over, and we are back a hundred percent. Every restaurant is every, everything.

Here’s one of the, even if we get a vaccine, I still believe it’s going to take years for us to get back to 4% unemployment. And one of the reasons that I believe that. is this, you mentioned, restaurants. There are some restaurants that maybe had cash. They were hugely successful for decades and they banked it, and they wanted to survive, but they’re losing money at 50% occupancy.

So rents are going to have to come down. I’m very worried about commercial real estate, and unless we get a vaccine, and we get totally back to normal. And it happens overnight.

In fact, I know of a few that were owned by families for 30, 35, 40 years. they’re, they’re tired of working 13 hour days. And they, it’s a labor of love and they were hugely successful, but they were already looking for a way to retire, get out. And then when this came along, they just shut down.

And so I have a beautiful corner spot and. New York or Toronto or Chicago, or w whatever town and. and that there will be a restaurant in there again, but not that one. Somebody has to come up with the cash, and then reinvest and open. and, I know that can happen reasonably quickly.

But if you start thinking about millions of small businesses that have to find a new owner, a new investor, that takes a long time, Plus, and then nobody knows if we’ve now made this normal, that we shut down every time there’s a new virus. That’s a scary thing too, because now what do you do?

You have to hold more cash. You have to have more insurance. You have to that’s what cash really is. It’s insurance. So you. You’re we’re actually going to change the way people operate in the future. And I think that all that causes some areas to grow, but other areas to hurt. So I do think the energy complex come back.

I think a lot of the cyclical companies, will, will do well. manufacturing is just coming back. I get it, president Trump put a tariff on Canadian aluminum and so those issues are the side, but as we open up, I think all of these things will benefit.

I think the rest of the market will start to catch up. the value companies will start to catch up with the growth ones, in the months ahead, and that’s just, I’m actually a believer that we will get back to normal. Would that even without a vaccine, because I believe in Farr’s law, I think, in that we’ve run the course without we’ll stay.

Everybody says it’s coming back in the winter. We’ll find out. But I believe this is my personal belief. If anybody can hate me, if they want for it, or they can call me whatever names they want, I’m just here to tell you what I think. And that is. that I do believe we’ve reached herd immunity in a lot of places.

I think Sweden has, I think it’s a lot lower than 70%. I don’t think you need that. I think there are a lot of people that were naturally immune to this. and it’s unfortunate that some groups of people weren’t but I think there were. And so I think we’ve reached that point and I think. People will get more comfortable.

I remember nine 11, like it was yesterday and we all remember that. And you couldn’t fly anywhere. And it just so happened that I flew on… I had a trip plan the very first day you were allowed to fly again. So it was eerie, being at the airport, but there was a group of guys that kind of all gathered, like in the waiting area, before we boarded the plane, they’re like, “Are you on aisle?”

Like everybody wanted to be the next Todd Beamer or something and we’re going to fight them off and we’re going to protect this plane and, and that happened a few times, in that first couple of months, but everybody said we would never get back to normal, but last year more people flew than ever before.

So I, human beings are resilient and I think we will get back to normal. Now, it’s not going to happen overnight, but people are going to travel again. They already are. And when your neighbor goes on a trip, and the kids are talking about it three weeks later and they had such a blast, guess what? Your spouse and your kids want to go on a trip too.

And so the peer pressure. The competitive pressure among companies. Elon Musk in California. So Detroit said the auto companies could open up again and they could start producing cars. California said you can’t and Elon Musk said, I’m gonna leave California. If you don’t let me open and guess what?

They let him open. And So that’s the pressure. You just have competition among companies, among states, among individuals and peer pressure. And I think we will get back to normal. And what that means is that these value companies will come back. I think the estimates of the damage… I’ve made a case here today that we’re gonna, that we’re going to pay an economic price, but I don’t think it’s going to happen at the stock market level.

it’s happens more that we just have less resources in the future to fight a battle, a new crisis, than we did because we overreacted to this one, but the stock market. I think it’ll come through just well, it already has.

Now, you’re right. It’s if you take out those high flyers, the market hasn’t done as well, but it’s not done as badly as everybody thought it would at the very beginning.

And I think that’s about to change. I think the value sector is going to catch up.

Pierre Daillie: [00:43:02] So basically you’re bullish on equities. Yup. And commodities, and yeah. What’s your outlook on commodities? Like on gold, on precious metals in general. And then beyond that in the every day commodities oil, you mentioned grains.

Yup. We’ve had such a long period where commodities, have underperformed the market tremendously and you see that we’re possibly entering a new inflationary period, however many years out that may be, that commodities prices are set for a rebound?

Brian Wesbury: [00:43:38] Yeah. and this goes back. we’ve already talked about this, but let me just say it the way I see it, look at or I think about it. And that is when the Fed first did and central banks around the world did quantitative easing in ’08, ’09, ’10, ’11, ’12, ’13. Up to, from really 2008 to 2015. At the same time they did all that quantitative easing, we hammered the banks with regulation. And so what ended up happening is that money didn’t get went out and it never really juiced the money supply. So M2 which is, if you, I’ll just give the short definition. You can look it up. Milton Friedman told me to watch M2, but it’s really all deposits in all financial institutions.

So it’s just all the cash that’s circulating. And M2 grew 6% a year, like all through ’09, ’10, ’11, ’12, all the way through the 20-teens, if you will. and, but now it’s growing 24% year-over-year and we haven’t seen money growth like that maybe ever, but certainly not since the 1970s. And, and that the 1970s was a case where commodities, and everybody kept thinking, “Oh, this is all about OPEC,” but it was really about the money supply.

And I think that’s going to happen today. And so I’m looking for a broad based increase in commodities. Now I will tell you that gold. it could go higher, right? It probably will. I’m not saying it won’t, but when you look at its value today versus other commodities, it’s pretty expensive. and, it’s priced in a lot of inflation already.

And so either other commodities have to come up a lot too to support the price… in other words, for every ounce of gold, historically, you get about 16 barrels of oil. today, I have to do the math in my head. I’ve been done. It’s $1,900 divided by 42. that’s a lot of barrels of oil and so it’s way more than historical, and so Oil is cheap relative to gold. Copper is cheap relative to gold. Aluminum, Tin, all the grains and that. And I, and so I believe that they will, because of this general inflationary pressure that I see, I think these commodities are going to come back up.

That’s really good for Canada, by the way. We all know, that commodities and the Canadian stock market kind of move together. So that’s a, I think that’s a really positive thing.

Pierre Daillie: [00:46:07] What are your best and worst case expectations?

Brian Wesbury: [00:46:11] It’s really, it’s not so much that I worry about the economy. I guess it’s more than I worry about the shutdowns and I, and they go hand in hand. So if we were to lock down again, really locked down again, that all bets are off. we could see 80% decline in corporate profits and the market would have been right back in April, but that’s the only way we’re going to go back and test those lows. or even get into a bear market is if we shut down don’t again. And I just don’t see that happening. I think the pressure, it’s interesting the political pressure that is building. and I, I don’t want to sound like a conspiracy.

I do not want this to be cynical or conspiratorial at all, but if you think about New York, they’ve really shut down hard. Now. Now there’s lots of people that have all kinds of thoughts about why they’re doing it. I think it’s fear and they, and boy, did they get hit hard in March and April?

A great many of the deaths in the United States happened right there in the Northeast. And so I get that, but even in New York, Andrew Cuomo is coming out and saying, schools should open. And the, and I think the reason is that the pressure, he went on TV and said, I need people to come back, and he’s having conversations with billionaires and they’re going, “Why should I come back?”

We need your tax money. My kids can’t go to school. I can’t go out to eat. I’m like, I’m not coming back. Why would I come back? And he goes, okay, we’re going to open schools. and And so what’s happening is there’s pressure building for them to open. That’s one of the reasons why I remain optimistic.

But if we reverse course, and by the way, something we haven’t even talked about in here yet. And that is the political pressure on why? I think a lot of governors, especially States like Illinois, New York, New Jersey, Connecticut, who are in financially really bad shape. they were before this all happened. They have unfunded pensions. they’re running basically running deficits, even though they’re not supposed to. And, they’re in financially bad shape. And so what’s interesting about that is that they want Washington to bail them out.

And they think if Joe Biden wins the election, that the government will just give cash to States to bail them out. And I, I don’t know, as we get closer to the election. I think that calculus matters a lot, but I think there’s some governors who are worried that will never happen. They need the open up because they need the revenues coming in too.

So my biggest fear is that we stay shut down. We’re willing to do it because we think the government will just bail us out. and then we just keep spending and spending. And then we end up with real problems, like the 1970s in a way, that begin to show up on our doorstep.

But right now, That’s a medium term problem to me, medium to long. It’s not really in the next six, 12, 18 months.

Pierre Daillie: [00:49:14] Yeah. It’s a weird catch 22. Children obviously want to get back to school and, but the catch 22 is that if you can’t send your children back to school, then getting back to work will also be too challenging or too difficult to do, for most families who have young children. It’s really a key to the solution. Catch 22, is that your children go to school and what, if they catch the virus at school and then bring it home there.

There’s a lot of, a risk being introduced there. And that’s really where the conundrum is for this back to school. It’s looming well, it’s already started in the U S but for most schools here starting in September after labor day, that’s really causing a lot of new concerns and new fears. The other thing that you mentioned was that the, given the amount of, payments that are being sent or were being sent, that really was creating a disincentive to the urgency to go back to work. People are getting more money to stay at home than they were getting than they were getting in their jobs.

Brian Wesbury: [00:50:12] There’s some people that want to make it all about politics and I’m just, I can’t, I just can’t go down that road. I don’t want to go to, I don’t need to. I really think it’s more about fear. and so what’s what I find fascinating is that every. if you let’s back up just a minute.

so we shut down the economy. You can’t have your restaurant open, you can’t have your bar open, you can’t get your haircut, you can’t do all these things. However, what people are willing to do is they’re willing to have the economy shut down, but they want to eat. So they want grocery stores open. They need gas to get to the grocery store. So they want gas stations open, which means they’re perfectly fine with grocery store clerks, working every day. the farmers and truckers and ranchers and Packers and pickers. they’re they’re. if you kinda think about it, people are saying, Oh, I don’t want to take a risk, but, I want this whole section of the economy to remain open so that I can still eat. If you really believed in all this stuff and it worked. I think I almost call it selfish. It’s like selfish fear because you’re saying, Hey, I’m sorry, you’re an essential worker. You work at Walgreens, you work at the drug store, you work at the grocery store.

you have to keep going right work, but I’m not, and what’s the, and then you find you every stories in the newspaper. So you can’t get it on an airplane. and you don’t get it in grocery stores. And then I say 45, only 45 kids have died. And, and I believe almost every single one of them had comorbidities. But then you read a story, there’s a seven year old, and they make it headline news everywhere. So every time you think you found a little sliver of good news, there’s a story that comes out that takes it away. Like kids are fine, but they give it to grandma, and so I, unfortunately this fear has spread, and I don’t blame politicians for what they’re doing. When you’re, when Dr. Fauci gives you a choice – either shut down the economy or kill people, what are you going to do? If you’re a politician, you’re going to shut down the economy because the alternative is you’re going to be called a killer, a murderer.

It’s happening to governor Cuomo, it’s happening to President Trump, so they’re using it as a political weapon, but that all came from these pandemic models and the scientists, and then the political choice was taken away. And that’s why. I I can make arguments all day long.

I can Twitter and, find slivers of data and show stuff. But in the end it really doesn’t matter.

Pierre Daillie: [00:52:51] It’s not black and white. I think that’s the bottom line. it’s, things have become so polarized and so politicized that, there’s a lot of virtue signaling. There’s a lot of people pointing fingers at each other and everybody, everybody wants to blame everybody else.

But the reality is that it really should be treated as a more gray situation as opposed to black and white. We should proceed forward with caution. We should reopen with caution. We should be careful and keep going forward as opposed to standing still.

A train’s coming down the tracks and we’re frozen with fear standing in the track and, if we don’t, if we don’t and get moving forward, but carefully, and whatever, the definition of careful is for everybody, that things will get worse just because we’re standing still.

Brian Wesbury: [00:53:36] Exactly. that’s, the thing is individuals and this is believing in freedom and the supply side, I believe in the individual. And so if your kid goes out and is at a party, you ought to know, all right, first of all, especially today, And then, put up a tent in the backyard, like for two weeks, like you went to that party, you’re staying in the tent, you can have it both ways you can’t, but now what we want to do. And I like that, by the way, what we’re doing is we’re saying, okay, I don’t want to tell my kid that you have to make rules so that nobody gets to do it, and so and there are some, I’ve been on airplanes a number of times. We had a family wedding, in Oklahoma. what do you do? I, I finally, I travel so much back January to March. I was in 38 different cities. I wow. If I didn’t get it right. You can’t get it.

Like I, I got, or I can’t get it. That’s what I’m, I, I flew on airplanes five times a week. it was like, I travel a lot. and I look back at that. I was in New York City on March 3rd New Jersey on March 4th. I was in the heart, the belly of the beast.

Pierre Daillie: [00:54:50] I read an article yesterday that the risk of catching COVID from a flight was one in 4,400, I think.

Brian Wesbury: [00:54:59] Yeah. I saw that. That’s one of those articles that I’m talking about. I’m like, how is that possible? it’s if you can get it at a party, how can you not get it on an airplane?

I wonder where all these studies are coming from, because they’re certainly not, double-blind tested, and there, I just, I find it interesting that you can get it at school, but you can’t get it on an airplane. You don’t get it at a protest, but you do get it at a pool party.

So it, I don’t know, were all these articles or studies and, and thoughts are coming from, but common sense, if you go to the airport, They make you stand six feet apart in the wine to go to TSA. But on each side of you, there’s people going by, only goes straight ahead. It doesn’t go sideways. And I just start looking at stuff like this and I have a hard time believing those are scientifically proven, and I, and a lot of it just, and this is what I think there’s a lot, especially a lot of Americans, I don’t know about Canadians necessarily, but we’re skeptical of a lot of this stuff.

And, and that’s why people are flying. Airplanes are packed, every seat is sold. I used to leave the middle seats open. Yeah. Not anymore. And, they’re all packed and I’ve flown a bunch and. w what I find fat and hardly anybody. I think people are scared to cough, but nobody’s coughing anymore.

I think partly we’re washing our hands, like crazy, but remember all these stories that you used to read. Hey, if you use that purifier, Purell. All the time then you’re not gonna really be exposed to bacteria and that, worsens your health over time. you need immunities.

So evidently right now we’re going to have a lower flu season because of the way we’re behaving. Now that’s probably guaranteed, but either that or there, or we’re wiping out or immunity. Yeah, exactly. Exactly. We’re not going to get immunity to things that we should, and that’s, we’ve had that debate about kids for a long time.

I always said, go out and eat some dirt. Kids need to eat dirt and all we, because we all did, and but it, and I think it will have, see, this is one of the longterm consequences that we may face. we look back 15, 20 years from now. We’re going to find out people aren’t as their immune systems aren’t as good. That’s I think I’m not a doctor, but I’ve heard this from doctors for years.

Pierre Daillie: [00:57:30] Already with the overuse of antibiotics, as a society, we’ve created superbugs right in the, in hospitals, from, all the abuse of antibiotics. I like your point, that there’s a lot of highlighting of really bad news, and it could be one, one, outlier case, but we’ll latch onto that because it is, it feeds our fear.

Brian Wesbury: [00:57:52] One of the things that I have tried to do to, for the people that listened to me and that are investors and people, people that want to hear is talk about the data that we’re using, and one of the, one of the things that we know is that for example, hospitals in the United States were compensated extra.

It’s A war zone pay or something for having a COVID case in the hospital. So in fact, the number was a pretty high compensation for these hospitals. and what we were trying to do is offset the damage cause they had to shut down all the elective surgeries, all the knee and hip replacements. All that stuff was shut down. and so that first CARES Act Bill gave the house hospitals, hundreds of billions of dollars, and some of it was distributed per COVID case. So that gives an incentive to label a death COVID, even if… I even heard one of the health experts in Illinois say, even if you were in hospice and you had two weeks to live and you get COVID, we list you as a COVID death.

So there’s that really a good number to use? The other thing is that we know the tests, give us false positives and false negatives. We just saw with Governor DeWine of Ohio, he had a positive one day and a negative the next day. and we don’t know which one was right. And so we know that we also know that some States, and I’m not trying to blow it all out of proportion. But I think we just need to understand some States were putting antibody tests. So if you tested positive for antibodies and then they were adding it to the positive, cases.

And so all of these things distort the data. I’m not trying to say it doesn’t exist. I’m not trying to say that it doesn’t kill people. I’m not trying to say any of that. However, the numbers that we are looking at every day, And making these huge policy decisions, $3 trillion of spending. The numbers aren’t perfect.

And I just think we need some humility about what we’re doing.

Pierre Daillie: [00:59:57] The way that the data’s being sampled is not uniform there’s no hard, there’s no hard rule about how it should be done, whether they’re receiving an incentive for doing it or whether, their collection methodology of that information is correct.

That’s going to happen globally, not just here. you pointed out that the number of deaths per million people, figures were, very telling exactly, how bad or how good things are, relatively speaking, and yet these numbers don’t get reported that way. It goes without saying that every death is a tragedy, it’s what we’ve been going through is tragic. And we really, because we’re being flooded every day with news about these numbers there, they’re starting to become numbers, and It’s hard not to become a little bit jaded or a little bit insensitive about what’s actually going on, but at the ground level, at that, at the household, by household level, it’s a pure tragedy what’s going on. This sickness has arrived on our shores and this is how we’re dealing with it, but to shine a light on it, to highlight the positives. is just as important as reporting the negatives, otherwise, what hope do we have, of going forward and saying, there’s this bad news, there’s some good news I’m going to move forward because I have to, thank you for that perspective.

I think that was a, it’s very interesting. And it’s very helpful. Before I let you go go, Brian, are there any sort of remarkable blind spots that you see that are positive?

Brian Wesbury: [01:01:26] The biggest one to me is the resilience of people. You go look at Italy, you look at, people want to get out. They want to be free.

Humans are not built to socially distance, and as I look at the high frequency data that we talked about, hotel stays, TSA, restaurant reservations, people flying, all of that stuff. What I see is that there are, there’s a huge group of people that I’m talking more about America.

Cause that’s the data I’m looking at, but I think it’s happening everywhere around the world. They’re saying, look, I know this thing kills it’s I know it. but there’s a lot of things that do, and I have to live my life. And, and I just, that’s the positive that I do think we will get back to normal.

I do not think this will change the world forever. if we think of 9-11 or the Spanish flu or the civil war, world war one, or world war II, people that were a lot of people in every one of those cases who said, we’ll never get back to normal, whatever normal is, we’ll never get back to what looks like normal.

And we did, and I think that will happen this time too. And so that’s the real, underlying positive. The thing that I, that I believe in, and that keeps me going because I, if I thought yeah, that the world would change, that there are quite a few people out there going, ah, you know what, we don’t need restaurants.

This is creative destruction. This is we’ll find a new way to do everything. I’m like, you still have to fly. You still have to drive, and we spent a lot of years coming up with restaurants and bars and, the ones that are successful do it really well. And I just don’t see, I don’t see the world finding all new ways of doing all that stuff just because they’re fearful of something that’s going to go away anyway. Cause it follows Farr’s law.

Pierre Daillie: [01:03:26] I agree. We don’t need to reinvent the wheel. I’m in total agreement with you.

Brian, before I let you go, I have to ask you, what have you been reading? Yeah. or streaming or watching if you’ve been watching any Netflix or anything like that or listening to podcasts, is there anything that you’ve read that really sticks out for you, during this period?

Brian Wesbury: [01:03:50] The one book that I’ve been telling her, yeah, we’re ready to grab. And it’s actually an easy read. I like history and I, but it’s, I think I’ve got his name, Erik Larson, just wrote a book, it’s called “The Splendid and The Vile”, but it’s really about Winston Churchill, and it’s about one year of the blitz of, of the German bombing of London and the United Kingdom.

And it’s written, he actually has pulled all these diaries from, Churchill’s, kids and, and it was the many of his top lieutenants and it’s really a fascinating book and, Goebbels,… there’s a bunch about him in there, was the propaganda arm of Hitler, of of Nazi Germany. And. Wow. You start reading about what he was saying and doing and how he was undermining. We think the Russians are messing with elections. He did it in the UK and, all during that period.

And it’s really fascinating. It’s an interesting look into Churchill and he’s one of my favorite world leaders, historical leaders, and, I found it fascinating it’s stuff that I hadn’t read before. Cause it’s a real personal look into his family and his inner circle.

Pierre Daillie: [01:05:05] That sounds fascinating. We’ll put up a link for it. I think that was, it was a very difficult time because Churchill was really up against the entire British government and what he wanted to do or how he saw things. and maybe this propaganda had turned his counterparts in the British government against him. That sounds like a fascinating read.

Brian Wesbury: [01:05:25] It was kind of in a way very timely, because you read about Goebbels and propaganda and the strengths that Churchill showed in the face of all that bombing and the resiliency of the people of the United Kingdom, they, they would have nights where, they would set cities on fire, and yet they were resilient. And that actually, that’s one of the things they had in there was that the British government, and I don’t think this was Churchill’s invention, but they put all these people on the streets that they did instant polling, like the next day or during the bombing. And they, then they would report back what people had said. So it was like this army of contact tracers, but in this case it was just this, they would report back whether people were in a good mood, a bad mood, scared, fearful, thought the government was doing good, bad.

Should they surrender? Should they not? all that stuff was of all that information was constantly coming in to the government. And it’s fascinating. I get is, Hey, we have Twitter.

Pierre Daillie: [01:06:32] That is fascinating Brian.

I want to thank you very much. You’ve been very generous. Thank you so much for being so generous with your time.

Thank you. we’re big fans and, I hope we can do this again in the not so distant future. Very much enjoyed our conversation.

Brian Wesbury: Thank you very much, Pierre.