by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Solar ETF $TAN moved below $77.49 setting an intermediate downtrend.

Chinese tech stocks remain under technical pressure. NetEase $NTES a NASDAQ 100 stock moved below $82.50 extending an intermediate downtrend.

The heat in the manufacturing economy has cooled with the price of copper remaining the tell. equityclock.com/2021/08/16/… $STUDY $CPER $FCX $HG_F #Copper #Economy #Manufacturing

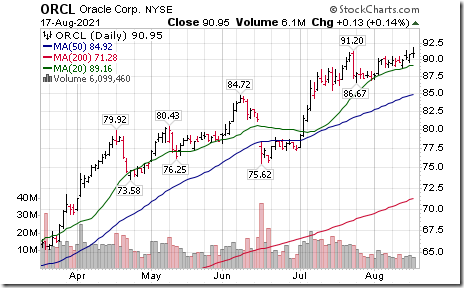

Oracle $ORCL an S&P 100 stock moved above $91.20 to an all-time high extending an intermediate uptrend.

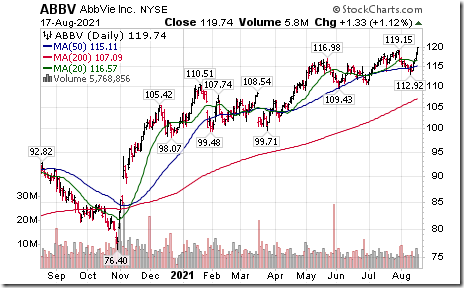

AbbVie $ABBV an S&P 100 stock moved above $119.15 to an all-time high extending an intermediate uptrend.

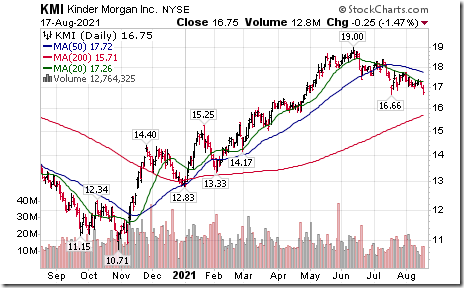

Kinder Morgan $KMI an S&P 100 stock moved below $16.66 extending an intermediate downtrend.

Pinduoduo $PDD a NASDAQ 100 stock moved below $77.66 extending an intermediate downtrend

Lam Research $LRCX a NASDAQ 100 stock moved below $575.33 setting and intermediate downtrend.

Lowe’s $LOW an S&P 100 stock moved below $183.70 setting an intermediate downtrend.

Merck $MRK a Dow Jones Industrial Average stock moved above $78.77 extending an intermediate uptrend.

BMO Equal Weight Cdn. Energy ETF $ZEO.CA moved below $39.37 extending an intermediate downtrend.

Imperial Oil $IMO.CA a TSX 60 stock moved below $32.87 extending an intermediate downtrend.

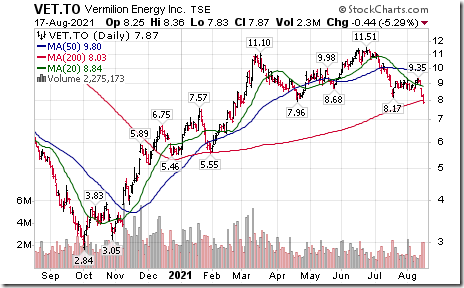

More Canadian energy breakdowns! Vermillion $VET.CA moved below $7.96 completing a double top pattern.

Saputo $SAP.CA a TSX 60 stock moved below $35.49 extending an intermediate downtrend.

Trader’s Corner

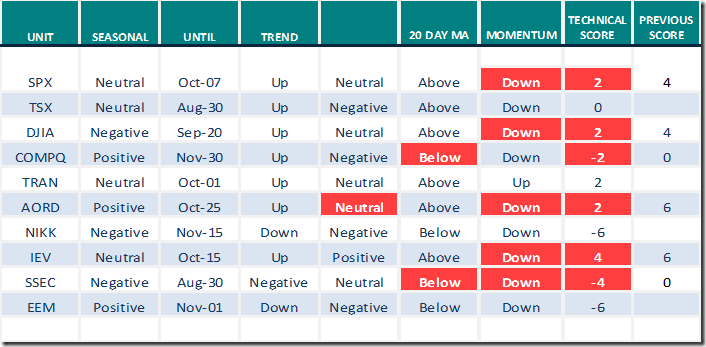

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

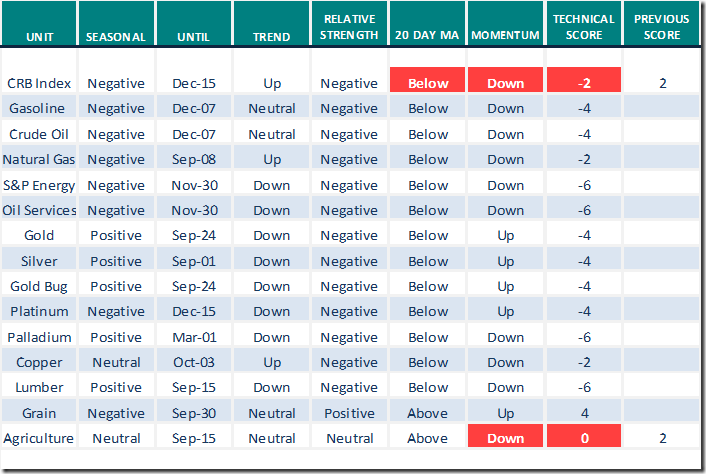

Commodities

Daily Seasonal/Technical Commodities Trends for August 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

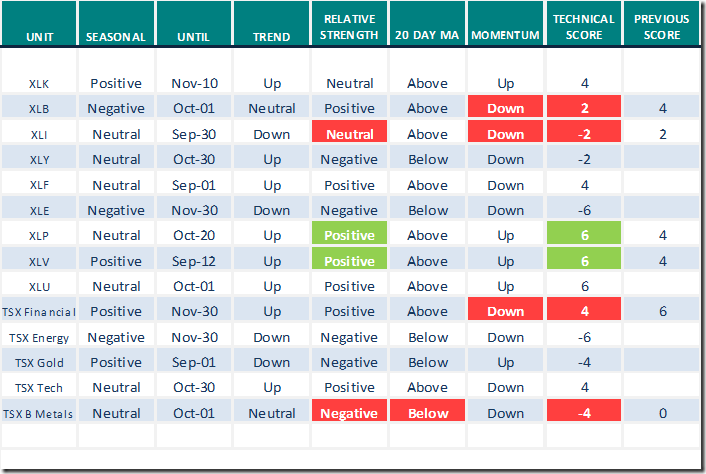

Sectors

Daily Seasonal/Technical Sector Trends for August 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

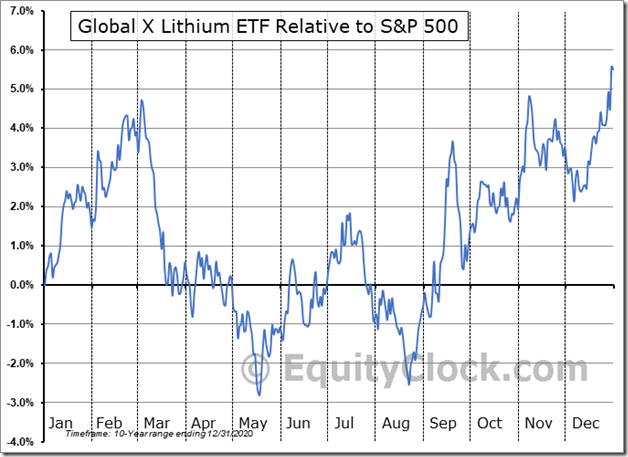

Seasonality Chart of the Day from www.EquityClock.com

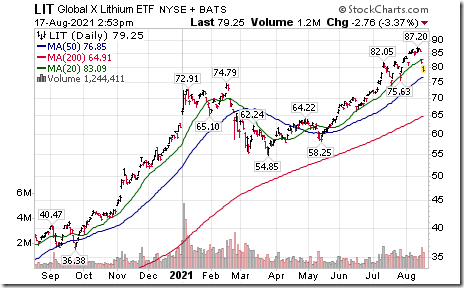

Lithium is about to enter a period of seasonal strength on a real and relative basis (relative to the S&P 500 Index) from August 20th to at least November 10th .

On the charts, Lithium recently rolled over from overbought levels. Preferred strategy is to defer purchases for now until units find indicated support near $75.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 5.41 to 63.33 yesterday. It remains Overbought, but showing early signs of rolling over.

The long term Barometer dropped 2.40 to 81.76 yesterday. It remains Extremely Overbought and is trending down.

TSX Momentum Barometers

The intermediate term Barometer plunged 5.10 to 48.78 yesterday. It remains Neutral and has resumed trending down.

The long term Barometer dropped 1.61 to 68.29 yesterday. It remains Overbought and is trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.