by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Company Ltd.

As expected, the Federal Open Market Committee (FOMC), announced a faster pace of balance sheet tapering. At the November FOMC meeting, the Fed announced the start of tapering at a pace of $15 billion per month; but only for November and December. At the conclusion of today’s meeting, the Fed announced it would double the pace to $30 billion per month—$20 billion of Treasury securities and $10 billion per month of mortgage-backed securities (MBS). That means tapering will conclude in March 2022; at which point the Fed will no longer be adding to its balance sheet.

The December FOMC meeting is one of the four at which new Summary of Economic Projections and “dot plot” are published along with the FOMC statement (see below). Those now show that Fed officials now expect three 25 basis points increases in the fed funds rate next year—moving up off the zero bound, where the rate has been since March 2020. The FOMC’s median projection for inflation in 2022 was revised up from 2.2% in September, to 2.6% today; and it now projects the unemployment rate will be 3.5% by the end of 2022, down from the 3.8% projection in September.

Source: Charles Schwab, Federal Reserve, as of 9/22/2021. Note: Projections of change in real gross domestic product (GDP) and projections for both measures of inflation are percent changes from the fourth quarter of the previous year to the fourth quarter of the year indicated. PCE inflation and core PCE inflation are the percentage rates of change in, respectively, the price index for personal consumption expenditures (PCE) and the price index for PCE excluding food and energy. Projections for the unemployment rate are for the average civilian unemployment rate in the fourth quarter of the year indicated. Each participant’s projections are based on his or her assessment of appropriate monetary policy. Longer-run projections represent each participant’s assessment of the rate to which each variable would be expected to converge under appropriate monetary policy and in the absence of further shocks to the economy. The projections for the federal funds rate are the value of the midpoint of the projected appropriate target range for the federal funds rate or the projected appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run. 1For each period, the median is the middle projection when the projections are arranged from lowest to highest. When the number of projections is even, the median is the average of the two middle projections. 2Longer-run projections for core PCE inflation are not collected.

The decision represents a significant shift from September’s forecasts, when the FOMC was evenly split on the need for any rate hikes in 2022. The new projections also show an additional three rate hikes as appropriate in 2023, with two more in 2024—bringing the fed funds rate to 2.1% by the end of 2024.

Although most initial reactions from Fed watchers used the “hawkish” label to describe today’s decision, the dot plot leans more dovish for 2023. Current market pricing suggests investors (as of now) believe that more rate hikes sooner could mean the hiking cycle ends earlier than originally thought.

Musical chairs

Importantly, President Biden still has three open seats to fill on the Fed’s Board of Governors. Those selections—as well as the decisions the Dallas and Boston Fed banks will make about their new presidents—could play a critical role in the direction of monetary policy in 2022. Given those pending changes, the current dots plot projections reflect views of some officials that will no longer be part of the decision-making process in 2022.

Statement highlights

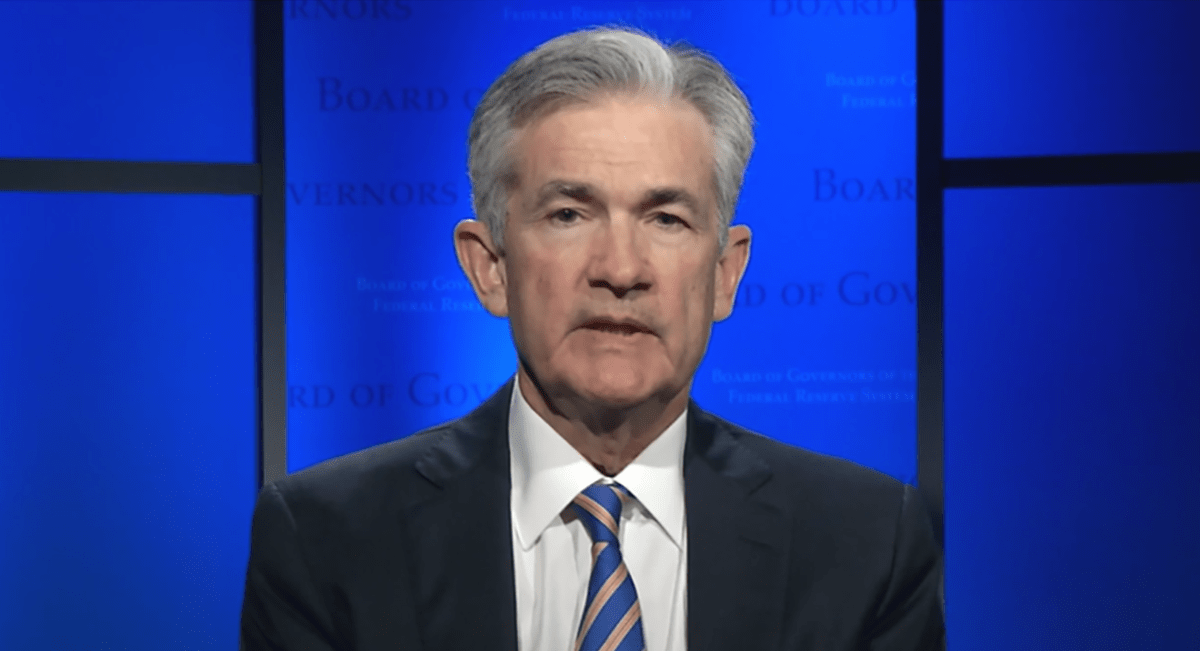

As telegraphed last month by Fed Chair Jerome Powell, the FOMC statement no longer referenced inflation, or the factors contributing to its surge, as “transitory.”

The faster pace of tapering reflects “inflation developments and the further improvement in the labor market” with the Fed reinforcing that it is “prepared to adjust the pace of purchases if warranted by changes in the economic outlook.”

On rate hikes, the statement noted that with “inflation having exceeded 2% for some time, the committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the committee’s assessments of maximum employment.”

Presser highlights

As usual, in the interest of putting this report into the publishing queue, these highlights only cover the first 30-40 minutes of the press conference.

- “Recent improvements in labor market conditions have narrowed the differences in employment across groups.”

- Price increases have spread to a “broader range of goods and services,” and that they “understand that high inflation imposes significant hardship” (particularly on lower-income households).

- The Fed is keeping an eye on wage increases that could push inflation higher.

- Dot plot forecasts do not represent an FOMC plan or commitment.

- In defining maximum employment, the FOMC will look at a broad range of indicators.

- The FOMC has learned it’s best to take a “careful, methodical approach to make adjustments” to its balance sheet.

- After the very hot CPI reading following the November FOMC meeting, the committee decided it was worth speeding up the taper.

- Financial conditions can change quickly—in contrast to original thinking that monetary policy’s impact is “long and variable” in terms of lags.

- If the Fed decides it wants to raise rates before the currently-scheduled end of tapering in March, it would have to speed up the taper again (Powell reiterated that the Fed doesn’t plan to raise rates while tapering is operational).

- The FOMC hasn’t decided on whether there should be a gap between ending tapering and starting rate hikes; but Powell doesn’t expect a “long delay.”

- On the omicron variant, “it is not clear how big the effects would be on inflation, growth or hiring.”

- The “quits rate” continues to be a very important indicator of the strength in the labor market.

In sum

The Fed has set up the possibility of tighter policy beginning in the spring of 2022; but the pace remains uncertain. In conjunction with our fixed income experts, led by my colleague Kathy Jones, here is what we will be watching:

- The initial positive reaction by equities persisting is predicated on confidence that the Fed has stepped up to the fight-inflation-plate and will be successful in keeping 1970s-style stagflation at bay.

- How much the Fed can tighten without inverting the yield curve and/or tightening financial conditions too much.

- Whether the Fed will use its balance sheet to keep long-term rates from staying low—that is, will it indicate that it’s going to let the balance sheet begin to actually decline sooner rather than later? (During the presser, Powell said the FOMC had the first discussion at this month’s meeting about potentially shrinking the balance sheet.)

- The U.S. dollar: The Fed is the world’s central bank; and as such, tighter U.S. policy can have a negative impact on risk assets both domestically and in the rest of the world, especially emerging markets.

Most importantly, we hope everyone has a wonderful holiday season!

Copyright © Charles Schwab & Company Ltd.