by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

Investor enthusiasm may have returned, but Russ Koesterich, Managing Director and Portfolio Manager of Global Allocation emphasizes a more prudent approach.

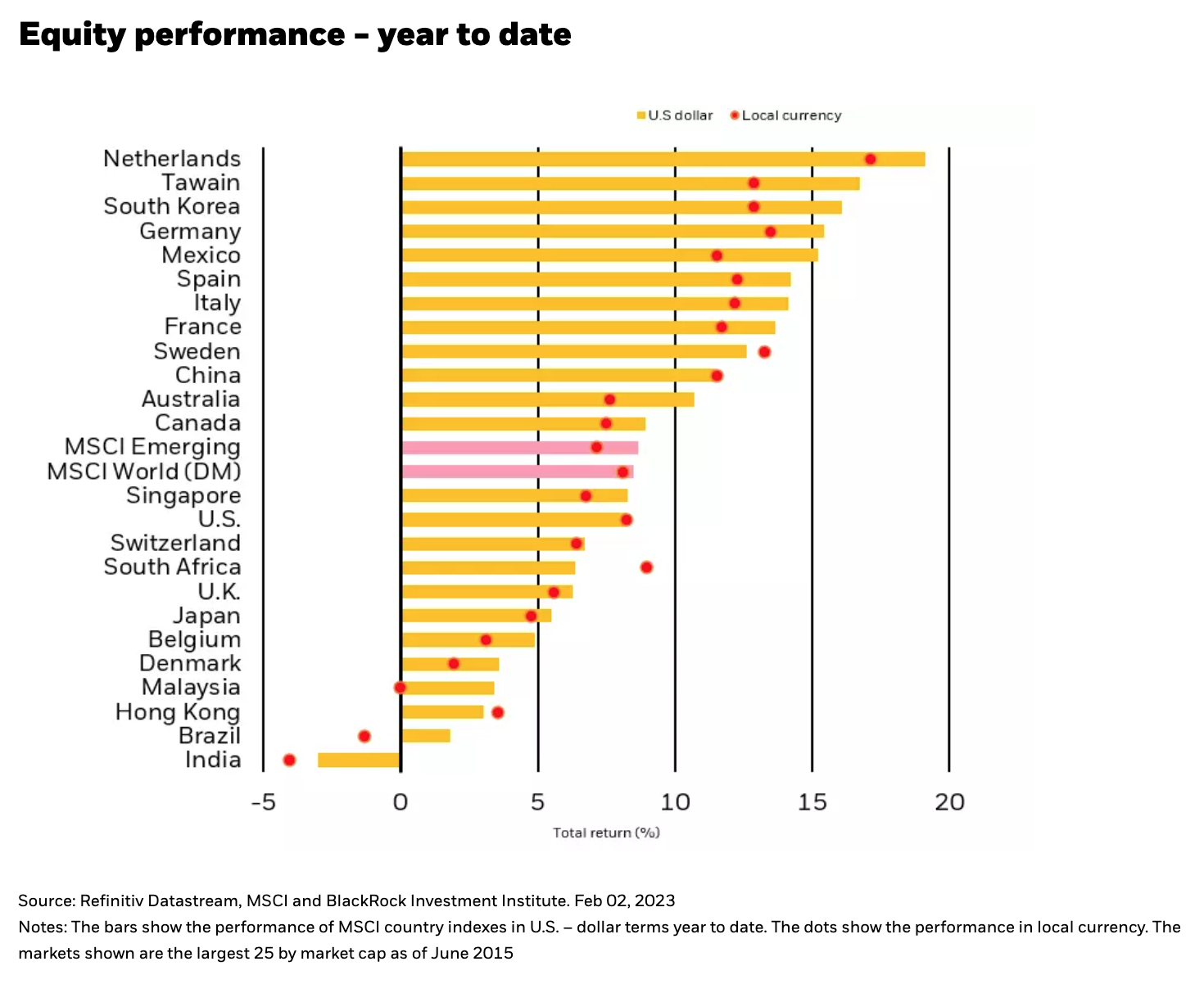

So far 2023 has been the mirror image of 2022. Last year featured a broad selloff in stocks and a spike in interest rates. This year has witnessed the exact opposite: stocks have surged, starting with last year’s worst performers, and both nominal and real interest rates have dropped (see Chart 1).

Today, potential market headwinds are of a different sort. Rising prices of goods and services and their impact on both interest rates and profit margins have become the larger concern. The good news is that rising inflation does not necessarily mean the end of the bull market. However, the shift in the macro backdrop does necessitate a shift in security selection. Investors now need to ensure enough exposure to those stocks likely to benefit from accelerating inflation.

Back in mid-October I suggested that the market was in the process of bottoming, but that the bottom would look different than the ‘V’ shaped bottom that defined the 2020 lows. So far, the market has broadly stuck to that script. Stocks bottomed in October but many parts of the market, particularly growth stocks, revisited those lows in December.

Going forward, three issues suggest patience and discretion:

Fuller valuations. In general, on a global basis equity valuations look reasonable. The MSCI World Index is trading at approximately 16x forward earnings, slightly below the long-term average. However, the rally has left U.S. valuations somewhat more stretched. The S&P 500 is currently valued at nearly 19x 2023 earnings. While this is well below the cyclical peak, it is hard to describe U.S. equities as cheap.

Vulnerable earnings. Adding to the near-term caution: valuations may be richer than they appear if earnings fail to meet still optimistic expectations. While earnings revisions have turned negative, they may have further to fall as the economy continues to decelerate and consumers pull back from giddy post-pandemic spending.

The technical nature of the January rally. The final reason for caution is rooted in the nature of the rally. The Nasdaq 100 has advanced 20% from the January low. Yet, even those gains pale in comparison to the advances in the most volatile segments of the market. For example, with crypto currencies up approximately 50% from the fall lows, crypto exchanges have surged, in some cases more than doubling. The gains in these names can largely be attributed to short covering, with the most shorted names posting the sharpest gains. While this has provided a sugar rush to many parts of the market, it is unlikely to drive returns throughout the remainder of the year.

Be patient and emphasize GARP

The bottom line: Rather than chase the rally, I would instead emphasize patience, avoiding the more speculative parts of the market and emphasizing growth conditioned on price.

Stocks can go higher but in near-term, particularly when it comes to lower quality, volatile names. Instead, consider adding to parts of the market that have underperformed, such as high-quality names in healthcare, agriculture and select industrials. Finally, while growth may continue to outperform in a softening economy, investors should avoid paying any price. Interestingly, GARP, or growth at a reasonable price, names have outperformed the broader market and mostly kept up with broader growth indices. In my mind this is a better place to put new money to work.

Copyright © Blackrock