Technical Notes for yesterday

NASDAQ Biotech iShares $IBB moved above $134.99 and $135.35 completing a long term reverse Head & Shoulders pattern.

Caterpillar $CAT a Dow Jones Industrial Average stock moved above $238.42 to an all-time high extending an intermediate uptrend.

Comcast $CMCSA an S&P 100 stock moved above $34.26 completing a base building pattern.

AbbVie $ABBV an S&P 100 stock moved above $153.99 extending an intermediate uptrend.

Oracle $ORCL an S&P 100 stock moved above $79.47 extending an intermediate uptrend.

Netlflix $NFLX a NASDAQ 100 stock moved above $305.63 extending an intermediate uptend.

Magna International $MG.TO a TSX 60 stock moved above $83.77 resuming an intermediate uptrend.

Silver stocks continue to respond to higher silver prices. Hecla Mining $HL moved above $5.17 extending an intermediate uptrend.

Trader’s Corner

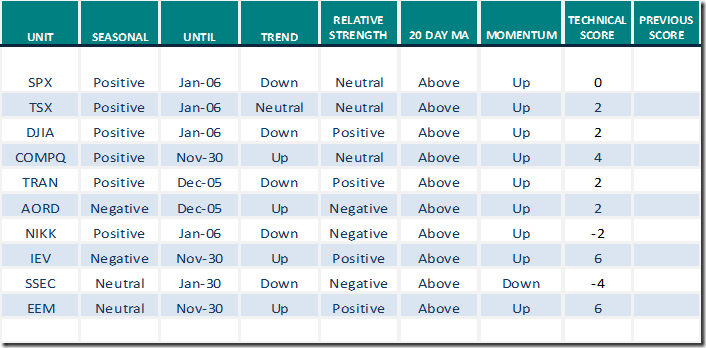

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 14th 2022

Green: Increase from previous day

Red: Decrease from previous day

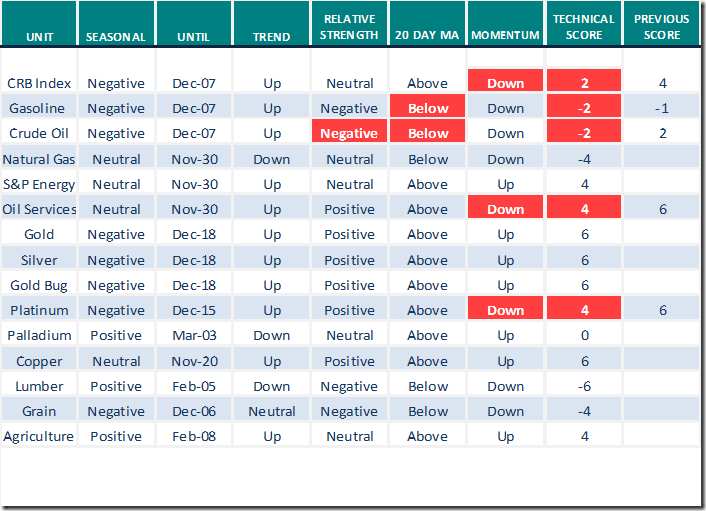

Commodities

Daily Seasonal/Technical Commodities Trends for November 14th 2022

Green: Increase from previous day

Red: Decrease from previous day

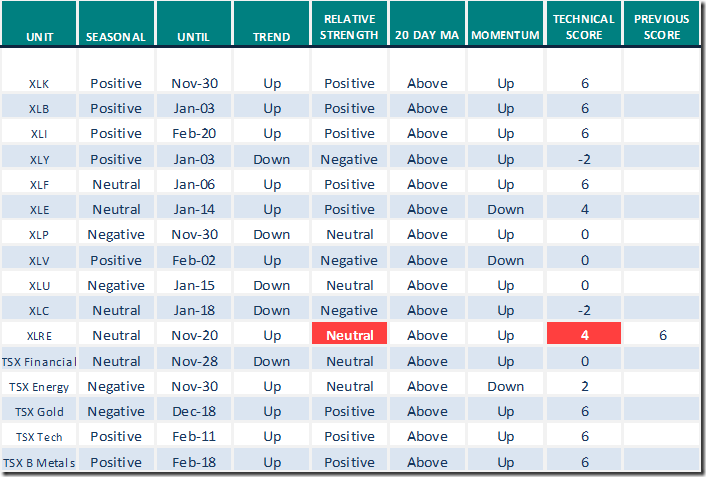

Sectors

Daily Seasonal/Technical Sector Trends for November 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued provider

Mary Ellen McGonagle sees “Sharp reversals and how to capitalize”.

Sharp Reversals And How To Capitalize | Mary Ellen McGonagle | The MEM Edge (11.11.22) – YouTube

Leslie Jouflas discusses “Monitoring key S&P 500 levels”.

Monitoring Key S&P 500 Levels | Leslie Jouflas, CMT | Your Daily Five (11.14.22) – YouTube

Teal Linde’s top market picks

Teal Linde’s Top Market Picks – YouTube

Lisa Riesman says “Conditions may be right for another nickel squeeze”. Also a discussion on copper, lithium and aluminum

Conditions may be ripe for another Nickel squeeze – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 3.20 to 78.80. It remains Overbought.

The long term Barometer dropped 3.00 to 52.40. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 4.24 to 72.88. It remains Overbought.

The long term Barometer dropped 6.78 to 44.49. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed