Portfolio Manager,

Dynamic Funds

March 30, 2021

With more than 25 countries and over 85% of the world’s population, emerging markets have become important drivers of global economic growth, considerably outpacing developed markets since 20001. This growth story isn’t a recent phenomenon, and we understand well that macroeconomic growth does not necessarily mean shareholder value creation.

What excites us is the transformation taking place in the Emerging Markets – from Latin America and Asia to Central Europe and beyond – as businesses are created and/or adapt to serve this large population base, which have been hungry for change and improvement in their lives.

And yet, despite the massive changes taking place, many investors’ perceptions of emerging markets remain tied to the past, characterizing and investing in them as a pool of undifferentiated businesses engaged in cut-throat competition and state-owned companies, many of which have had a history of value destruction.

We instead see today’s emerging markets as fertile ground for innovative companies with the potential to create large and growing profit pools at high returns, protected by competitive advantages, such as network effects of dominant platforms, strong brands and cutting-edge intellectual property.

We instead see today’s emerging markets as fertile ground for innovative companies with the potential to create large and growing profit pools at high returns, protected by competitive advantages, such as network effects of dominant platforms, strong brands and cutting-edge intellectual property.

— Danilo Martins, Portfolio Manager, Dynamic Funds

An important contributor to this change is strong access to capital, meeting a deep supply of talent with desire to solve problems, which were seen as structural in their societies. As many know, a substantial amount of Venture Capital (VC) investments have poured into China, funding talented entrepreneurs who have worked hard to meet the needs of customers with strong focus innovation.

This has paved the way for the creation of some of the world’s most dominant and innovative companies in fintech, gaming, e-commerce, etc. In other parts of the emerging markets, we see the beginning of a similar path. Having done business in Brazil, for example, I’ve seen this firsthand, and -- whereas capital was very scarce and people were reluctant to start businesses or join start-ups at the time in the mid 2000s -- capital is today much more widely available and top talent eager to participate.

Latin America (LatAm) start-ups saw over USD $4.5 billion of VC investments in 2019, compared to less than USD $150 million as early as 2011, and VC investments have doubled each of 2017, 2018 and 2019. This is a recent phenomenon for LatAm, which has already generated several unicorns and some of the world’s most successful start-ups in e-commerce, fintech/challenger banks.

EM Businesses: Controlling their own destiny

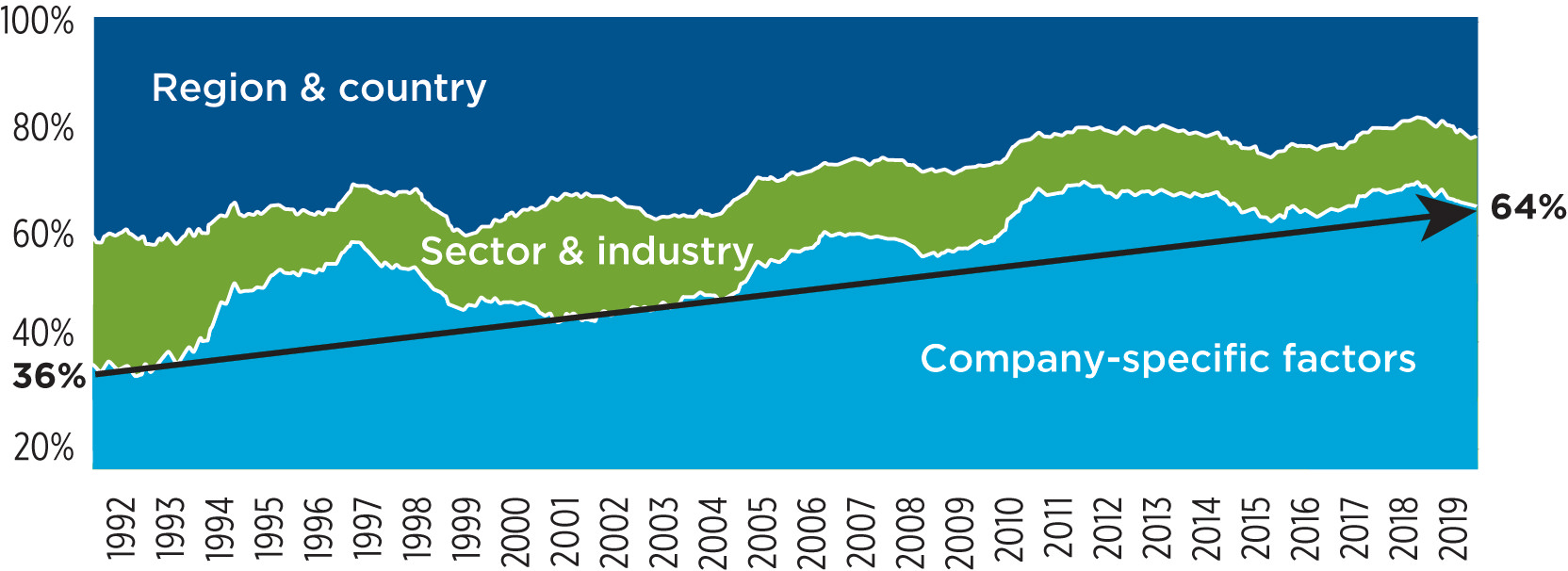

Source: Capital Group. As of 8/31/19. Returns in U.S. dollars

The change discussed can be visualized in the graphic above/below. Company-specific factors have been increasingly driving the returns for emerging markets investors. Twenty years ago, the undifferentiated nature of many emerging market companies put investors at the mercy of cyclical factors. An undifferentiated business becomes a hostage to its cycle, the lack of competitive advantages guaranteeing no pricing power, with its cost of capital being the most it can ever earn.

The mix of listed emerging markets companies has been changing, with more weight concentrated in companies with competitive advantages driving considerably more pricing power – companies increasingly in control over their own destinies.

In emerging markets, experience counts

While we are excited about these changes – which we believe open doors for bottom-up and long-term-oriented investors to own dominant innovative companies that can compound wealth at high returns – we think navigating this changing environment from the top down can be challenging.

Although we think these changes will drive economic growth and improve the lives of people in these regions, they will at the same time disrupt several markets and industries, providing challenges for incumbents and more competition for many listed companies. A strong opportunity to own businesses with competitive advantages, which create long-term shareholder value, is not synonymous with entire markets going up.

Finding great companies at good prices means literally going those extra miles to meet with management in person, to visit supply chains and explore channels, up-close and in-person. When it comes to emerging markets investing, there’s simply no substitute for on-the-ground research.

— Danilo Martins, Portfolio Manager, Dynamic Funds

Finding great companies at good prices means literally going those extra miles to meet with management in person, to visit supply chains and explore channels, up-close and in-person. When it comes to emerging markets investing, there’s simply no substitute for on-the-ground research.

In today’s fast-paced emerging markets, experience counts – more than ever. While we believe the opportunities are immense, investing in emerging markets may pose challenges for retail investors – from language barriers and currency issues to accessing securities on foreign exchanges.

We believe investors looking to compound wealth by accessing long-term investment opportunities in emerging markets would be well advised to partner with an experienced investment team who invest like long-term owners, aiming to build a low-turnover portfolio of fairly valued (or undervalued) companies with best-in-class teams, and with competitive advantages protecting high returns on long-term growth opportunities.

1 International Monetary Fund, World Economic Outlook, October 2020. Danilo Martins joined Dynamic in 2017, working closely with Dana Love on the Core Global Equity team. Danilo is a generalist manager by sector and region, with global investment experience, having also lived and worked in North America, Latin America and Asia Pacific. He believes in bottom-up investment analysis aimed at building low-turnover portfolios of undervalued or fairly valued companies that have sustainable competitive advantages protecting high returns on capital, which capital can be allocated towards visible long-term growth opportunities. He looks for management teams with demonstrated ability to recruit and retain owner-minded talent, allocate capital for long-term value creation, develop existing business franchises and innovate.

Danilo Martins joined Dynamic in 2017, working closely with Dana Love on the Core Global Equity team. Danilo is a generalist manager by sector and region, with global investment experience, having also lived and worked in North America, Latin America and Asia Pacific. He believes in bottom-up investment analysis aimed at building low-turnover portfolios of undervalued or fairly valued companies that have sustainable competitive advantages protecting high returns on capital, which capital can be allocated towards visible long-term growth opportunities. He looks for management teams with demonstrated ability to recruit and retain owner-minded talent, allocate capital for long-term value creation, develop existing business franchises and innovate.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Views expressed regarding a particular investment, economy, industry or market sector should not be considered an indication of trading intent of any of the mutual funds managed by 1832 Asset Management L.P. These views are not to be relied upon as investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views. To the extent this document contains information or data obtained from third party sources, it is believed to be accurate and reliable as of the date of publication, but 1832 Asset Management L.P. does not guarantee its accuracy or reliability. Nothing in this document is or should be relied upon as a promise or representation as to the future.

© Copyright 2021 1832 Asset Management L.P. All rights reserved.

Dynamic Funds® is a registered trademark of its owner, used under license, and a division of 1832 Asset Management L.P.