Vice President and Senior Portfolio Manager, Dynamic Funds

and

Peter Rozenberg,

Vice President and Portfolio Manager, Dynamic Funds

Strategic diversification remains one of the cornerstones of successful portfolio construction. Whether you're looking to strengthen your portfolio diversification or are searching for growth opportunities, international equities have an essential role to play in any overall investment strategy. International economies are expanding, productivity is increasing, and we're seeing the emergence of a growing global middle class. These trends suggest the case for truly international investing is likely to only get stronger.

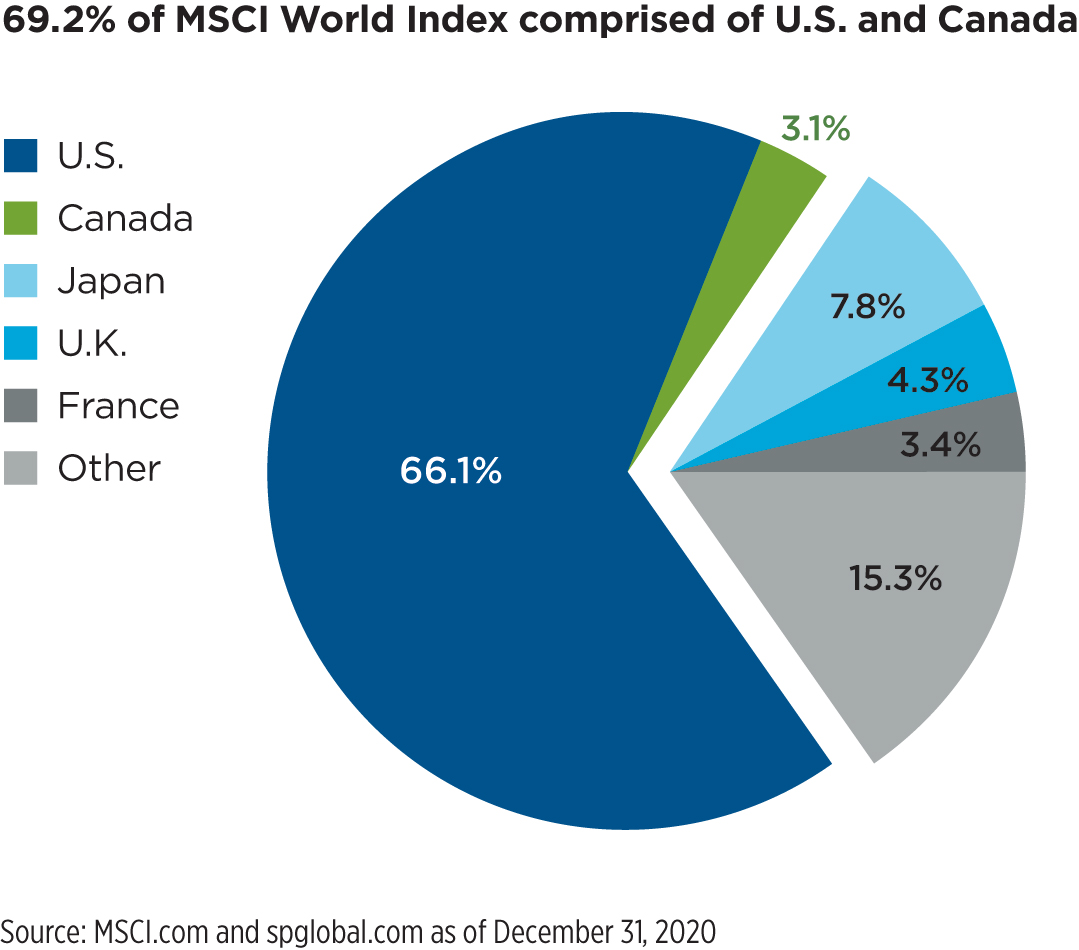

Many Canadian investors fail to realize they may be overexposed to U.S. and Canadian equities via their global equity funds, many of which have a low active share and are similar to the benchmark.

And yet many Canadian investors fail to realize they may be overexposed to U.S. and Canadian equities via their global equity funds, many of which have a low active share and are similar to the benchmark. A quick look at the MSCI World Index reveals that, as of February 2021, U.S. and Canadian companies made up nearly 70% of the index.

By adding a truly international mandate to a portfolio, advisors can help diversify exposure by markets, currencies and especially sectors, where there’s a stark contrast between the U.S. and international indexes. While the S&P 500 index is very heavily weighted in the information technology sector (27%), the MSCI EAFE index is much more broadly diversified and has only 8.9% in the sector (In fact, information technology isn’t even within the top five sectors of the MSCI EAFE index). Additionally, the top 10 holdings in the S&P 500 account for more than a quarter of the index (26.4%), whereas the top 10 holdings of the MSCI EAFE index represent only 12% of the index1.

International experience is key

For those looking to invest internationally, it makes sense to do so with an experienced investment team focused on providing equity exposure beyond the U.S. and Canada. As active managers, we’re focused on constructing rigorously researched, concentrated portfolios that can do well in a variety of market environments. We’re looking for companies that generate strong free cash flows, have good margins and are valued at a discount to our assessment of their intrinsic value. The companies must also have a catalyst—a key factor in the company’s favour that the market has yet to recognize.

Introducing Dynamic International Discovery Fund and Dynamic Active International ETF (DXIF)

When it comes to choosing an actively managed mandate, Dynamic Funds believes it’s essential for advisors to have options. That’s why we offer two distinct international mandates: Dynamic International Discovery Fund and Dynamic Active International ETF (DXIF).

The latest mutual fund from Dynamic's David Fingold, Dynamic International Discovery Fund is a go-anywhere mandate looking for international industry leaders with high returns on invested capital and high free-cash-flow yields. The fund's underlying investment strategy is very similar to that of Dynamic Global Discovery Fund, which David has managed since 2002.

Dynamic Active International ETF (DXIF), co-managed by David Fingold and Peter Rozenberg, is a flexible mandate that aims to invest in a portfolio of high-quality equity investments from countries outside the U.S. and Canada. Although DXIF shares a similar investment philosophy with Dynamic International Discovery Fund in terms of investment process, the two products are distinctly different and could have a low overlap in the number of similar holdings.

While Dynamic International Discovery Fund can invest in companies across the capitalization scale, DXIF will be restricted to companies with a market cap over $5 billion. Also, DXIF will have a maximum cash weighting of 5%, while Dynamic International Discovery Fund does not have a minimum or maximum cash weighting.

1 Bloomberg and spglobal.com as of February 28, 2021.

About David L. Fingold, BSc. Management, Vice President & Senior Portfolio Manager David Fingold has more than 30 years of industry experience and has been the sole lead manager on Dynamic Funds' mandates for more than 15 years, in which time he's navigated the Iraq War, the U.S. sub-prime housing bubble, the Great Recession and the global pandemic.

David Fingold has more than 30 years of industry experience and has been the sole lead manager on Dynamic Funds' mandates for more than 15 years, in which time he's navigated the Iraq War, the U.S. sub-prime housing bubble, the Great Recession and the global pandemic.

He is lead portfolio manager for a number of U.S. and Global strategies, including Dynamic Global Discovery Fund, Dynamic Global Dividend Fund and Dynamic American Fund.

About Peter A. Rozenberg, BComm, Vice President & Portfolio Manager Peter joined Dynamic in 2013 as a Senior Portfolio Analyst bringing more than 30 years of extensive industry experience to David Fingold’s team. Prior to joining 1832 Asset Management L.P., Peter spent 15 years at UBS Securities in various equity analyst roles.

Peter joined Dynamic in 2013 as a Senior Portfolio Analyst bringing more than 30 years of extensive industry experience to David Fingold’s team. Prior to joining 1832 Asset Management L.P., Peter spent 15 years at UBS Securities in various equity analyst roles.

Along with David Fingold, Peter is co-portfolio manager of Dynamic Active International ETF, as well other U.S. and Global strategies.

Disclaimer:

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments and active Dynamic ETFs. Please read the prospectus before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Views expressed regarding a particular investment, economy, industry or market sector should not be considered an indication of trading intent of any of the mutual funds managed by 1832 Asset Management L.P. These views are not to be relied upon as investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views. To the extent this document contains information or data obtained from third party sources, it is believed to be accurate and reliable as of the date of publication, but 1832 Asset Management L.P. does not guarantee its accuracy or reliability. Nothing in this document is or should be relied upon as a promise or representation as to the future.

© Copyright 2021 1832 Asset Management L.P. All rights reserved.

Dynamic Funds® is a registered trademark of its owner, used under license, and a division of 1832 Asset Management L.P.