Technical Notes for yesterday

Wal-Mart $WMT a Dow Jones Industrial Average stock moved above $142.72 after reporting higher than consensus fiscal third quarter results.

ASML $ASML a NASDAQ 100 stock moved above $590.97 extending an intermediate uptrend.

Applied Material $AMAT a NASDAQ 100 stock moved above $111.37 extending an intermediate uptrend.

Oracle $ORCL an S&P 100 stock moved above $79.47 extending an intermediate uptrend.

Visa $Van S&P 100 stock moved above $211.05 extending an intermediate uptrend.

Trader’s Corner

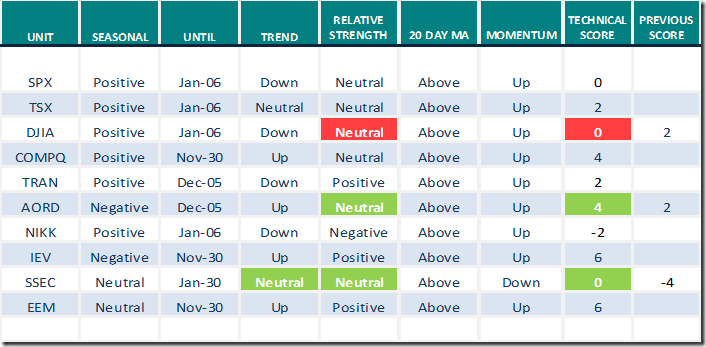

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

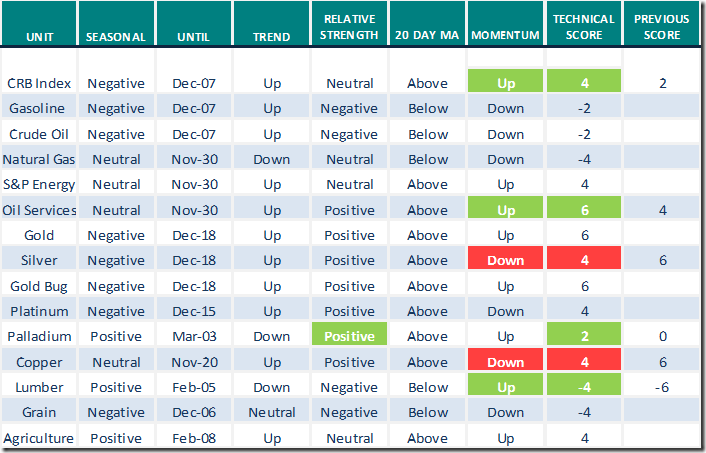

Commodities

Daily Seasonal/Technical Commodities Trends for November 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for November 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Tom Bowley discusses “Home construction building momentum”.

Home Construction "Building" Momentum | Tom Bowley | Trading Places (11.15.22) – YouTube

Jim Cramer reacts to earnings from Wal-Mart and Home Depot.

Jim Cramer reacts to earnings from Walmart, Home Depot – YouTube

According to Larry Williams, “The end of the year is near”.

The End Is Near | Larry Williams Special Presentation (11.15.22) – YouTube

We have a positive view of the equity markets over the next 12 months, says Mariner’s Krumpelman: A comment on seasonality also is included.

Joe Rabil has five attractive stocks on the charts.

5 Attractive Stocks | Joe Rabil | Your Daily Five (11.15.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.00 to 81.80. It remains Overbought.

The long term Barometer added 2.60 to 55.20. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 2.12 to 75.00. It remains Overbought.

The long term Barometer added 1.69 to 46.19. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed