Pre-opening Comments for Friday September 9th

U.S. equity index futures were higher this morning. S&P 500 futures were up 30 points in pre-opening trade.

The Canadian Dollar dropped 0.15 to US76.70 cents following release of Canada’s August Employment report at 8:30 AM EDT. Consensus was an increase of 15,000 jobs versus a decline of 30,600 in July. Actual was a drop of 39,700. Consensus for the August Unemployment Rate was an increase to 5.0% from 4.9% in July. Actual was an increase to 5.4%.

DocuSign advanced $10.50 to $68.39 after reporting higher than consensus second quarter revenues and earnings. The company also offered positive third quarter guidance.

Smith & Wesson dropped $0.99 to $12.44 after reporting lower than consensus fiscal first quarter sales.

Regeneron advanced $5.65 to $714.50 after Morgan Stanley upgraded the stock from Equal Weight to Overweight.

EquityClock’s Daily Comment

Headline reads “Are Banks providing yet another leading indication that the intermediate-term trend of the broader market is shifting”?

http://www.equityclock.com/2022/09/08/stock-market-outlook-for-september-9-2022/

Upcoming Event…

Using Seasonality to Determine Where We Are in the Economic Cycle (Recession)? and How to Invest

Saturday, September 17, 2022 |

3:00 pm – 3:45 pm EDT

Some leading indicators are hinting that we are on the path towards an economic recession, traditionally an ideal time to abandon risk in portfolios. Jon Vialoux will show you what he’s looking at and how to best position your portfolio using seasonal analysis.

Click on the following registration link to book your FREE spot to our presentation: Register Now

Technical Notes for yesterday

Regeneron $REGN a NASDAQ 100 stock moved above $652.52 extending an intermediate uptrend.

Restaurant Brands International $QSR.TO, a TSX 60 stock moved above Cdn$78.76 extending an intermediate uptrend.

CCL Industries $CCL.B a TSX 60 stock moved above $66.17 extending an intermediate uptrend.

Loblaw Companies $LTO a TSX 60 stock moved below intermediate support at $114.74.

Technical score for Palladium increased from 0 to 6 yesterday:

· Relative strength turned positive

· Momentum indicators (RSI, MACD, Stochastic) turned higher

· Moved above its 20, 50 and 200 day moving averages.

Trader’s Corner

Equity Indices and Related ETFs

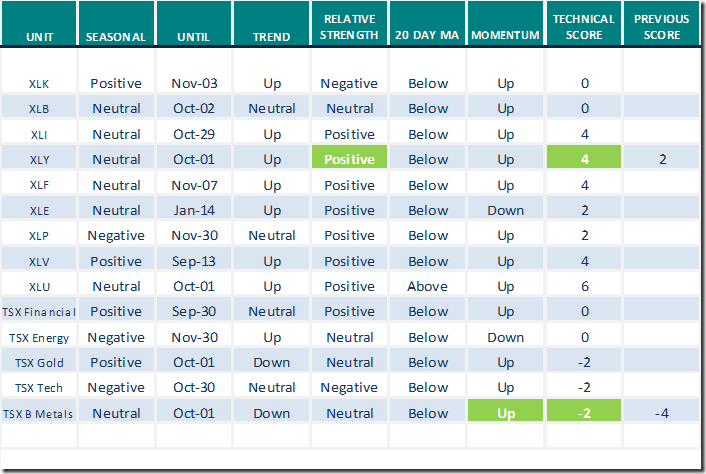

Daily Seasonal/Technical Equity Trends for September 8th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for September 8th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for September 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Tom Bowley says “S&P 500 holds critical support”

S&P 500 Holds Critical Support | Tom Bowley | Trading Places (09.08.22) – YouTube

Jeff Huge asks “1987 Redux using Elliott Wave Analysis?

1987 Redux? | Jeffrey Huge, CMT | Your Daily Five (09.08.22) – YouTube

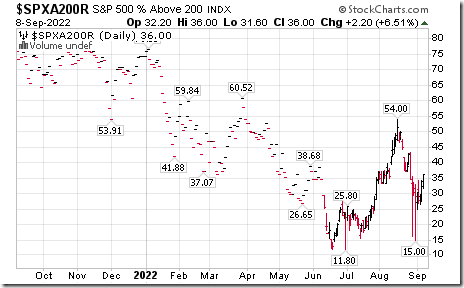

S&P 500 Momentum Barometers

The intermediate term Barometer added another 7.00 to 57.00 yesterday. It remains Neutral. Trend is up.

The long term Barometer added 2.20 to 36.00 yesterday. It remains Oversold. Trend is up.

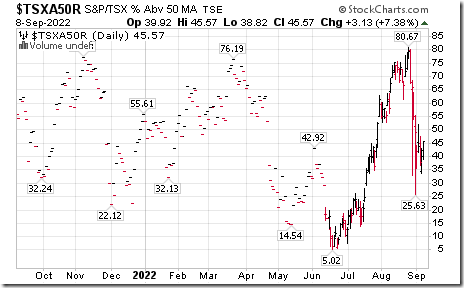

TSX Momentum Barometers

The intermediate term Barometer added 3.13 to 45.57 yesterday. It remains Neutral. Trend is up.

The long term Barometer added 0.55 to 31.22 yesterday. It remains Oversold.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed