Alternative Assets:

The Case for

a Defensive Stance

by Damian Hoang,

Vice President & Portfolio Manager,

1832 Asset Management L.P.

October 30, 2018

It's worth noting that we're currently in the second-longest economic expansion cycle in modern history -- 110 months removed from the last recession. The length of the cycle by itself doesn't mean much; economic cycles and bull markets don't die of old age. However, as the cycle matures, it can become more susceptible to shocks.

In long-term investing, the catalyst that ties valuation and future returns together is the economic cycle.

In long-term investing, the catalyst that ties valuation and future returns together is the economic cycle. Since World War II, investors have encountered a recession approximately 58 months, on average, into an economic cycle. Roughly six months to a year before the official start of a recession, the equity markets would usually sell off first. With the equity sell-off, stock valuations would compress. And generally speaking, the higher the prevailing valuation, the greater the compression.

Equity Valuations: Proceed With Caution

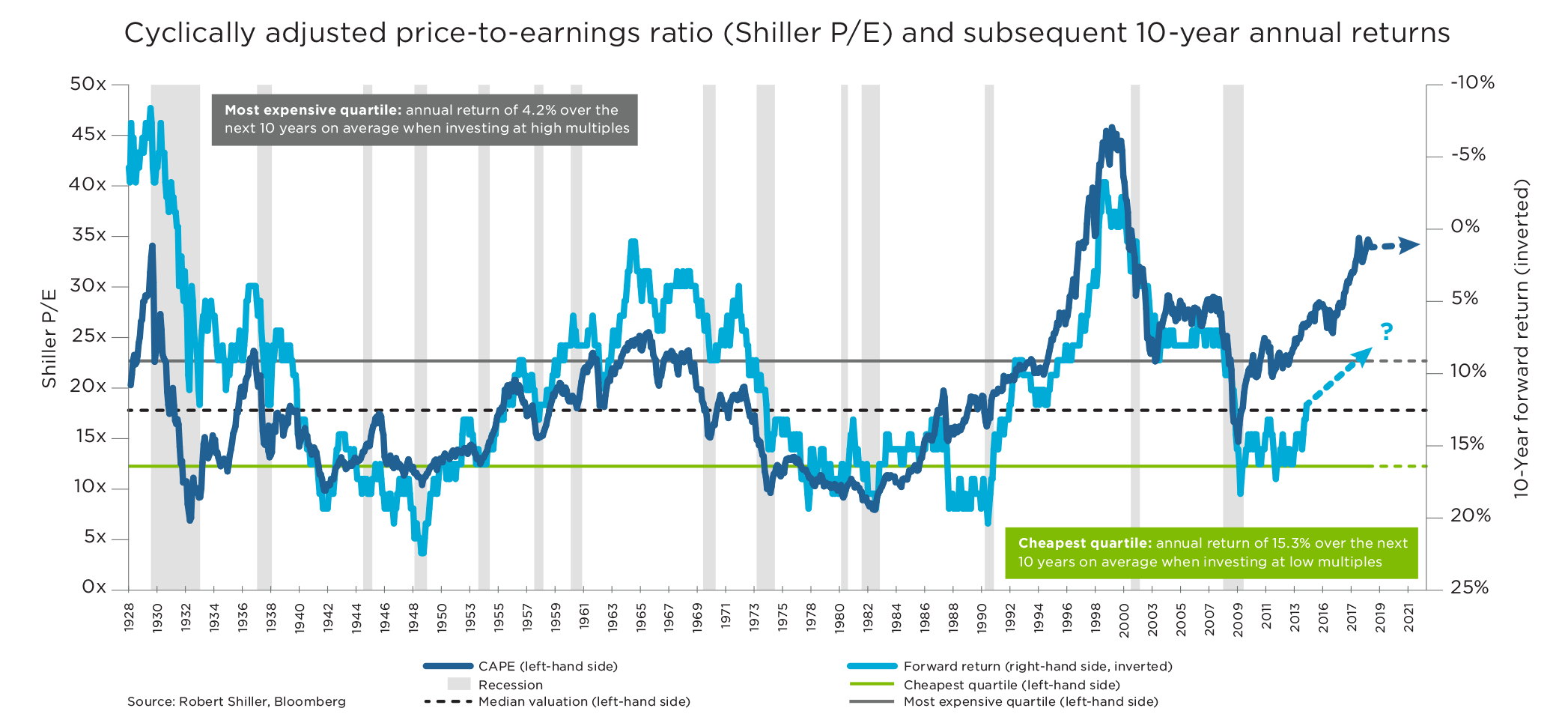

According to data going back to 1927, the S&P's current valuation is in the most expensive quartile. And when the S&P is that expensive, on average, the S&P's Shiller P/E multiple (Cyclically Adjusted Price to Earnings or CAPE ratio) would compress by 17 turns (for example, from a P/E of 30x to 13x) -- versus a compression of only 3x at valuations below the most expensive quartile.The chart above shows the Shiller PE (left axis) and the subsequent 10-year forward annual returns (inverted and on the right axis); inverted means the higher the line vertically, the lower the forward returns. As you can see, the starting Shiller P/E and the subsequent 10-year returns are highly--and negatively--correlated. The relationship is clear - if you invest when the market is inexpensive with a low Shiller P/E, the subsequent returns are likely to be high and vice versa.

I'm certainly not inferring that a fully priced market has all risk and no reward. However, I do believe, given the current U.S. equity valuations, that it's only prudent to proceed with caution and perhaps to start thinking defensively.

Bonds Are Not Cheap Either

Unfortunately, bonds may not provide much of a defense in the current environment. Out of $50 trillion of bonds outstanding, about $8 trillion are trading with a negative yield. And inflation and interest rates - no friends to fixed-income investors -- are trending up. The core U.S. inflation rate is already higher than 2% (the threshold above which central bankers would start to get nervous) and the full inflation measure (which leads the core number by 12 to 18 months) is around 3%.

Given the rich valuation across stocks and bonds, rising inflation and interest rates, and an extended market cycle, what can a conservative investor do?

At this point of the market cycle, alternative investments that come with downside protection should be part of a diversified portfolio.

The Case for Alternatives

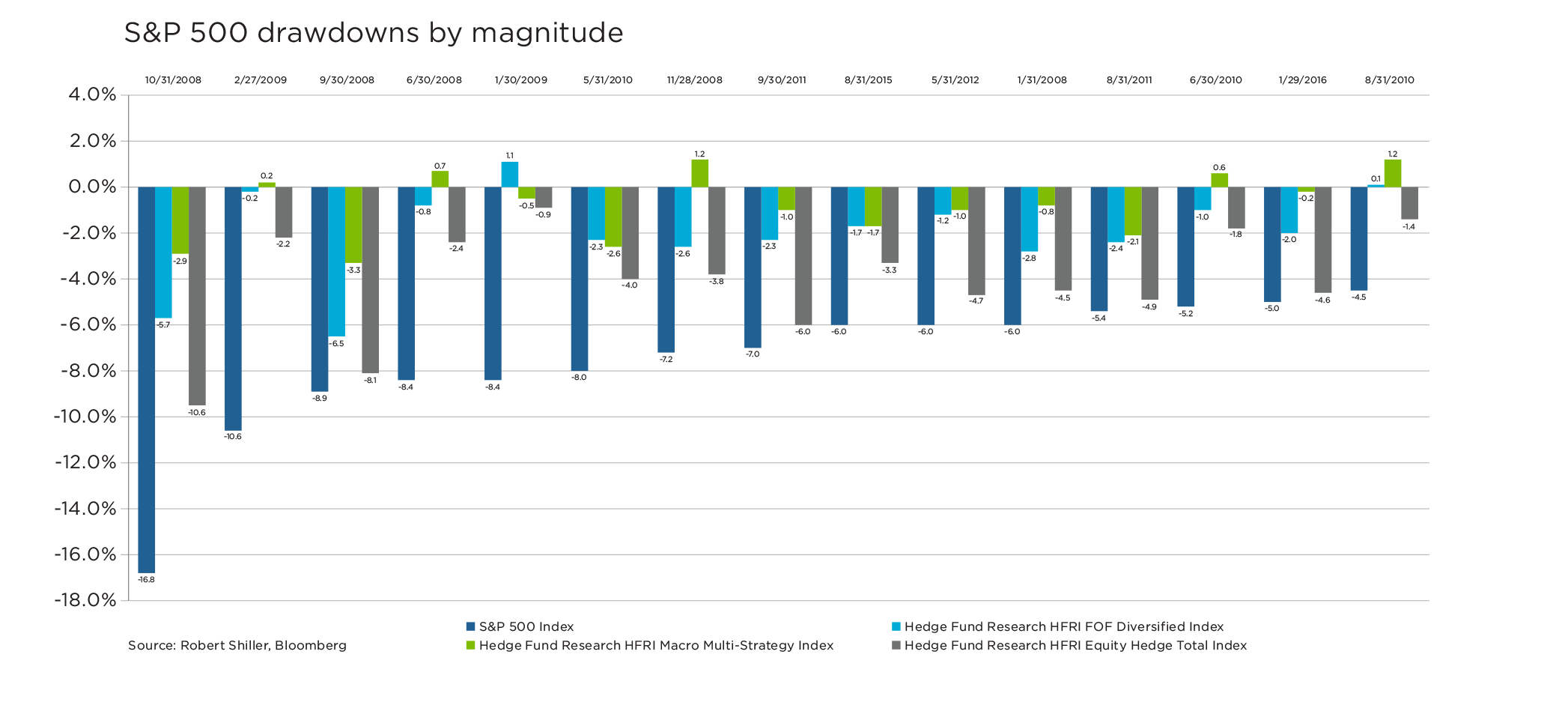

At this point of the market cycle, alternative investments that come with downside protection should be part of a diversified portfolio. Over the past decade plus (including the credit crisis), hedge funds using certain types of strategies (that aren't just long or levered long market vehicles) have provided consistent and reasonable downside protection during market sell-offs. As illustrated in the chart below, equity hedged and diversified macro hedge funds have held in very well versus the S&P 500 -- even during the worst months of the credit crisis.

The challenge is that alternative investments - which have a lower correlation to traditional assets -- tend to underperform in good markets. Consequently, it can be difficult to find an alternative strategy that can deliver throughout the complete market cycle.

Dynamic Premium Yield Fund is one such fund. Since inception, the fund has delivered reasonable upside with low volatility and low beta driven by its systematic income-generation and portfolio-hedging strategy. The fund was designed to provide defensive low beta, low volatility exposure to U.S. equities and a robust distribution yield with minimal interest-rate sensitivity. The downside protection of the fund comes from the combination of the margin of safety that comes with writing puts on blue chip stocks and the systematic purchase of equity index puts for portfolio hedging.

About Damian Hoang

Focused on options strategies and U.S. equities, Damian joined Dynamic Funds in 2012 as a Senior Derivatives Strategist and currently manages six mandates for 1832 Asset Management.

Learn more about Damian and the recently launched Dynamic Premium Yield PLUS Fund.

Disclaimer:

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any funds managed by 1832 Asset Management L.P. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. Dynamic Funds® is a registered trademark of its owner, used under license, and a division of 1832 Asset Management L.P.