1832 Asset Management L.P.

and Frank Latshaw, Vice President & Portfolio Manager,

1832 Asset Management L.P.

While the environmental and economic threats posed by climate change are immense, the investment opportunities being created in the search for renewable power are equally unprecedented. It’s become evident that the great transition from fossil fuels to renewable energy stands to be one of the most important developments of the new millennium – for both investors and the planet.

And the momentum toward renewable energy continues to grow. In late May a Netherlands court ruled that Royal Dutch Shell has a legal responsibility to cut its carbon emissions by 45% in the next 10 years. Although the ruling will certainly be challenged, it’s become increasingly clear that strengthening government support means companies will have little choice but to move away from fossil fuels.

It’s not just governments or the courts that are driving change. Recent shareholder rebellions/actions at both ExxonMobil and Chevron are pushing both companies toward greener strategies to combat climate change. These are extremely positive developments for the future of renewable energy.

And it’s not just governments or the courts that are driving change. Recent shareholder rebellions/actions at both ExxonMobil and Chevron are pushing both companies toward greener strategies to combat climate change. These are extremely positive developments for the future of renewable energy. It’s also important to note that it’s not just small groups of activist investors who are involved.

A Story of Enduring Growth

Without doubt, the two most appealing aspects of investing in renewable energy are growth and endurance. Here we’re seeing not only growth in the technology but also adaptation and advancement, whether it’s a solar panel, wind turbine or a fuel cell.

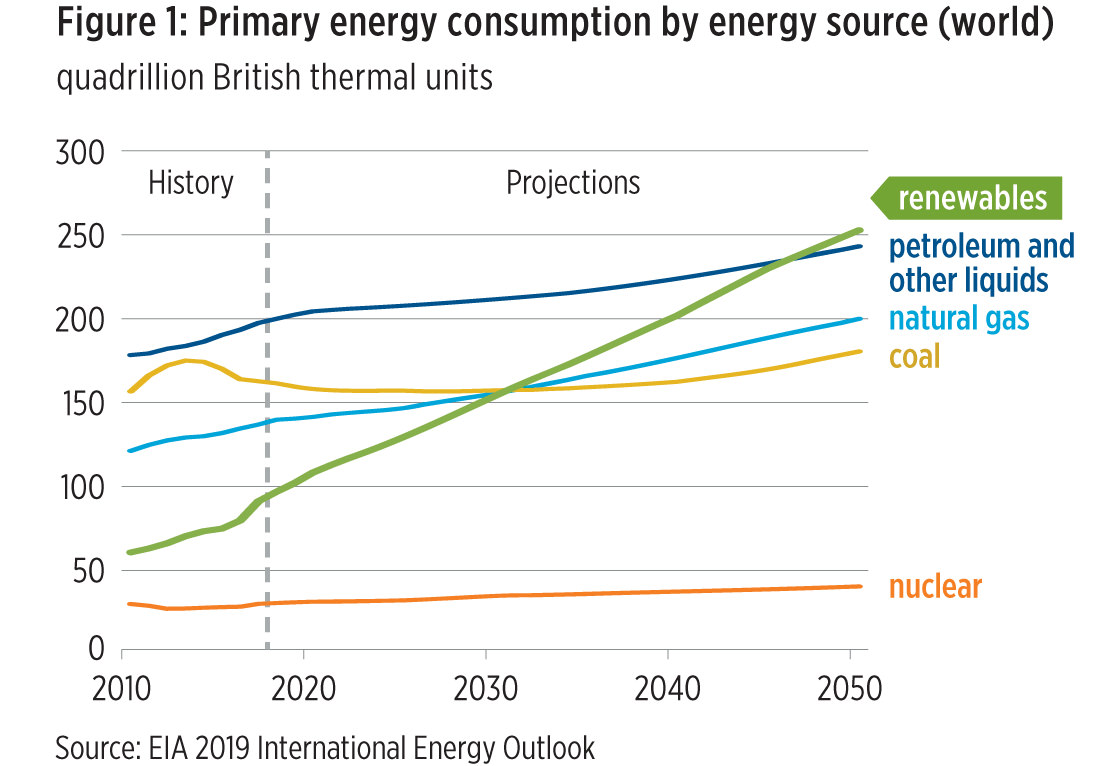

According to U.S. government estimates, renewable energy will become the world’s leading source of primary energy consumption by 2050 – outpacing even petroleum (Figure 1).

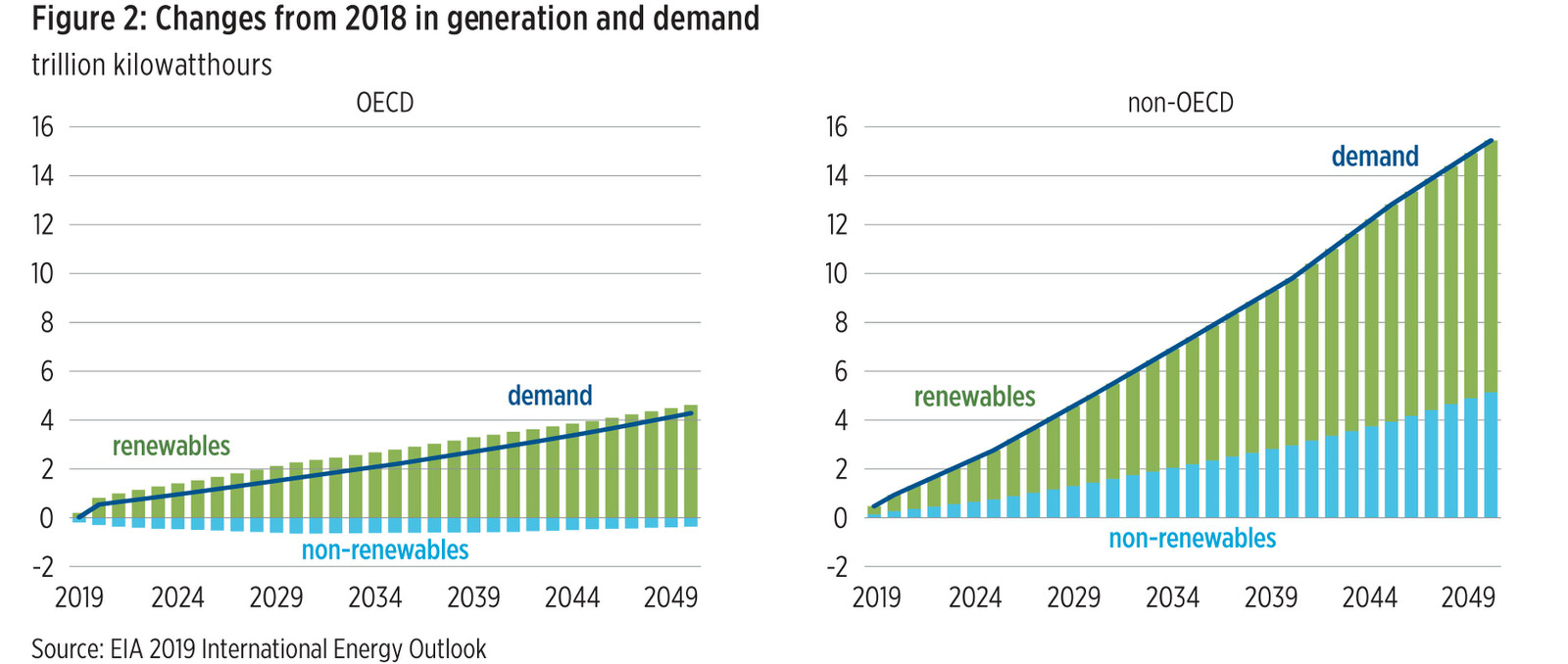

Additionally, in both developed and developing countries, increases in electricity demand will be primarily met with renewables generation (Figure 2).

Renewable Energy: The Time is Now

In recent years, improving technology, economies of scale, competitiveness of supply chains and developer experience have all worked in unison to make renewables cost competitive. Now we’re seeing more sustainable, profitable businesses in which to invest.

Some of the common characteristics of the quality companies that we’re looking at are proven business models and technologies that work today, along with sustainable growth and scalable operations. These aren’t speculative investments – these are solid businesses with a visible outlook.

Introducing Dynamic Active Energy Evolution ETF (DXET)

On June 15, 2021, Dynamic Funds launched Dynamic Active Energy Evolution ETF (TSX Ticker: DXET), a thematic investment providing exposure to the opportunities arising from the energy industry’s secular shift away from traditional fossil fuels towards a more sustainable model focused on renewable energy sources.

Dynamic believes an active approach is needed to take full advantage of the transformation in the energy sector. Unlike many passive ETFs focused on the energy transition, Dynamic Active Energy Evolution ETF features a concentrated portfolio of high-conviction holdings to help lead the transition to renewable energy on both a residential and commercial scale – all for less than 100 basis points.

In terms of construction, process and discipline, Dynamic Active Energy Evolution ETF will be managed similarly to Dynamic’s existing mutual fund option, Dynamic Energy Evolution Fund, which was launched in October 2020.

About Jennifer Stevenson and Frank Latshaw

Jennifer Stevenson, B.Comm., MBA

Vice President & Portfolio Manager

Jennifer has extensive energy industry experience and has been active in the energy sector for nearly three decades, closely following industry trends and the innovations shaping the future of the industry. By expanding the investment universe beyond the index, she is able to take advantage of the inherent complexity of the sector to invest in the various segments of the global energy supply chain, including renewables and hydrogen.

Jennifer has extensive energy industry experience and has been active in the energy sector for nearly three decades, closely following industry trends and the innovations shaping the future of the industry. By expanding the investment universe beyond the index, she is able to take advantage of the inherent complexity of the sector to invest in the various segments of the global energy supply chain, including renewables and hydrogen.

Frank Latshaw, CPA, CA, CBV, CFA

Vice President & Portfolio Manager

Lead portfolio manager of Dynamic Global Infrastructure Fund, Frank Latshaw has over 28 years of investment industry experience. Frank’s deep understanding of the global power sector allows him to identify a wide range of related companies that stand to benefit from the great energy transition. His funds have been investing in these areas globally for almost a decade.

Lead portfolio manager of Dynamic Global Infrastructure Fund, Frank Latshaw has over 28 years of investment industry experience. Frank’s deep understanding of the global power sector allows him to identify a wide range of related companies that stand to benefit from the great energy transition. His funds have been investing in these areas globally for almost a decade.

Disclaimer:

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments and active Dynamic ETFs. Please read the prospectus before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Views expressed regarding a particular investment, economy, industry or market sector should not be considered an indication of trading intent of any of the mutual funds managed by 1832 Asset Management L.P. These views are not to be relied upon as investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views. To the extent this document contains information or data obtained from third party sources, it is believed to be accurate and reliable as of the date of publication, but 1832 Asset Management L.P. does not guarantee its accuracy or reliability. Nothing in this document is or should be relied upon as a promise or representation as to the future.

© Copyright 2021 1832 Asset Management L.P. All rights reserved.

Dynamic Funds® is a registered trademark of its owner, used under license, and a division of 1832 Asset Management L.P.