Don’t Read Too Much Into an Address (Ronalds)

Printer-friendly Version

Printer-friendly Version

« How ETFs Act as a Price Discovery Vehicle During Market Holidays ~|~ Dividend-Payers Should Prosper in a Slow-Growth Environment (Koesterich) »

Tweet

Email This Article

By Scott Ronalds, Steadyhand Investment Funds

The Asia Pacific is the fastest growing economic region in the world. Not surprisingly, many multinational companies are increasingly focusing on selling their goods and services in countries such as China, Indonesia, Singapore, Vietnam, and the Philippines among others, where populations, consumption and incomes are growing.

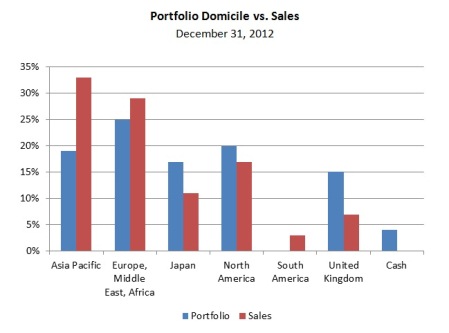

A result of this increasing globalization is that a company’s physical headquarters may say little about where it generates its revenues. This is illustrated clearly in our Global Equity Fund. The chart below shows that over 33% of the fund’s revenues are generated in the Asia Pacific (excluding Japan), yet only 20% of the fund’s investments are headquartered in the region. Many U.S., European and Japanese-based holdings, however, generate a large share of their sales in Asia as opposed to their domestic market.

Another takeaway from the chart is that the Global Fund remains heavily focused on Asian and European markets, as opposed to North America. This is a reflection of where the manager (Edinburgh Partners) is finding the best opportunities – i.e. cheap stocks.

Copyright © Steadyhand Investment Funds

Latest AdvisorAnalyst Stories

About Tom Bradley Tom is the President and co-founder of Steadyhand. His education includes a Bachelor of Commerce degree from the University of Manitoba (1979) and an MBA from the Richard Ivey School of Business (1983). Tom has 26 years of experience in the investment industry. He started his career in 1983 as an Equity Analyst at Richardson Greenshields. Tom spent eight years with the firm, the last three as Director of Institutional Sales. In 1991, he joined Phillips, Hager & North as a Research Analyst and Institutional Portfolio Manager. Tom was appointed to the Board of Directors of PH&N in 1996. He took on the role of Chief Operating Officer in 1998, and was appointed President and Chief Executive Officer in 1999, a role that he held until he resigned from the firm in 2005. Tom writes a column every second Saturday in the Globe and Mail. Aside from stocks and (to a lesser extent) bonds, his passions include skiing, golf, music and The Family Guy. Read more from the author/contributor here.

Tags: scott ronalds, Steadyhand

Posted in Markets| Comments Off