by Oscar Belaiche, Senior Vice President & Portfolio Manager,

1832 Asset Management L.P.

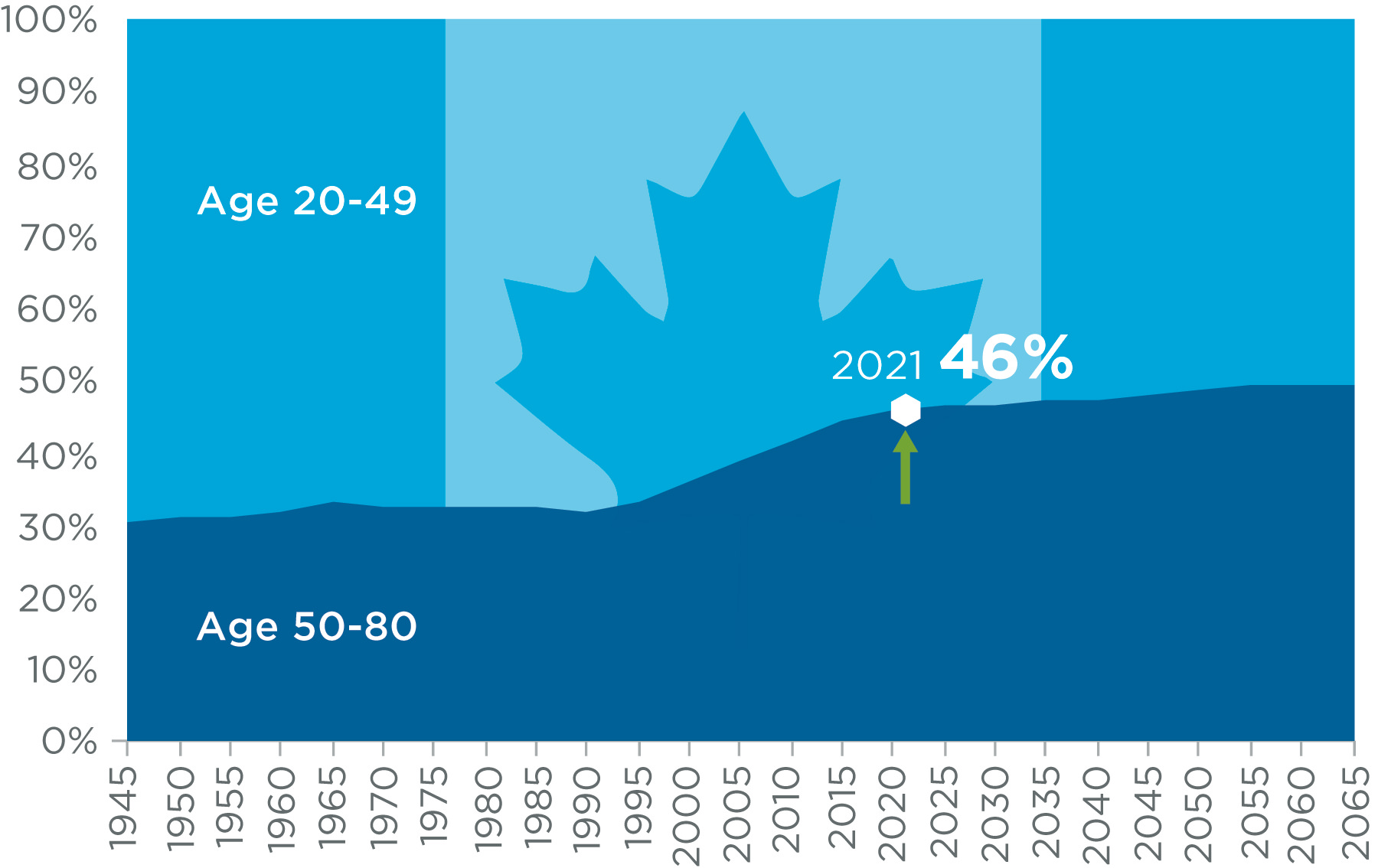

For over a decade now, financial advisors have been challenged to provide sustainable retirement income for investors, as interest rates have declined and now hover near historic lows. For investors in the pre-retirement or retirement stage of life, income has always been the focal point. However, in today’s low-yield world, the income available may not be enough for retirement. The need for retirement income in Canada continues to grow dramatically as a record number of Baby Boomers are exiting the workforce.

While the reality of near-zero interest rates presents a formidable challenge, the current market environment – featuring low rates and elevated dividend yields – presents an unprecedented opportunity for an equity income solution to generate a stable stream of income* for retirement. We believe a truly sustainable retirement now requires a greater allocation to dividend- and distribution-paying equities. First, however, let’s take a look at the demographic shift taking place in Canada.

With almost five million Canadians set to turn 65 this decade, the 2020s will see an unprecedented retirement explosion, creating a critical need for investment income to help replace wages and salaries.

–Oscar Belaiche

A retirement boom

With almost five million Canadians set to turn 65 this decade, the 2020s will see an unprecedented retirement explosion, creating a critical need for investment income to help replace wages and salaries. Half of the baby boomers will have reached retirement by 2021, with the remaining half hitting this milestone by 2030.

Source: Statistics Canada, "Historical Age Pyramid," revised 2019.

The return of sustainable income: the opportunity zone

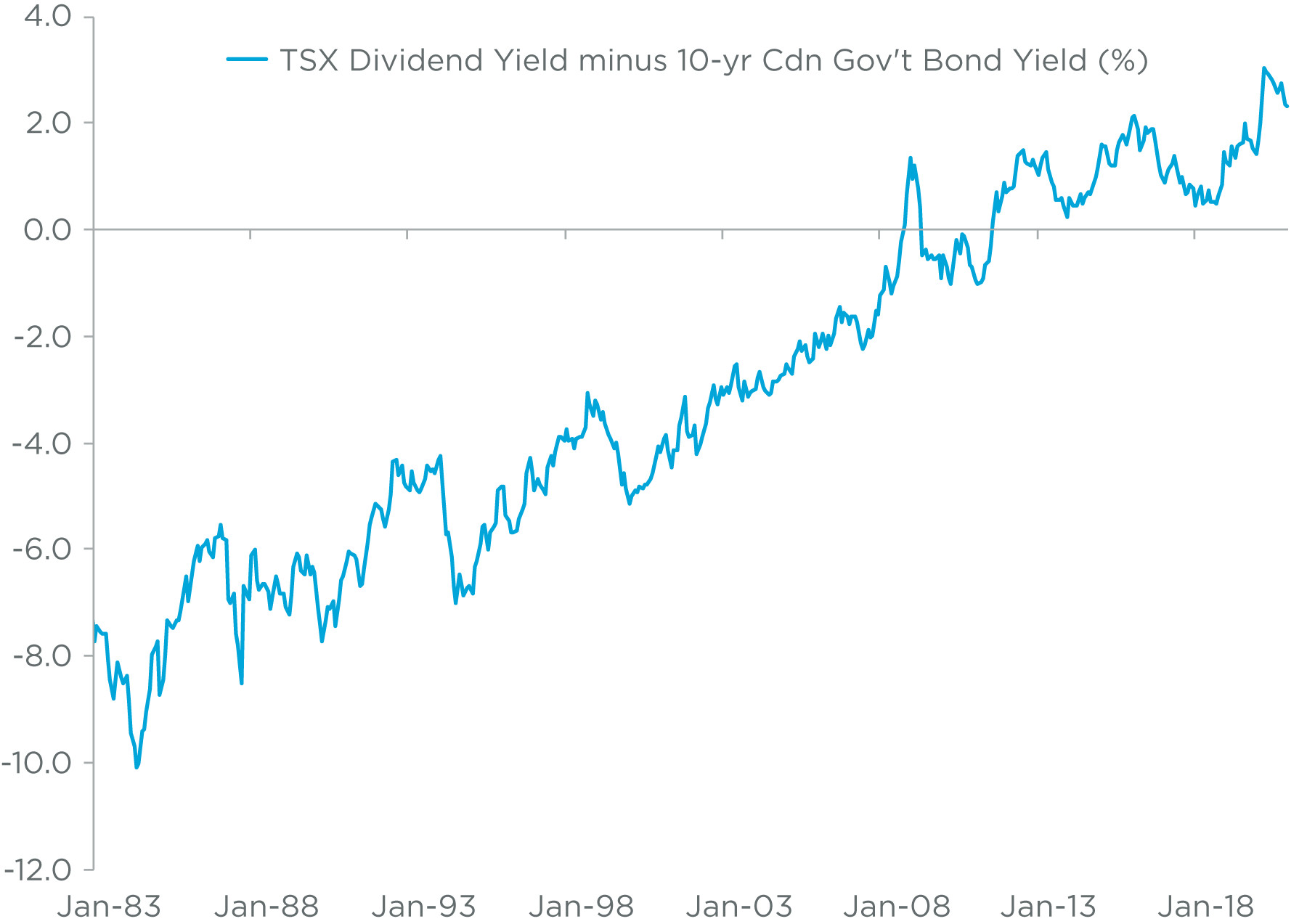

While historically low interest rates have posed a daunting challenge to income investors for more than a decade, there is a silver lining when it comes to generating retirement income.

Consider the following:

1. With near-zero interest rates and currently elevated dividend yields, the spread between the two is at its most attractive levels in more than six decades. This creates a tremendous opportunity to invest in companies that can generate sustainable levels of income.

Source: 1832 Asset Management L.P., Haver Analytics, December 31, 2020.

2. This environment creates a further opportunity to lock in favourable yields by investing in high-quality, dividend- or distribution-paying securities – at an attractive entry point.

3. The low interest-rate environment presents an additional opportunity for an alternative fund to employ a moderate amount of leverage to generate additional income.

Ultimately, the low interest-rate environment, coupled with high dividend yields and the ability to employ a judicious amount of leverage, presents an opportunity to generate a stable stream of income.

Introducing Dynamic Retirement Income+ Fund

A recently launched liquid alternative, Dynamic Retirement Income+ Fund was created for investors seeking stable income – primarily from dividend- or distribution-paying securities, along with the opportunity for capital appreciation. Managed by Oscar Belaiche and backed by his 23-member Dynamic Equity Income Team, the Fund seeks to earn enhanced returns that have a lower correlation to major stock and bond market indices.

The Liquid Alternative Advantage

Providing the liquidity and transparency of a mutual fund with some of the investment flexibility of a hedge fund, liquid alternatives deliver the potential for enhanced diversification, decreased volatility and better risk-adjusted returns. A key appeal of Dynamic Retirement Income+ Fund is the strength of its 23-member Equity Income team, which employs its Quality at a Reasonable Price (QUARP®) investment philosophy, and covers all 11 GIC sectors, along with the opportunity to generate additional income using modest amounts of leverage.

Footnotes:

* To the best of our abilities

About Oscar Belaiche

Oscar Belaiche, Senior Vice President & Portfolio Manager

Oscar Belaiche, Senior Vice President & Portfolio Manager

The Head of Dynamic’s Equity Income Team, Oscar Belaiche has over 39 years of business, operational and investment experience. Over the past 23 years, Oscar has built a highly successful team of Portfolio Managers, Associate Portfolio Managers and Analysts that manages approximately $19 billion in AUM for Dynamic. He has been responsible for some of the firm’s most successful fund launches, including Dynamic Equity Income Fund, Dynamic Dividend Income Fund and Dynamic Strategic Yield Fund.

Disclaimer:

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Views expressed regarding a particular investment, economy, industry or market sector should not be considered an indication of trading intent of any of the mutual funds managed by 1832 Asset Management L.P. These views are not to be relied upon as investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views. To the extent this document contains information or data obtained from third party sources, it is believed to be accurate and reliable as of the date of publication, but 1832 Asset Management L.P. does not guarantee its accuracy or reliability. Nothing in this document is or should be relied upon as a promise or representation as to the future.

© Copyright 2021 1832 Asset Management L.P. All rights reserved.

Dynamic Funds® is a registered trademark of its owner, used under license, and a division of 1832 Asset Management L.P.