by Gareth Williams, Co-Portfolio Manager, BlackRock International Fund,

David Vos, Industrials and Autos Analyst, Global Equity Team, Blackrock

Supply chain issues are making headlines, particularly as consumers are seeing prices rise and delivery times lengthen amid product and component shortages. International equity investors Gareth Williams and David Vos offer four Investment takeaways

Global supply chains, a term encompassing all components necessary to produce consumer goods, are under strain as economic activity picks up and pent-up demand after nearly two years of pandemic containment is unleashed in a global spending spree.

The early focus of supply chain stresses centered on semiconductors, where limited supply met with a surge in digitalization as remote work became the norm and car makers powered up production of electric vehicles (EVs). We now see some signs of the semi situation easing, says Gareth Williams, Co-Portfolio Manager of the BlackRock International Fund. Yet as one concern slowly fades, others loom larger.

One case in point: aluminum. Consider that without semiconductors, car production can’t be fully completed. But without aluminum, car production can’t even start ― and aluminium supply is scarce. A key component to making it ―magnesium ― has fallen to a third of global capacity.

Supply is slowly coming back on stream, but car buyers may be in for yet higher prices and longer wait times, as the auto industry represents roughly a quarter of aluminum demand. This is a microcosm of what we’re seeing across the global economy, with implications for both businesses and consumers.

How can investors identify those companies best positioned to navigate supply chain stresses? Global equity analyst David Vos, an industrials and autos specialist, offers four considerations:

1. The simpler, the better

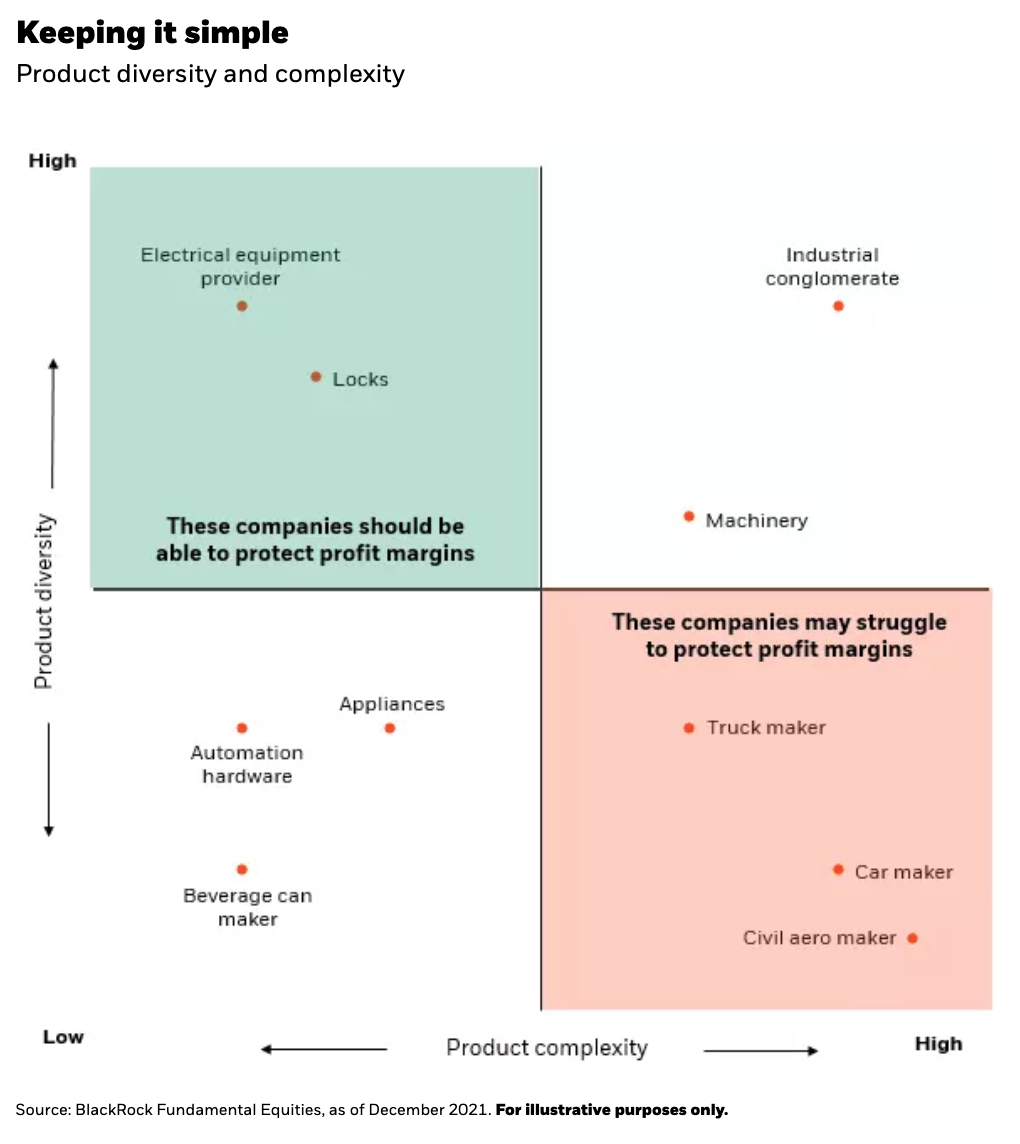

Companies that can manage around higher input costs and pass them through to consumers are better positioned to weather supply chain stresses. Diversity and complexity of products are one way to assess which companies may possess this kind of pricing power.

Companies making many different and relatively simple products are better positioned to sustain production and profits. Conversely, companies with one highly complex product ― such as car and airplane makers ― may find they can’t access one crucial component amid the thousands required, thereby having to halt production. The grid below plots some potential winners and losers on this score.

2. Company clout

Supply problems are exacerbated for companies (particularly those in the grid’s bottom-right quadrant) that lack negotiating power. Companies at the top of supply chains ― such as the semiconductor makers ― are prioritizing their largest customers. This means some smaller companies ― such as EV start-ups ― are being cut out of the chain while some of the big-brand car makers are nearing pre-COVID levels of production.

3. Early actors

Mr. Vos sees opportunity to pick up well-managed companies at good valuations ― particularly those that adjusted early on to the supply chain crisis. Companies with a diverse source of supply ― rather than those that relied on the single, cheapest supplier ― should be able to maintain healthy production.

4. From efficiency to resiliency

In the short term, manufacturers are moving from a focus on maximum efficiency, or “just in time,” to “just in case” ― building up inventories of essential components. This should benefit warehouse automation and logistics companies. Longer term, this shift may lead to onshoring of production and greater capital expenditures.

What next?

Mr. Williams acknowledges it is hard to identify how long supply chain challenges may persist. He notes: “As with all periods of demand-supply imbalances, prices move to find a new market clearing level ― in this case higher given demand strength and supply constraints.” But as companies look to build inventory and over-order while suppliers simultaneously increase production, the pendulum may eventually swing the other way and result in supply gluts.

Mr. Williams and the broader Global Equity Team are watching closely. As active investors, they are prepared to pivot as they seek to nimbly avert risks and take advantage of emerging opportunities as the situation evolves.

Authors:Gareth Williams, Co-Portfolio Manager, BlackRock International Fund, Blackrock

Copyright © Blackrock