The Bottom Line

History shows that U.S. equity markets during the second year of the U.S. Presidential cycle after a Democrat wins the White House from a Republican reach a brief peak near the end of August, followed by a brief correction to the end of September followed by resumption of an upward trend to the end of the year.

In the short term, equity markets are focusing on the action by central bank authorities. The Federal Reserve and Bank of Canada indicated their relief last week that inflation pressures likely have peaked. They also indicated extension of their current policy of “Quantitative Tightening” by raising central bank lending rates until inflation rates show a clear downward trend. More information on U.S. monetary policy likely will be revealed at the Jackson Hole Symposium this week hosted by the Federal Reserve. Tone of comments by Federal Reserve officials are expected to offer little hope for a change in monetary policy in the short term. Look for U.S. equity prices to respond accordingly. See the Special Report below for additional insights.

Consensus for Earnings and Revenues for S&P 500 Companies

Updates are scheduled to resume in Tech Talk on September 6th.

Economic News This Week

July U.S. New Home Sales released at 10:00 AM EDT on Tuesday are expected to drop to 575,000 units from 590,000 units in June.

July Durable Goods Orders released at 8:30 AM EDT on Wednesday are expected to increase 0.5% versus a gain of 2.0% in June. Excluding Transportation Orders, July Durable Goods Orders are expected to increase 0.2% versus a gain of 0.4% in June.

Jackson Hole Symposium is held August 25th to August 27th

Next estimate of second quarter U.S. real GDP released at 8:30 AM EDT on Thursday is expected to change to -0.8% from the previous estimate at -0.9%.

July U.S. Personal Income released at 8:30 AM EDT on Friday is expected to increase 0.6% versus a gain of 0.6% in June. July Personal Spending is expected to increase 0.3% versus a gain of 1.1% in June.

Core July PCE Price Index released at 8:30 AM EDT on Friday is expected to increase 0.3% versus a gain of 0.6% in June. July PCE Price Index year-over-year is expected to slip to 4.7% from 4.8% in June.

August Michigan Consumer Sentiment released at 10:00 AM EDT on Friday is expected to increase to 55.2 from 55.1 in June.

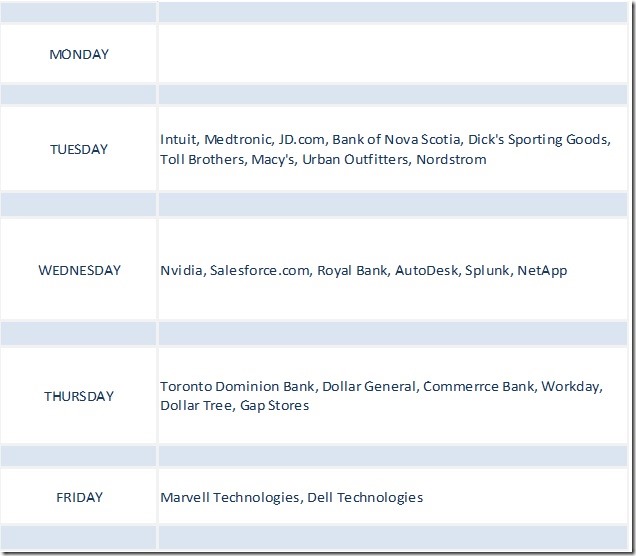

Selected Earnings News This Week

Focus this week is on Canada’s banks.

Trader’s Corner

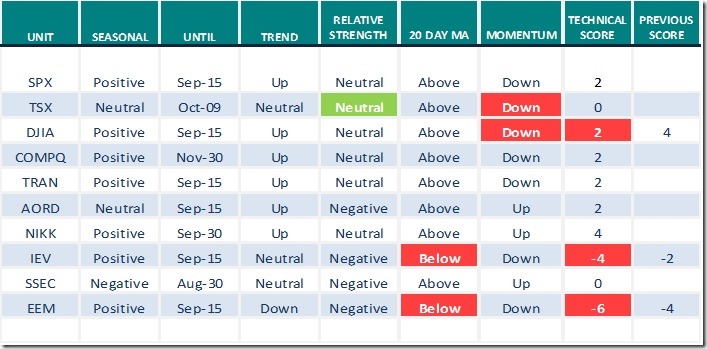

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 19th 2022

Green: Increase from previous day

Red: Decrease from previous day

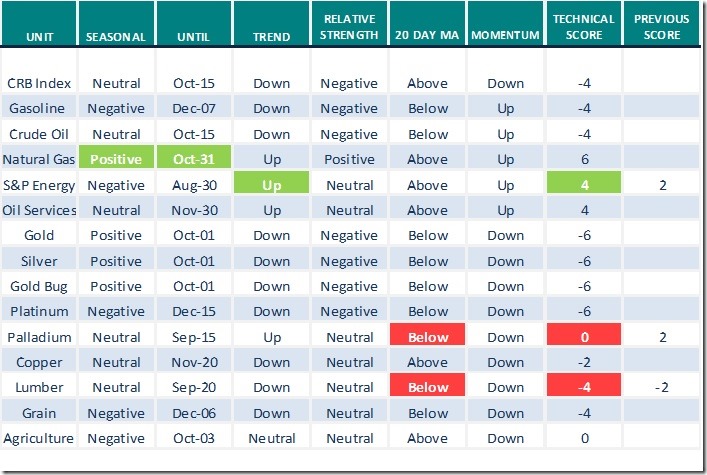

Commodities

Daily Seasonal/Technical Commodities Trends for August 19th 2022

Green: Increase from previous day

Red: Decrease from previous day

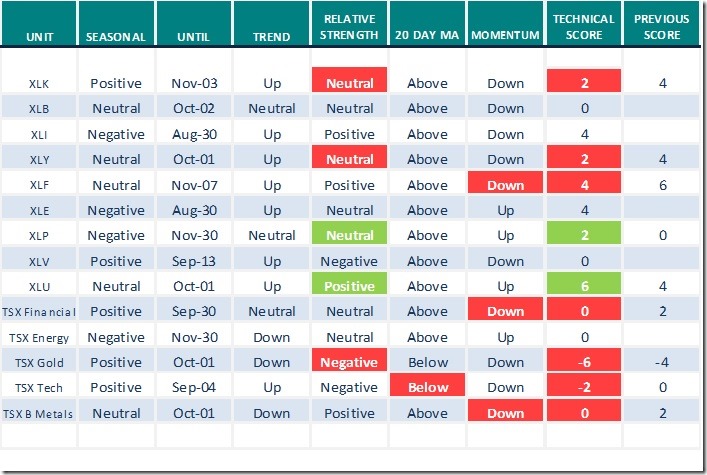

Sectors

Daily Seasonal/Technical Sector Trends for August 19th 2021

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Special Report

Don Vialoux was a guest on “Wolf on Bay Street” on Saturday. Following are notes used during the interview (taped last Thursday).

North American equity markets have recorded significant gains since their lows on June 17th. Where do they go from here?

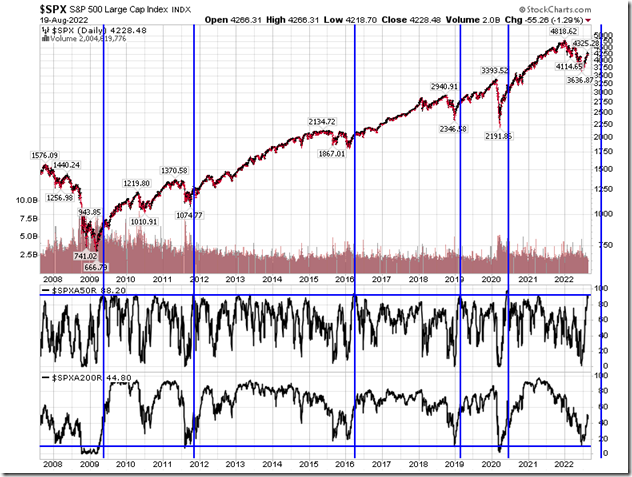

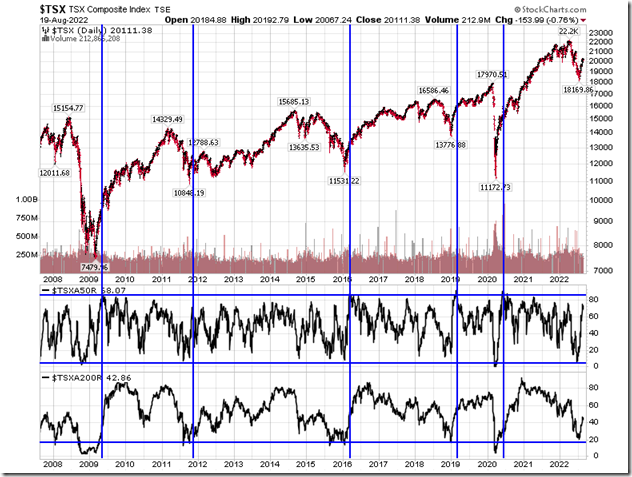

- Since lows set on June 17th the S&P 500 Index has gained more than 17% and the TSX Composite has gained more than 11%.

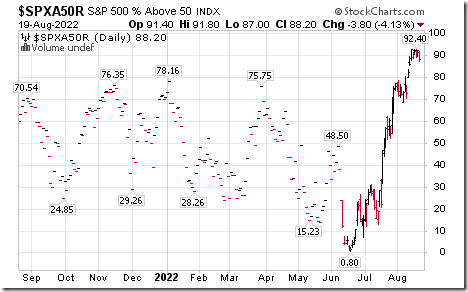

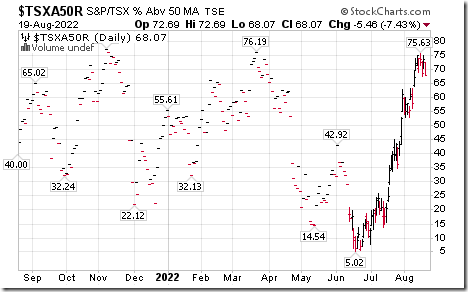

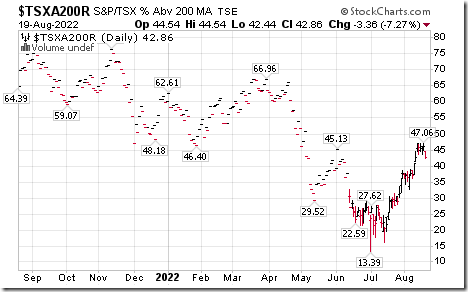

- Technical indicators show that North American equity indices recovered from extremely oversold levels set on June 17th. Percent of S&P 500 stocks trading above their 50 day moving average dropped to 1% and percent of S&P 500 stock trading above their 200 day moving average dropped to 12%. Similarly, Percent of TSX stocks trading above their 50 day moving average dropped to 5% and percent of TSX stocks trading above their 200 day moving average dropped to 13%.

- Recoveries from these magnitudes have occurred on five occasions since 2009. On each occasion, the S&P 500 Index and TSX Composite Index moved higher during the next two months (as seen this time) but also continued moving higher for at least the next 12 months.

- U.S. equity indices are following their historic Presidential cycle. The S&P 500 Index has a history of reaching the bottom of its four year U.S. Presidential cycle in June during mid-term U.S. Congressional election years.

- Investor concerns about rising inflation rates have been relieved slightly during the past two weeks. Annual inflation rates in Canada and the U.S. reached forty year highs in June: They moved lower in July. Urgency by the Federal Reserve and Bank of Canada to raise interest rates to control inflation has diminished. However, look out for a “speed bump” triggered by anticipation of negative news from the next FOMC meeting on September 21st: The FOMC is expected to increase the Fed Fund Rate by another 0.75%. The Federal Reserve also is expected to announce a reduction in size of its balance sheet. In Canada, Bank of Canada governor Macklem confirmed on Tuesday that the Bank of Canada intends to increase further its Overnight Lending rate for Canada’s banks.

- Anticipation of change in control of Congress from Democrats to Republicans in the November Congressional elections is a potential bonus for investors. History shows that that the party in power usually loses seats to the opposition party during mid-term election years: The reason: a new President normally launches tough new policies to pay for his mandate (e.g. in this case, higher taxes, more regulation). Democrats and Republicans currently hold 50 seats each in the Senate and the Democrats hold a slim 12 seat majority in the House of Representatives. A small shift in voter sentiment could flip control in both legislatures from Democrat to Republican. Net result could be a federal government with a less intrusive mandate for the next two year. Recent opinion polls suggest a high probability for change in control following the November mid-term elections this year.

- Rising corporate revenues and earnings by key North American sectors post COVID are setting the stage for higher North American stock prices. Second quarter results released by S&P 500 and TSX 60 companies nicely exceeded consensus expectations. Equity prices responded accordingly. Consensus estimates for 2022 calls for a 9% increase in S&P 500 earnings and an 11% increase in revenues.

Conclusion: Be aware of a “speed bump” by North American equity prices between now and late September. Ultimately, weakness will provide a buying opportunity.

Links offered by valued providers

Mark Leibovit comment for August 18th

Gold, Crude Oil, Stock Buy-Backs, Volcanos – HoweStreet

David Keller notes that “S&P 500 pulls back from key resistance”

https://www.youtube.com/watch?v=6GgNwA-nQwI

Greg Schnell asks “Oil and gas: calling crude oil’s bluff”?

Oil and Gas – Calling Crude Oil’s Bluff? | The Canadian Technician | StockCharts.com

Michael Campbell’s Money Talks for August 20th

August 20th Episode (mikesmoneytalks.ca)

Mary Ellen McGonagle asks “Is it time to get defensive”?

Infallible Rule of 20 Must Be Triggered to Signal All Clear for Stocks – Uncommon Sense Investor

Damir Tokic says “Expect a rough September”.

SPY: Expect A Rough September (NYSEARCA:SPY) | Seeking Alpha

Victor Adair’s trading desk notes for August 20th

Trading Desk Notes For August 20, 2022 – HoweStreet

Josef Schachter notes “U.S. exports record amount of oil”

US Exports Record Amount of Oil – HoweStreet

Links from Mark Bunting and www.uncommonsenseinvestor.com

Why Apple Could Soar Another 30% – Uncommon Sense Investor

Infallible Rule of 20 Must Be Triggered to Signal All Clear for Stocks – Uncommon Sense Investor

More links to follow

Technical Notes for Friday

General Motors $GM an S&P 100 stock moved above $39.64 extending an intermediate uptrend. The company reinstated its dividend and announced resumption of a share buyback program.

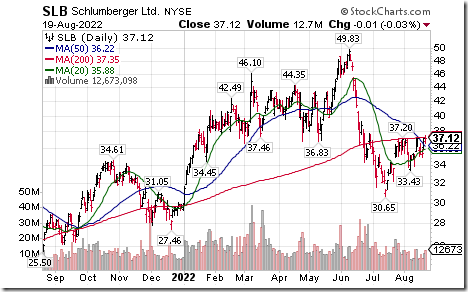

Schlumberger $SLB an S&P 100 stock moved above $37.31 resuming an intermediate uptrend.

UnitedHealth Group $UNP an S&P 100 stock moved above $549.72 to an all-time high extending an intermediate uptrend.

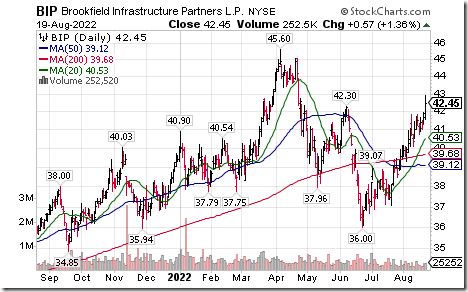

Brookfield Infrastructure $BIP a TSX 60 stock moved above intermediate resistance at US$42.30 extending an intermediate uptrend.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 3.80 on Friday and 4.20 last week to 88.20. It remains Overbought and has passed its peak.

The long term Barometer dropped 5.00 on Friday and 3.20 last week to 44.80. It remains Neutral and has started to roll over.

TSX Momentum Barometers

The intermediate term Barometer dropped 5.46 on Friday and 7.14 last week to 68.07. It remains Overbought and shows early signs of rolling over.

The long term Barometer dropped 3.36 on Friday and 4.20 last week to 42.86. It remains Neutral and has started to roll over.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed