Pre-opening Comments for Friday April 21st

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged at 8:30 AM EDT.

The Canadian Dollar was unchanged at US73.92 cents following release of Canada’s February Retail Sales at 8:30 AM EDT. Consensus was a decrease of 0.6% versus a gain of 1.4% in January. Actual was a decrease of 0.2%.

CSX added $0.81 to $31.62 after reporting higher than consensus first quarter earnings.

PPG Industries gained $0.95 to $142.40 after reporting higher than consensus adjusted first quarter earnings.

Chipotle added $0.58 to $1,798.98 after Stifel Nicolaus raised its target price from $1,750.00 to $2,000.00

Procter & Gamble gained $3.45 to $154.30 after reporting higher than consensus fiscal third quarter results. The company also raised guidance.

EquityClock’s Daily Comment

Headline reads “The weak Philly Fed Index keeps us with the belief that the manufacturing economy has already entered into recession”.

http://www.equityclock.com/2023/04/20/stock-market-outlook-for-april-21-2023/

Technical Notes

Pepsico $PEP an S&P 100 stock moved above $185.59 to an all-time high extending an intermediate uptrend.

AT&T $T an S&P 100 stock moved below $17.78 completing a double top pattern.

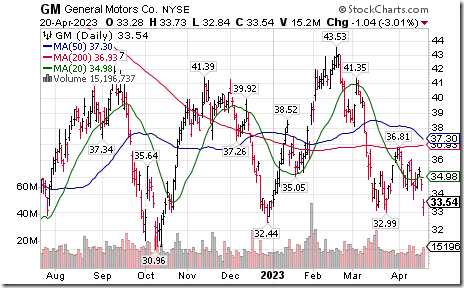

General Motors $GM an S&P 100 stock moved below $32.99 setting an intermediate downtrend.

American Express $AXP a Dow Jones Industrial Average stock moved below $154.33 setting an intermediate downtrend.

Cisco $CSCO a Dow Jones Industrial Average stock moved below intermediate support at $47.66,

Tesla $TSLA a NASDAQ 100 stock moved below $163.91 completing a double top pattern.

Baidu $BIDU a NASDAQ 100 stock moved below $126.33 completing a double top pattern.

Peloton $PTON a NASDAQ 100 stock moved below $14.73 extending an intermediate downtrend.

Trader’s Corner

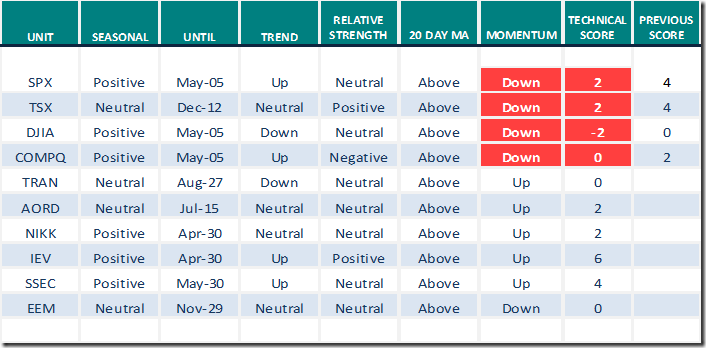

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

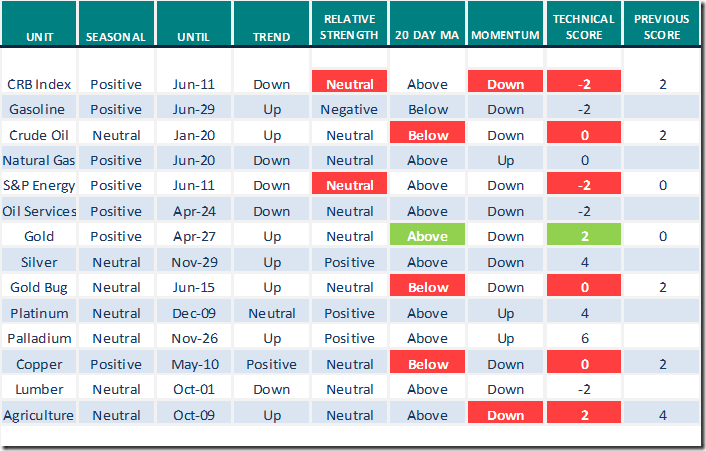

Commodities

Daily Seasonal/Technical Commodities Trends for April 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

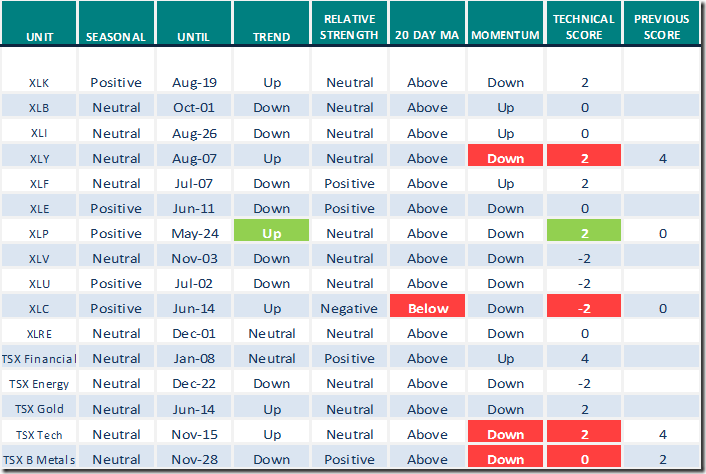

Sectors

Daily Seasonal/Technical Sector Trends for April 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

Headwinds Warning for Passive Investing | Chris Kimble | Your Daily Five (04.20.23)

Headwinds Warning for Passive Investing | Chris Kimble | Your Daily Five (04.20.23) – YouTube

The Most Important Chart to Watch | David Keller, CMT | The Final Bar (04.19.23)

The Most Important Chart to Watch | David Keller, CMT | The Final Bar (04.19.23) – YouTube

Why Options Create Selling | Tom Bowley | Trading Places (04.20.23)

Why Options Create Selling | Tom Bowley | Trading Places (04.20.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 2.40 to 56.80. It remains Neutral.

The long term Barometer dropped 2.60 to 60.00. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer dropped 1.72 to 62.50. It remains Overbought.

The long term Barometer dropped 0.85 to 65.52. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed