Morocco:

The Next "Motor City?"

by Adam Kutas, Portfolio Manager, Fidelity Investments Canada

August 31, 2017

Share this post

Photo credit: Irish News, July 11, 2017 - Moroccan Groupe Renault plant produces one millionth car

Last month I visited the North African country of Morocco. I have not visited the country for some time, but after a few meetings with some Moroccan banks in London, I thought it was time to research a few ideas.

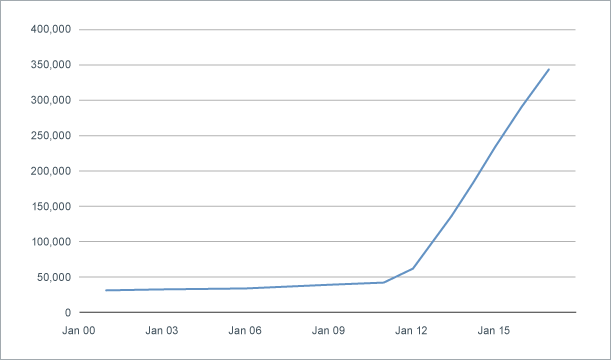

As seen in Chart 1, in a span of four years, Morocco has more than tripled its auto production, driven by investments by France-based auto companies.

— Adam Kutas

The key change in the country’s outlook has been the rise of a domestic auto production industry. As seen in Chart 1, in a span of four years, Morocco has more than tripled its auto production, driven by investments by France-based auto companies. These companies invested after the government improved Morocco’s infrastructure, ports and rail capacity to take advantage of its favourable trading relationship and historical linkages with the EU.

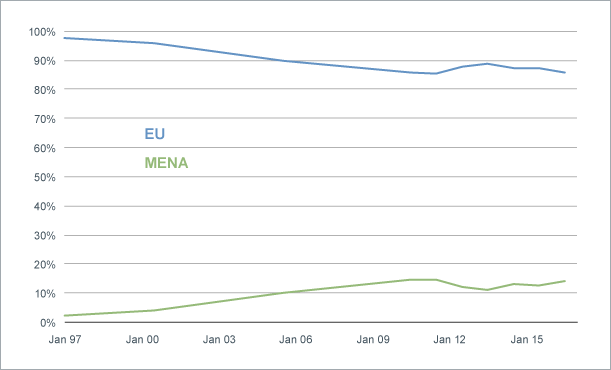

As seen in Chart 2, MENA (Middle East-North Africa) countries are gaining production share from the rest of the EU

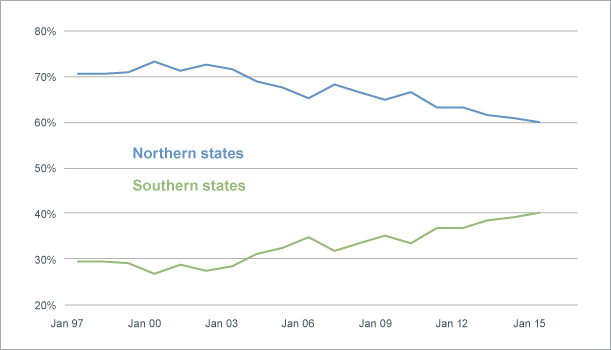

Auto investments in countries like Morocco are also occurring in nearby Turkey and other parts of North Africa; accordingly, as seen in Chart 2, MENA (Middle East-North Africa) countries are gaining production share from the rest of the EU. This trend is similar to the trend we saw (and continue to see) in North America when auto production moved from higher-cost areas like the northern U.S. states to the U.S. South (as well as Canada and Mexico) – see Chart 3.

This trend is similar to the trend we saw (and continue to see) in North America when auto production moved from higher-cost areas like the northern U.S. states to the U.S. South (as well as Canada and Mexico) – see Chart 3.

And historically, in my experience, the best means for an underdeveloped country to emerge is through U.S. dollar-based manufactured exports. So potentially, if Morocco makes a transition from an economy largely based on agriculture and materials to an economy based on manufacturing, it could start to move up the development curve. This would be quite positive for consumer incomes, credit demand and formalized retail growth.

In addition to the domestic opportunities, many Moroccan companies have been allocating capital to French-speaking West Africa, as many global companies were selling their operations following the 2008 global financial crisis. As discussed in previous blogs, one trend we follow is South African companies’ expansion to Africa to arbitrage a cheaper cost of capital and strong free-cash flow in their home market. This trend, though, was primarily in English-speaking Africa (e.g., Kenya, Nigeria, Zambia, Botswana, Namibia, etc.). Moroccan companies, given their bilingual heritage (Arabic and French) have been investing in French-speaking countries such as Cameroon, Republic of Congo, Senegal and Côte d’Ivoire. These investments, although accounting for only approximately 15%–20% of Moroccan companies’ revenue, offer a long-term structural growth opportunity with minimal competition – and therefore potentially higher returns.

Finally, given that Moroccan companies are generally off most investors’ radars, and that valuations are in line with historical averages, I was able to find a few stock ideas in the banking and housing sectors that fit my investment process for the frontier portfolios. But given the early stage nature of the auto sector’s growth and West African investments, I plan to do more research and closely monitor the rise of this frontier country only about 15 kilometres away from Europe.

Thanks for reading,

Adam Kutas

*****

This article was originally posted at Adam Kutas' blog.

As the portfolio manager for Fidelity Frontier Emerging Markets Fund, Adam Kutas frequently travels to distant locales in search of new investment opportunities. A core part of the Fidelity investment process is “kicking the tires” on companies by visiting management in their home countries and seeing the operations first-hand. As well, with emerging and frontier markets, having a deep understanding of a particular country’s economic and political environment is essential to fully comprehending the risk and rewards. This blog is intended to highlight this research process and help investors and advisors better understand the opportunities provided by exposure to frontier markets.

*****

Views expressed regarding a particular company, security, industry or market sector are the views of that individual at the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. These views may not be relied upon as investment advice, nor are they an indication of trading intent or any Fidelity Fund. These views are subject to change at any time based upon markets and other conditions, and Fidelity disclaims any responsibility to update such views.

Certain statements in this commentary may contain forward-looking statements (“FLS”) that are predictive in nature and may include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” and similar forward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest and foreign exchange rates, equity and capital markets, and the general business environment, in each case assuming no changes to applicable tax or other laws or government regulation. Expectations and projections about future events are inherently subject to, among other things, risks and uncertainties, some of which may be unforeseeable and, accordingly, may prove to be incorrect at a future date. FLS are not guarantees of future performance, and actual events could differ materially from those expressed or implied in any FLS. A number of important factors can contribute to these digressions, including, but not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition and catastrophic events. You should avoid placing any undue reliance on FLS. Further, there is no specific intention of updating any FLS whether as a result of new information, future events or otherwise.