by Don Vialoux, EquityClock.com

The Bottom Line

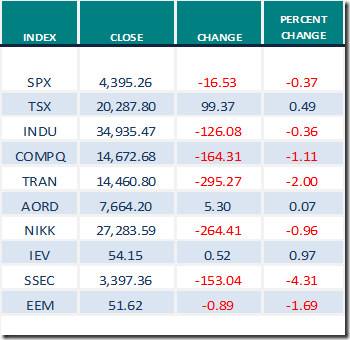

U.S. equity indices were slightly lower and the TSX Composite Index was slightly higher last week. Greatest influences remained the possibility of a fourth wave by COVID 19 (negative) and continued expansion of distribution of a COVID 19 vaccine (positive).

Observations

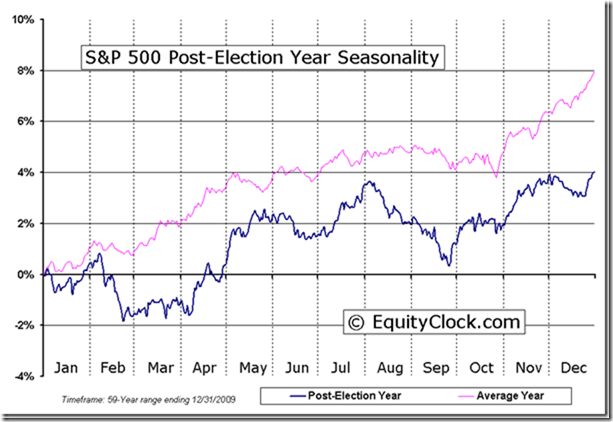

Favourable seasonal influences for U.S. equity markets end at the beginning of August (particularly in a Post-U.S. Presidential Election year). Last week, the S&P 500 Index, Dow Jones Industrial Average and the NASDAQ Composite Index rallied to record all-time highs. Strength to the end of July during Post-U.S. Presidential Election years is related to a “honey moon” period when investors anticipate launch of a new mandate by the President. Strength by U.S. equity markets last week was triggered by release of surprisingly strong second quarter results that overwhelmed growing COVID 19 concerns: Of the 59% of S&P 500 companies that released quarterly results to date, 88% exceeding consensus earnings estimates and 88% exceeding consensus revenue estimates. However, if history repeats, North American equity markets will reach an important intermediate top this week following a peak in frequency of quarterly earnings reports by major U.S. companies. Normally, U.S. equity markets record a mild correction of 3%-4% between now and the end of September.

Early warning signs of a pending intermediate corrective phase in U.S. equity markets appeared late last week. Major U.S. stocks came under profit taking pressures following release of quarterly results that exceeded consensus estimates. U.S. stocks in this category included Apple, Microsoft, Visa, Starbucks, MMM, Facebook, PayPal, McDonalds, Boeing, Amazon, Caterpillar, Merck and MasterCard.

Following is an interesting link to a comment about the pullback by PayPal released by StockCharts’ chief strategist David Keller on Saturday

PayPal’s Pullback May Be a Broader Signal | ChartWatchers | StockCharts.com

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) mostly moved lower last week.

Intermediate term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 50 day moving average) moved slightly higher last week, but remained Neutral. See Barometer charts at the end of this report.

Long term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 200 day moving average) was unchanged last week. It remained Extremely Overbought.. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors were mixed last week.

Intermediate term technical indicator for Canadian equity markets moved slightly higher last week. It remained Neutral. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (Percent of TSX stocks trading above their 200 day moving average) moved slightly higher last week. It remained Overbought. See Barometer charts at the end of this report.

Consensus estimates for earnings by S&P 500 companies continued to increase from our report last week. According to www.FactSet.com earnings in the second quarter on a year-over-year basis are expected to increase 74.2% (versus previous estimate last week at 74.2%) and revenues are expected to increase 23.1% (versus previous estimate at 20.9%). Earnings in the third quarter are expected to increase 27.7% (versus previous estimate at 26.2%) and revenues are expected to increase 13.9% (versus previous estimate at13.4%. Earnings in the fourth quarter are expected to increase 21.2% (versus previous estimate at 20.3%) and revenues are expected to increase 10.7% (versus previous estimate at 10.1%). Earnings for all of 2021 are expected to increase 40.7% (versus previous estimate at 38.9%) and revenues are expected to increase 13.9% (versus previous estimate at 13.3%). Earnings in 2022 are expected to increase 9.7% (versus previous estimate at 11.0%) and revenues are expected to increase 6.7%.

Economic News This Week

June Construction Spending to be released at 10:00 AM EDT on Monday is expected to increase 0.4% versus a decline of 0.3% in May.

July ISM Manufacturing Index to be released at 10:00 AM EDT on Monday is expected to increase to 60.9 from 60.6 in June.

June Factory Orders to be released at 10:00 AM EDT on Tuesday are expected to increase 1.0% versus a gain of 1.7% in May.

July ADP Non-farm Employment to be released at 8:15 AM EDT on Wednesday is expected to increase to 700,000 from 692,000 in June.

July ISM Non-manufacturing Index to be released at 10:00 AM EDT on Wednesday is expected to increase to 60.2 from 60.1 in June.

June U.S. Trade Deficit to be released at 8:30 AM EDT on Thursday is expected to increase to $73.9 billion from $71.2 billion in May.

June Canadian Trade Balance to be released at 8:30 AM EDT on Thursday is expected to be a deficit of $800 million versus a deficit of $1.39 billion in May.

July Non-farm Payrolls to be released at 8:30 AM EDT on Friday is expected to increase to 900,000 from 850,000 in June. July Unemployment Rate is expected to drop to 5.7% from 5.9% in June. July Average Hourly Earnings are expected to increase 0.3% versus a gain of 0.3% in June.

July Canadian Employment to be released at 8:30 AM EDT on Friday is expected to show a gain of 150,000 versus a gain of 230,700 in June. July Unemployment Rate is expected to slip to 7.4% from 7.8% in June.

Selected Earnings News This Week

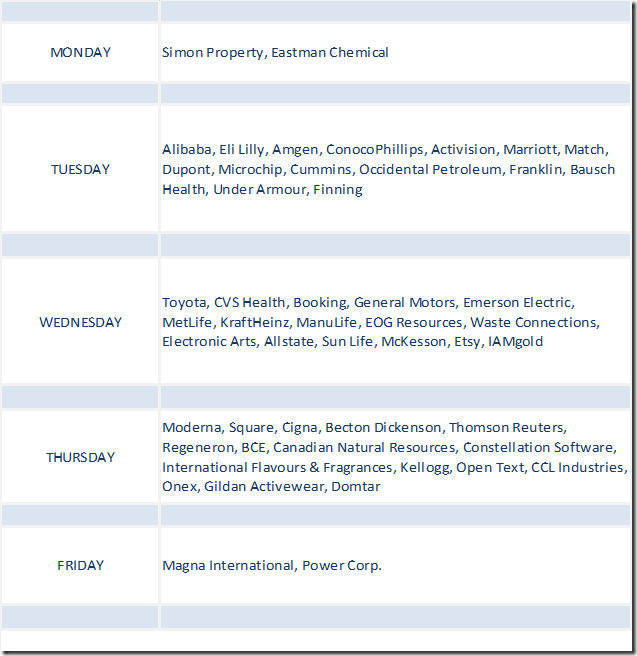

Frequency of quarterly reports by S&P 500 and TSX 60 companies reached a peak last week: 295 S&P 500 companies have reported to date. Another 148 S&P 500 companies ((including one Dow Jones Industrial Average company) and 12 TSX 60 companies are scheduled to report this week.

Trader’s Corner

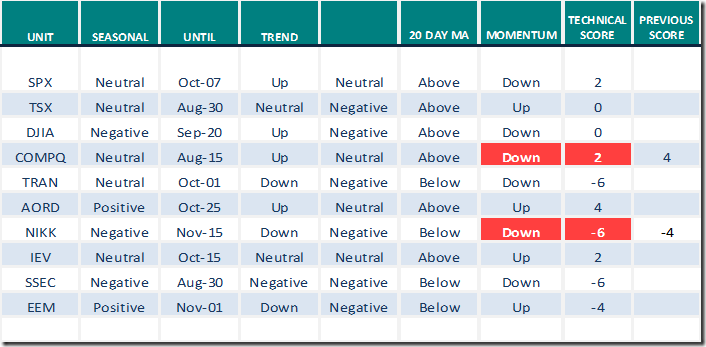

Equity Indices and Related ETFs

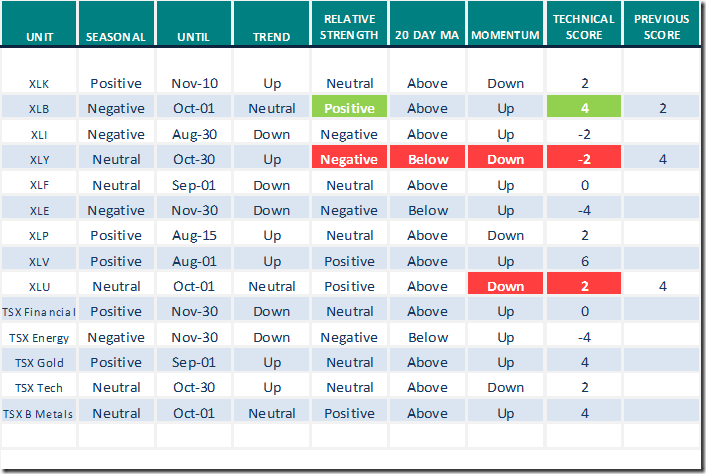

Daily Seasonal/Technical Equity Trends for July 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

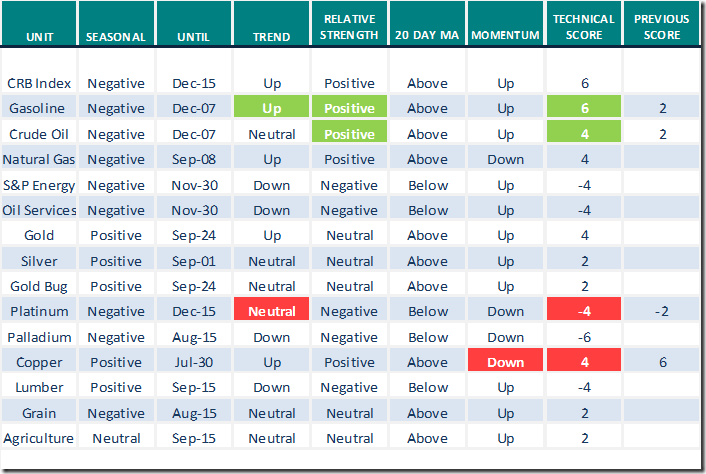

Commodities

Daily Seasonal/Technical Commodities Trends for July 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for July 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

The Canadian Technician

Greg Schnell says “These industries are getting some attention”

Editor’s Note: Think steel, copper and gold!

Following is a link:

https://stockcharts.com/articles/canada/2021/07/these-industries-are-getting-s-344.html

Comment and video from uncommon Sense Investor

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for a links to the following video and interview

Playing the Game Out Loud with Keith McCullough, CEO of Hedgeye Risk Management

Playing the Game Out Loud – Uncommon Sense Investor

Keith McCullough: How I’m Building My Long Gold Position

McCullough: How I’m (Incrementally) Building My Long Gold Position (hedgeye.com)

10 High Return Stocks That Continue to Deliver –

https://www.kiplinger.com/investing/stocks/603224/high-return-stocks-that

David Rosenberg: Ignore the calls to buy the dip — this reflation trade has run its course

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

The decline in the US Dollar is creating opportunities to buy. equityclock.com/2021/07/29/… $USDX $UUP $GLD $GDX $DUST $NUGT

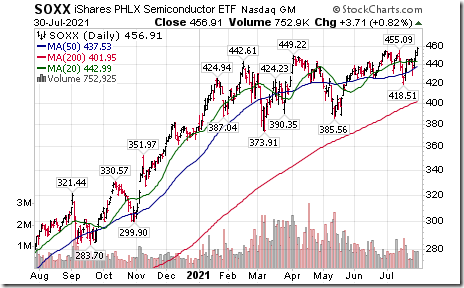

Semiconductor iShares $SOXX moved above $455.09 to an all-time high extending an intermediate uptrend.

Colgate $CL an S&P 100 stock moved below $79.78 completing a double top pattern.

Kirkland Lake Gold $KL.CA a TSX 60 stock moved above Cdn$54.08 extending an intermediate uptrend.

Algonquin Power $AQN.CA a TSX 60 stock moved above $19.56 completing a double bottom pattern.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 3.01 on Friday and 1.80 last week to 56.31. It remains Neutral.

The long term Barometer slipped 1.60 on Friday and was unchanged last week at 87.98. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 3.43 on Friday and 6.43 last week to 58.33. It remains Neutral.

The long term Barometer was unchanged on Friday and up 5.07 last week to 77.45. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.