Discipline in action:

Two companies we like and why

by Jeff Feng, Head of Emerging Markets Equities,

Invesco Hong Kong Ltd. Invesco Canada

November 9, 2017

Share Article

Discipline in action: Two companies we like and why

by Jeff Feng, Head of Emerging Markets Equities, Invesco Hong Kong Ltd. Invesco Canada

I think it’s important for advisors and investors to truly understand a portfolio manager’s approach, and the best way to do that is to see the discipline in action. In my last blog post, Why EM? Why now? I presented my case for emerging markets and reviewed my approach to investing in these regions. Today, I will discuss two companies we’re invested in, why they made the cut and how they have performed for our investors.

Kweichow Moutai Co., Ltd.

Kweichow is a Chinese premium spirits company that produces “moutai” (a brand of “baiju”), which is an alcoholic beverage popular in China. In April 2017, Kweichow surpassed Diageo Plc. – makers of iconic brands such as Johnnie Walker, Tanqueray and Smirnoff – as the most valuable liquor company in the world.1 The company has a dominant market share – nearly 60% – in the high-end baiju segment in China.

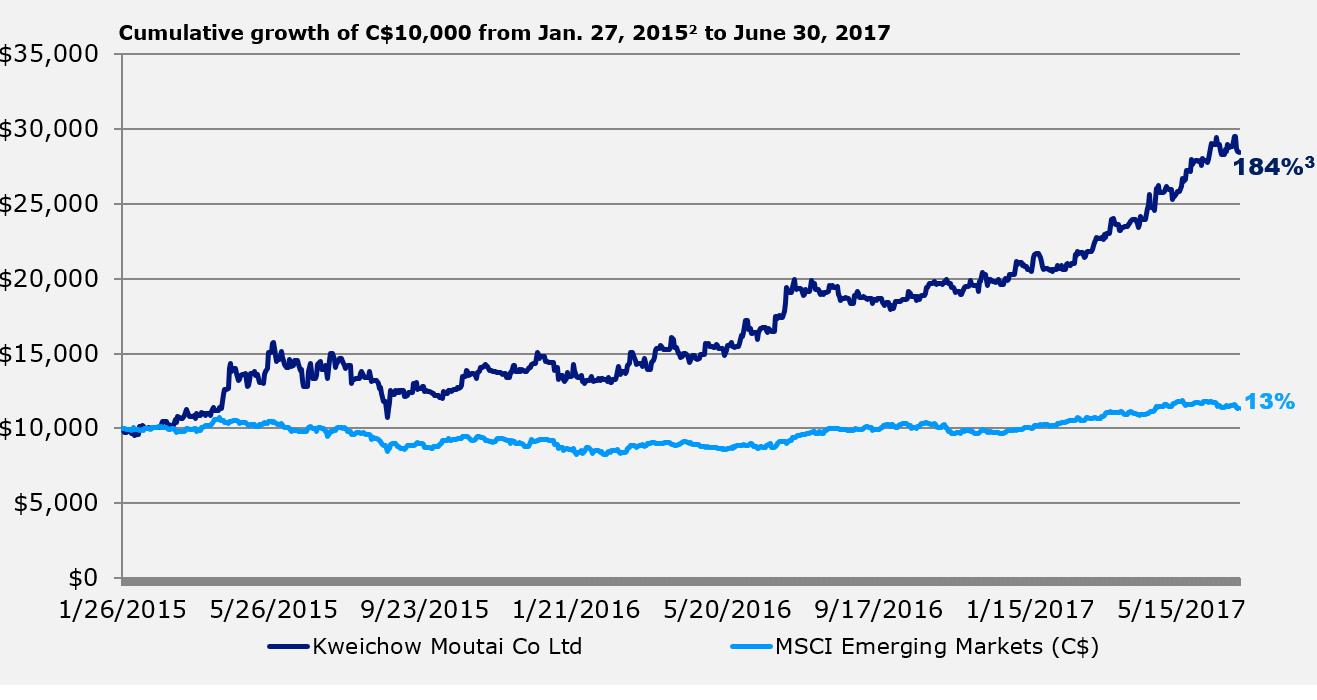

Trimark Emerging Markets Class took its first position in the company on January 27, 2015. As at June 30, 2017, the stock is up 184%, compared to a 13% rise in the MSCI Emerging Markets Index for the same time period (see chart below).

Source: Morningstar Research Inc.

Returns are in Canadian dollars.

Note: The stock is used for illustrative purposes only and is not meant to be a buy/sell recommendation.

How does Kweichow meet our FORS criteria?

Free cash flow

• Free-cash-flow conversion rate of 70% over past seven years

Organic growth

• The sector’s growth should be driven by continuous premiumization. As middle-class growth continues in China, more and more consumers will be able to afford the company’s premium products, which should allow for continued market-share growth

Returns on capital

• Has consistently generated approximately 70% operating margin since 2007, in part due to strong brand equity and dominant position on distributors’ shelves

Sustainable competitive advantage

• Strong brand equity and a stronghold on distribution channels in China

New Oriental Education & Technology Group Inc.

New Oriental is China’s largest provider of private education services. It was founded in 1993 and trades on the New York Stock Exchange. The company offers prep courses for domestic entrance exams and international tests such as the SAT, GRE or TOEFL. It is also well-known for providing after-school programs for core subjects in the K-12 curriculum, private-school services, foreign-language training and educational software and content.4

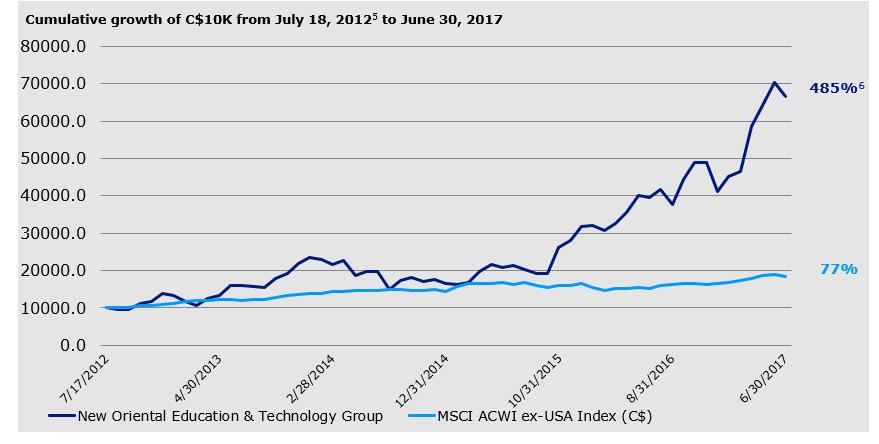

Trimark International Companies Fund/Class made its first investment in New Oriental on July 18, 2012. As at June 30, 2017, the company’s stock is up 485%, as compared to a 77% rise in the MSCI All Country World Ex-USA Index for the same time period (see chart below).

Source: Morningstar Research Inc.

Returns are in Canadian dollars.

Note: The stock is used for illustrative purposes only and is not meant to be a buy/sell recommendation.

How does New Oriental meet our FORS criteria?

Free cash flow

• Strong free-cash-flow generation because clients pay for services in advance, while the company pays operating costs (rent, wages etc.) in arrear

Organic growth

• Rising income levels and fierce competition for entrance into top schools has driven double-digit growth of spending (per capita) on after-school tutoring

Returns on capital

• Has historically generated high returns on invested capital, in part due to the company’s significant negative working-capital position and moderate fixed-asset base

Competitive advantage

• Strong brand and scale, which means the company can attract and retain top teachers because a growing student base and premium pricing allows for better wages. On the flip side, a roster of star teachers encourages enrollment, which creates a virtuous cycle7

If you have any questions about our investment approach (“FORS”), the funds or the companies discussed in this post, please contact us directly.

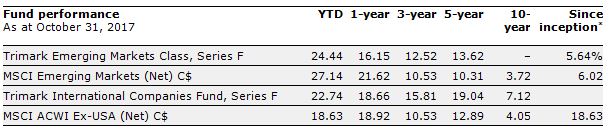

*The inception date for Trimark Emerging Markets Class is January 12, 2011. On April 5, 2013, the Fund’s investment strategies and portfolio advisor were changed. The performance of this Fund for the period prior to this date would have been different had the current investment strategies and portfolio advisor been in place during that period.

Series F is available only to eligible investors who have fee-based accounts with their Dealer and whose Dealer has signed an Invesco Series F Dealer agreement with Invesco Canada. Sales charges and trailing commissions are not payable for Series F units/shares; however investors may pay other fees to their Dealer for investment advice and other services. Other series’ performance will differ due to fees and expenses.

Glossary

Free cash flow: The net amount of cash that is generated for a firm after expenses, taxes and changes in net working capital and investments are deducted.

Operating margin: The proportion of a company’s revenue that remains after paying for variable costs of production.

Return on invested capital: A measure of a company’s efficiency at allocating the capital under its control to profitable investments. It is calculated as net income, less dividends, divided by total capital.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog