by Kent Hargis, PhD, Co-Chief Investment Office—Strategic Core Equities, Sammy Suzuki, CFA, Co-Chief Investment Officer—Strategic Core Equities; Head—Emerging Markets Equities, Jillian Geliebter, CAIA, Managing Director—Equities, AllianceBernstein

It’s hard to remember just how calm the last decade has been on equity markets. But from a historical perspective, that period looks like an anomaly. If volatility becomes more common in the future, strategies that help reduce downside risk should become integral to equity allocations.

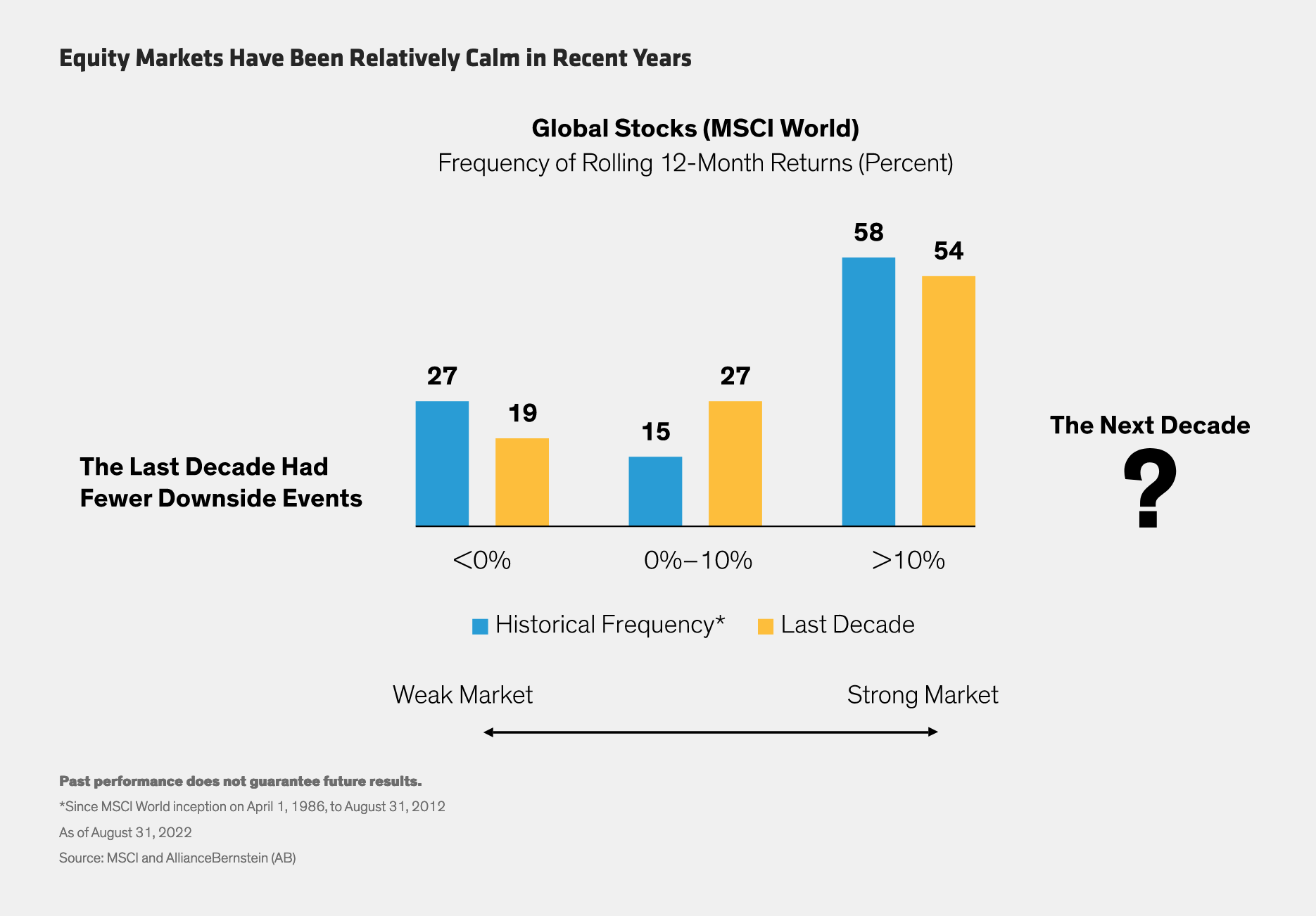

Investors are still stunned by the scale of this year’s downturn. To some extent, the pain has been magnified by the relative calm of the past decade. Even considering the sharp but brief COVID-induced crash in early 2020, global equities were less volatile in the past decade than over the previous 26 years. Our research shows that the MSCI World Index was down only 19% of the time in the last 10 years, versus 27% of the time from 1986 through 2012 (Display, above).

Moderate gains were practically a mirror image of that. About 27% of the time, equities were up by as much as 10% over the past decade—a historically strong run. Big rallies—with gains exceeding 10%—were seen at a similar frequency over the last decade and the longer term.

Nobody knows what the future holds. But given severe macroeconomic and geopolitical stress as well as less support from central banks, it doesn’t take a stretch of the imagination to see more volatility in the next 10 years than in the recent past—in line with longer-term trends.

How to Prepare for More Frequent Downturns

Volatility shouldn’t scare investors away from equities. Instead, allocate strategically to dampen the downside. We believe high-quality stocks with stable trading patterns and attractive prices can help investors capture equity potential while navigating more turbulent market conditions ahead. An active approach focused on quality, stability and price (QSP) is especially important when investors are fleeing to safer pockets of the market and pushing up prices of defensive stocks.

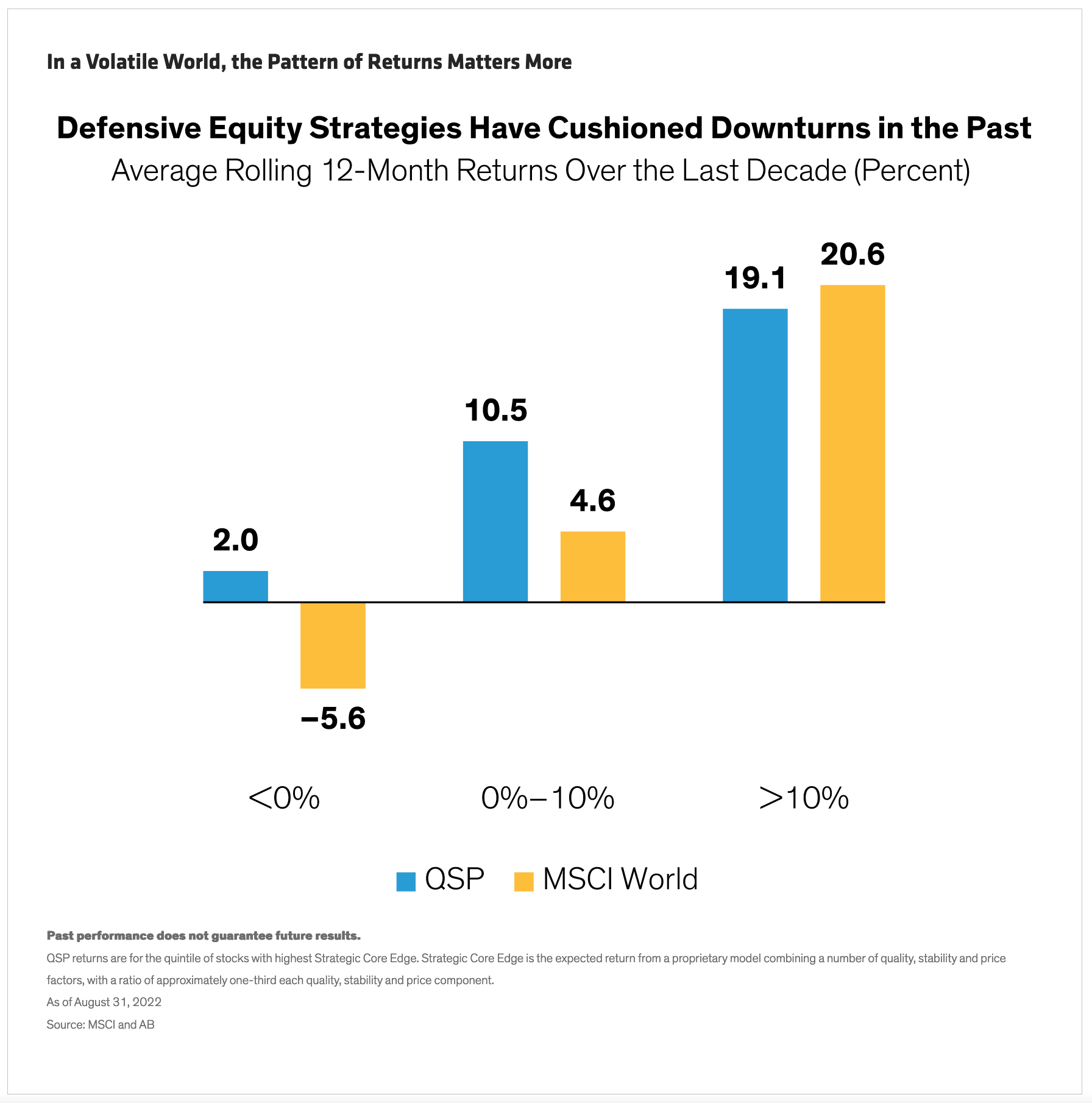

Our QSP universe of global stocks delivered returns of 2.0% on average in falling markets over the last decade, when the MSCI World fell by 5.6% on average (Display, below). In modestly rising market environments, QSP stocks advanced by 10.5%—more than double the broader market.

Don’t Fixate on Relative Returns

What’s the catch? When markets rose by 10% or more, QSP stocks underperformed by 1.5 percentage points. So investors must get comfortable with sacrificing some return in very strong markets—less upside capture. The good news is that a strategy that loses less than the market in downturns can beat the market over time even if it doesn’t capture all of the market’s rallies.

Embracing this type of strategy requires a mindset shift that doesn’t fixate on relative returns quarter after quarter. Knowing that the defensive stocks in a portfolio are well positioned for hard knocks can help investors stay invested in equities to capture vital return potential for meeting long-term financial goals.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.