The retirement crisis:

Meeting longevity risk head on

by David De Pastena, CFA, CMT, CAIA, CIM, FCSI

Vice-President, Dynamic Funds Portfolio Solutions

The risk of outliving one’s assets, also known as longevity risk, is an important concern for investors about to enter retirement. Running out of money prematurely can be the difference between thriving and just surviving in your golden years.

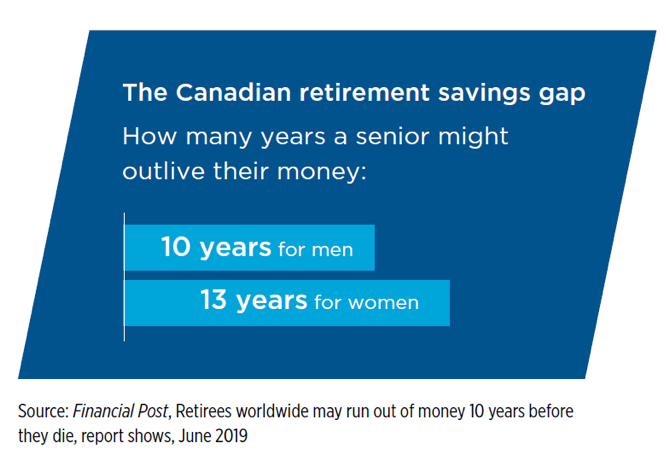

According to a 2019 report, the Canadian retirement gap – the number of years that seniors might outlive their money – is now 10 years for men and 13 for women. In this piece, we’ll examine the three key threats posed by longevity risk.

Growing anxiety for seniors

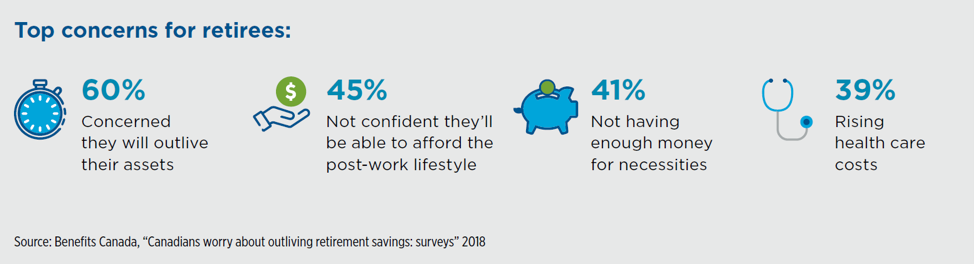

That new reality has understandably resulted in a lot of anxiety for both retirees and those on the cusp of retiring. According to a 2018 survey, more than 60% of Canadians are concerned they’ll outlive their retirement savings, and 45% don’t feel confident they’ll be able to afford the post-work lifestyle they want.Understanding longevity risk: Three key threats

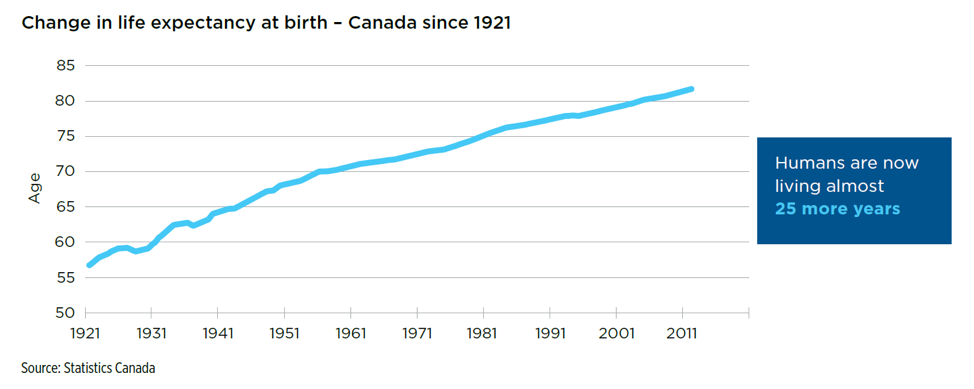

Longer life expectancies

The good news is that Canadians are living longer. However, living longer means that retirees need to accumulate more to fund their desired retirement lifestyle. With retirement periods now stretching more than two decades, the risk of running out of money has become a real concern for many Canadians.A riskier proposition: the retirement portfolio has changed

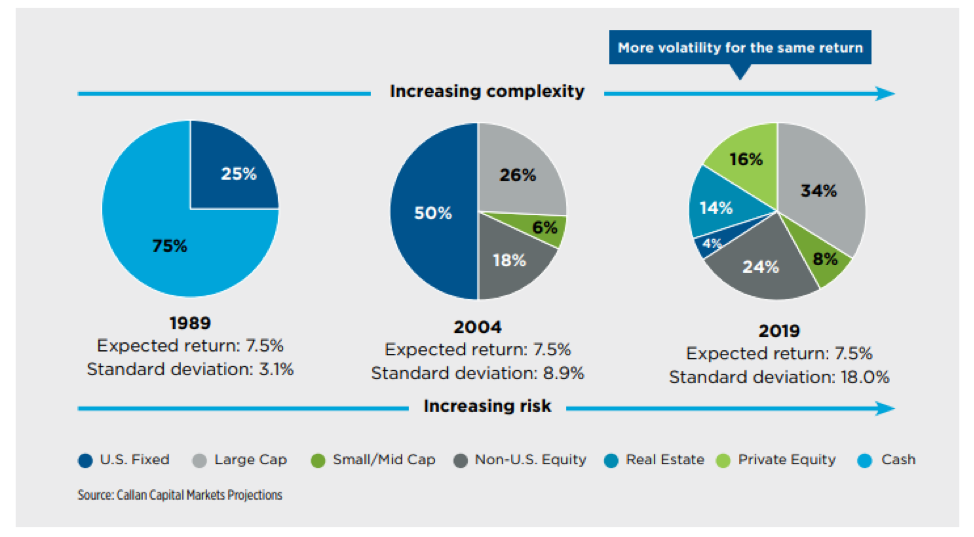

When it comes to saving for retirement, the investment landscape has changed drastically since the Great Recession of 2008. In today’s volatile markets, trying to generate consistent retirement income has become increasingly complex and has forced retirees to take on more risk to generate the same return from20 years ago.

Markets are different… take on more risk to generate the same return?

Return vs. Volatility

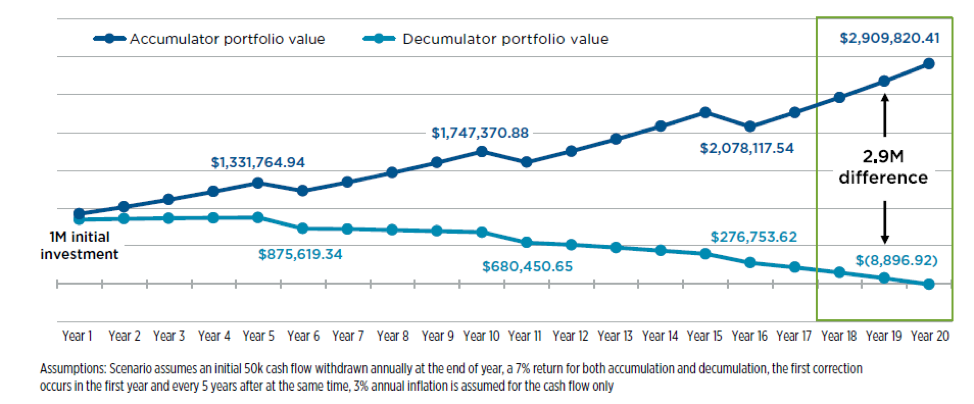

Sequence of returns risk

When it comes to a successful retirement, timing is everything. Unfortunately, market declines in the early years of one’s retirement, coupled with ongoing withdrawals, could significantly reduce the longevity of a portfolio. Oftentimes, the difference between one’s money running out or lasting a lifetime is determined by market performance in early retirement – a matter largely beyond retirees’ control.Introducing Dynamic Funds Retirement Income Centre

In today’s volatile markets, many of the old rules about building a comfortable retirement no longer apply. Given this new retirement reality, investors need new strategies and insights to help them achieve their retirement goals. That’s why Dynamic Funds created the Retirement Income Centre.Focused on key retirement challenges, the Centre is designed to provide a road map to retirement insights, investing strategies and new perspectives on helping retirees (and those on the cusp) create sustainable cash flow to meet today's retirement realities head on.

Re-envision your clients' retirement reality today.

dynamic.ca/ric

Disclaimer:

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Views expressed regarding a particular company, security, industry or market sector are the views of the writer and should not be considered an indication of trading intent of any investment funds managed by 1832 Asset Management L.P. These views should not be considered investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views.

© Copyright 2022 1832 Asset Management L.P. All rights reserved.