Rising rates call for an active bond portfolio

by Matt Brill, Senior Portfolio Manager, Invesco Fixed Income

March 29, 2018

Share This Article

Video: Matt Brill, Senior Portfolio Manager, Invesco Fixed Income, explains "Core-Plus"

Rising rates call for an active bond portfolio

A global "core-plus" approach may be the answer

After a decade of record lows, North American interest rates began to rise in 2017. While rates are still very accommodative, this shift has already been felt in both the equity and fixed-income markets, and investors now face tough choices around their bond allocations.

While some fixed income assets may struggle in a rising rate environment, bonds remain important because they can provide diversification against equity risk, as well as generate income. Many traditional bond portfolios may be constrained by benchmark limitations. These constraints can make it difficult to consistently generate positive total returns in a prolonged environment of rising rates.

A truly active, global “core-plus” approach may help mitigate the impact of rising rates on fixed income portfolios.

An active “core”

Selecting a fixed-income portfolio shouldn’t be simply an exercise in checking a box – investors need core bonds that truly behave like bonds, rather than mimicking equities. A solid core holding of investment-grade bonds can help preserve capital, while diversifying the overall portfolio from equity risk.

An active global approach that allows for allocation among a wide variety of fixed-income assets can help enhance risk-adjusted returns. It also offers the ability to adjust the duration in a portfolio, helping to shield overall portfolio returns (contrary to an indexed or passive approach).

Duration may be viewed as a bit of a bogeyman in times of rising rates, but a portfolio that shuns duration entirely derives more of its returns from credit risk. Such a portfolio will tend to be more highly correlated to equities, undermining the diversification role of fixed income.

While duration remains a risk to monitor, I believe the better approach is to actively optimize it, rather than minimize it. An active manager can adjust the duration of the portfolio to adapt to changing rates, as well as diversifying into other less interest rate sensitive fixed income securities, such as floating rate notes, emerging markets debt and higher-yield corporate bonds.?

The “plus”: Additional yield and growth potential

These higher-yielding and emerging market issues form the “plus” part of a global “core-plus” strategy and their many potential benefits make them a considerable complement to an investment grade core.

Despite the recent rise in short-term rates, yield remains elusive. Adding higher-quality sub-investment grade global bonds can enhance the overall yield of a core-plus portfolio, compared to a portfolio of core bonds alone.

Deep research into sub-investment grade issuers can uncover those that may be on the cusp of being upgraded to investment grade. Buying these bonds prior to their upgrade may benefit the total return profile of a core-plus mandate. An allocation to these “plus” assets can also provide diversification across a broad swath of industries, fixed income sectors and credit. The goal of our resulting “core-plus” strategy is to provide s higher yield to maturity than the benchmark, within a high-quality, investment-grade portfolio.

Bringing core and plus together: Invesco Global Bond Fund

In both the “core” and “plus” elements of the portfolio, a flexible, global approach to fixed income can help reduce interest-rate risk while providing exposure to differing monetary policies. While yields may still be low on a global basis, there is strong demographic support for fixed income, as aging populations around the world still need the relative stability of bonds.

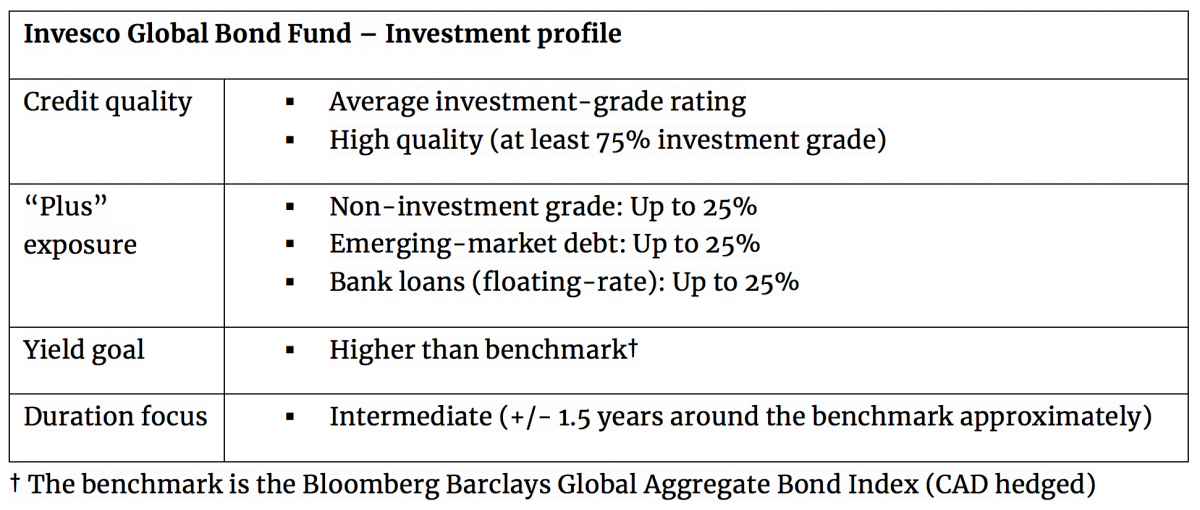

For example, Invesco Global Bond Fund is designed to find opportunities across a variety of global fixed income sectors. The strategy invests in a minimum, core allocation of 75% investment grade bonds and complements that with up to 25% allocation to other areas of the market where we see growth potential.

The goal of the approach is to provide income, diversify from equities and to help preserve capital.

Given the influences mentioned above, we are closely watching for opportunities. With tax reform creating a potentially positive environment for U.S. investment grade bonds, and growing opportunities in other areas of the market, the Invesco Global Bond Fund team remains bullish on the outlook for 2018.

To learn more about how a core-plus strategy can address multiple challenges in your clients’ fixed income allocation, visit InvescoGlobalBond.ca.

*****

Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the simplified prospectus before investing. Copies are available from your advisor or from Invesco Canada Ltd.

* Invesco® and all associated trademarks are trademarks of Invesco Holding Company Limited, used under licence.

© Invesco Canada Ltd., 2018 (CA 15,910)