The Bottom Line

Focus this week is on the FOMC’s update on monetary policy released at 2:00 PM EST on Wednesday. Consensus is virtually universal that the Federal Reserve will increase the Fed Fund Rate by 0.25% to 4.50%-4.75%. Of greater importance, the FOMC will offer guidance on future changes for the Rate. Comments by Federal Reserve Chairman Powell at 3:00 PM EST will be watched closely.

Consensus for Earnings and Revenues for S&P 500 Companies

Analysts lowered fourth quarter earnings estimates since our last report on January 23rd . According to www.factset.com fourth quarter earnings are expected to decrease 5.0% (versus previous decrease of 4.6%) but revenues are expected to increase 3.9% (versus previous increase of 3.7%). For all of 2022 earnings are expected to increase 4.4% (versus previous increase of 4.6%) and revenues are expected to increase 10.5% (versus previous increase of 10.3%.

Preliminary estimates for 2023 continued moving lower. According to www.factset.com first quarter 2023 earnings are expected to decrease 3.0% (versus previous decrease of 1.1%) but revenues are expected to increase 2.3% (versus previous increase of 2.7%). Second quarter 2023 earnings are expected to decrease 2.4% (versus previous decrease at 1.2%) but revenues are expected to increase 0.1% (versus previous increase at 0.3%). Third quarter earnings are expected to increase 3.7% (versus previous increase of 4.6%) and revenues are expected to increase 1.4% (versus previous increase of 1.5%). Fourth quarter earnings are expected to increase 10.3% (versus previous increase of 10.5%) and revenues are expected to increase 4.5% (versus previous increase of 4.6%). For all of 2023, earnings are expected to increase 3.4% (versus previous increase of 4.2%) and revenues are expected to increase 2.6% (versus previous increase of 2.9%)

Economic News This Week

November Canadian GDP released at 8:30 AM EST on Tuesday is expected to increase 0.1% versus a gain of 0.1% in October.

January Chicago Purchasing Managers Index released at 9:45 AM EST on Wednesday is expected to slip to 45.0 from 45.1 in December

December Construction Spending released at 10:00 AM EST on Wednesday is expected to increase 0.1% versus a gain of 0.2% in November.

January ISM Manufacturing PMI released at 10:00 AM EST on Wednesday is expected to dip to 48.0 from 48.4 in December.

FOMC Interest Rate Decision is released at 2:00 PM EST on Wednesday. Consensus calls for another 0.25% increase in the Fed Fund Rate to 4.50%-4.75%.

Fourth quarter Non-farm Productivity released at 8:30 AM EST on Thursday is expected to increase 2.1% versus a gain of 0.8% in the third quarter.

December Factory Orders released at 10:00 AM EST on Thursday are expected to increase 1.3% versus a decline of 1.8% in November.

January Non-farm Payrolls released at 8:30 AM EST on Friday is expected to increase 185,000 versus a gain of 223,000 in December. January Unemployment Rate is expected to increase to 3.6% from 3.5% in December. January Average Hourly Earnings are expected to increase 0.3% versus a gain of 0.3% in December. On a year-over-year basis, January Average Hourly Earnings are expected to increase 4.3% versus a gain of 4.6% in December.

January ISM Non-manufacturing PMI released at 10:00 AM EST on Friday is expected to improve to 50.2 from 49.6 in December.

Selected Earnings News This Week

Another 107 S&P 500 stocks (including six Dow Jones Industrial Average stocks) are scheduled to report quarterly results this week: 29% of S&P 500 companies have reported to date.

Focuses this week are on Apple, Alphabet and Amazon when they report on Thursday.

Trader’s Corner

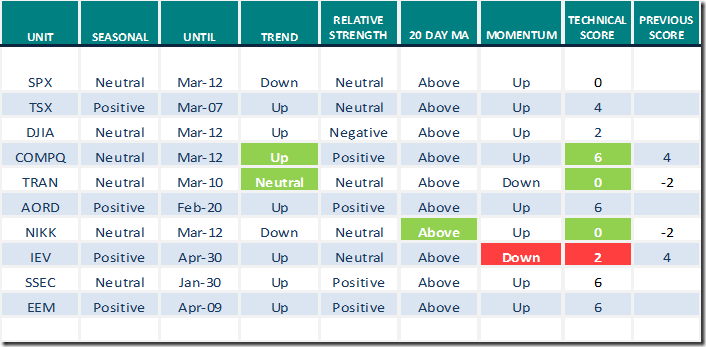

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 27th 2023

Green: Increase from previous day\

Red: Decrease from previous day

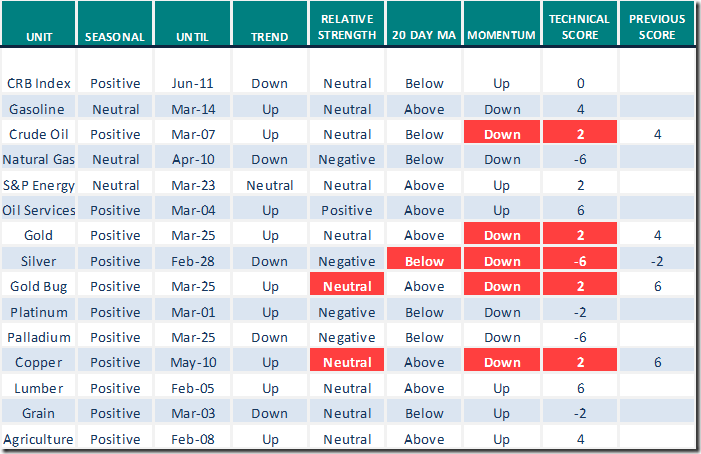

Commodities

Daily Seasonal/Technical Commodities Trends for January 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

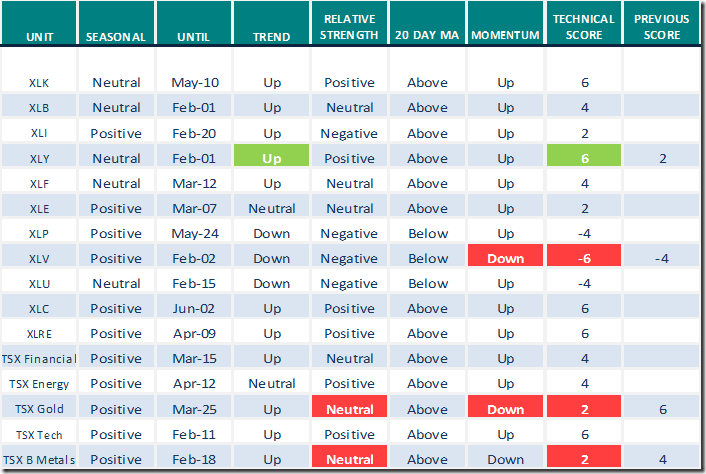

Sectors

Daily Seasonal/Technical Sector Trends for January 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

NASDAQ Composite Index $COMPQ moved above 11,571.64 completing a double bottom pattern. It also moved above its 200 day moving average.

Consumer Discretionary SPDRs $XLY moved above $146.92 and $147.91 setting an intermediate uptrend.

American Express $AXP a Dow Jones Industrial Average stock moved above $160.99 and $164.86 extending an intermediate uptrend.

Salesforce.com $CRM a Dow Jones Industrial Average moved above $166.03 and 165.25 extending an intermediate uptrend

Zoom $ZM a NASDAQ 100 stock moved above $72.17 completing a double bottom pattern

Capital One Financial $COF an S&P 100 stock moved above intermediate resistance at $118.40.

Palladium ETN $PALL moved below $153.95 extending an intermediate downtrend.

Links offered by valued providers

Mark Leibovit’s comments for October 26th

https://www.howestreet.com/2023/01/crude-oil-gasoline-the-fed-us-dollar-mark-leibovit/

Positive Rotation From Bear to Bull | Greg Schnell, CMT | Market Buzz (01.25.23)

Positive Rotation From Bear to Bull | Greg Schnell, CMT | Market Buzz (01.25.23) – YouTube

Always Be Learning: Exiting Too Soon On A Losing Position

S&P 6000 Or Bust! | The Final Bar | David Keller, CMT (01.26.23)

(Includes a target price on gold at $3,000 per ounce)

S&P 6000 Or Bust! | The Final Bar | David Keller, CMT (01.26.23) – YouTube

Michael Campbell’s Money Talks for January 28th

https://mikesmoneytalks.ca/category/mikes-content/complete-show/?mc_cid=ec7b1d5aab&mc_eid=592546b4b5

The S&P 500 Leaves the 200-Day Behind: David Keller | January 27, 2023

The S&P 500 Leaves the 200-Day Behind | The Mindful Investor | StockCharts.com

Tesla Rips Higher as SPX Accelerates | The Final Bar | David Keller, CMT

Tesla Rips Higher as SPX Accelerates | The Final Bar | David Keller, CMT (01.27.23) – YouTube

Can QQQ Prove the Bears Wrong? Arthur Hill| January 27, 2023

Can QQQ Prove the Bears Wrong? | Art’s Charts | StockCharts.com

Gold’s Price Oscillator Tom McClellan January 27, 2023

Gold’s Price Oscillator | Top Advisors Corner | StockCharts.com

Growth Stocks Push Market Above Resistance | Mary Ellen McGonagle | The MEM Edge

https://www.youtube.com/watch?v=qnfDg8p0Gfk

My Favorite Indicator Says – We’re In A New Uptrend | Joe Duarte | Your Daily Five

Bob Hoye’s Weekly Comment

The Fed Trying to Cure the Inflation It Started – HoweStreet

Victor Adair’s Trading Notes for January 28th

https://victoradair.ca/trading-desk-notes-for-january-28-2023/

Links from Mark Bunting and www.uncommonsenseinvestor.com

Davis Rea Quarterly Update Livestream. – YouTube

Technical Scoop from David Chapman and www.EnrichedInvesting.com

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.40 on Friday, but added 9.60 last week. It remains Overbought.

The long term Barometer added 1.40 on Friday and gained 6.40 last week. It remains Overbought. Daily momentum continues to trend higher.

TSX Momentum Barometers

The intermediate term Barometer was unchanged on Friday and gained 0.42 last week. It remains Overbought.

The long term Barometer added 0.42 on Friday and gained 3.82 last week. It remains Overbought. Daily momentum continues higher.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed