by Don Vialoux, EquityClock.com

Technical Notes for Yesterday at

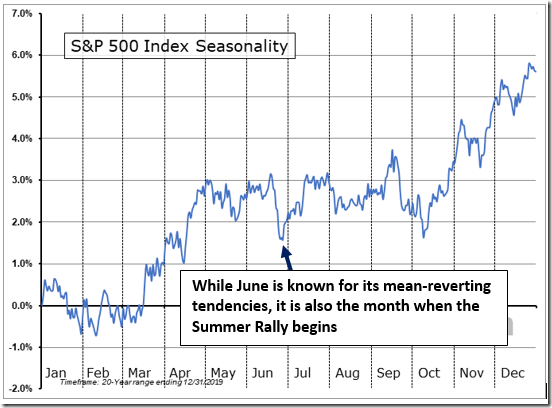

The activity that we’re seeing in the market is very typical for this time of year; Find out how to play it and what to target next as we look out on our seasonal timeline into the middle of summer. equityclock.com/2021/06/09/… $XLB $XLF $IYT $KBE $XLP $XLK $IEF $TLT $SPY

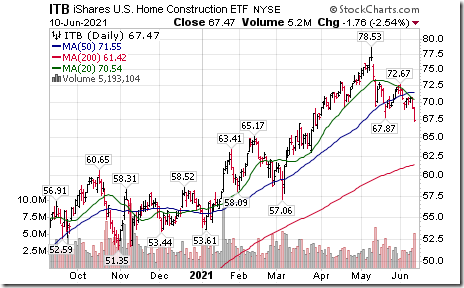

Home Builders iShares $ITB moved below $67.87 completing a double top pattern.

Treasury Inflation Protected Bond iShares $TIP moved above $127.61 extending an intermediate uptrend.

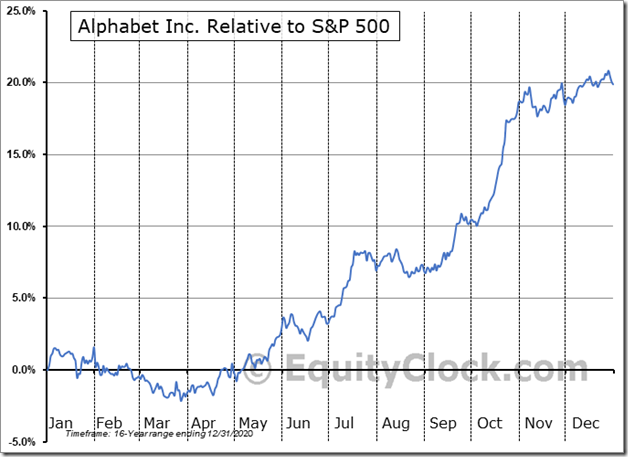

Alphabet $GOOGL a NASDAQ 100 stock moved above $2431.38 to an all-time high extending an intermediate uptrend.

Seasonal influences for Alphabet $GOOGL on a real and relative basis (relative to the S&P 500 Index) are positive from mid-June to the first week in November

ExxonMobil $XOM a Dow Jones Industrial Average stock moved above $63.10 extending an intermediate uptrend.

Another oil stock breakout! ConocoPhillip $COP an S&P 100 stock moved above $60.67 extending an intermediate uptrend.

INCYTE $INCY a NASDAQ 100 stock moved above $86.34 completing a double bottom pattern.

IDEXX Laboratories $IDXX a NASDAQ 100 stock moved above $573.99 to an all-time high extending an intermediate uptrend.

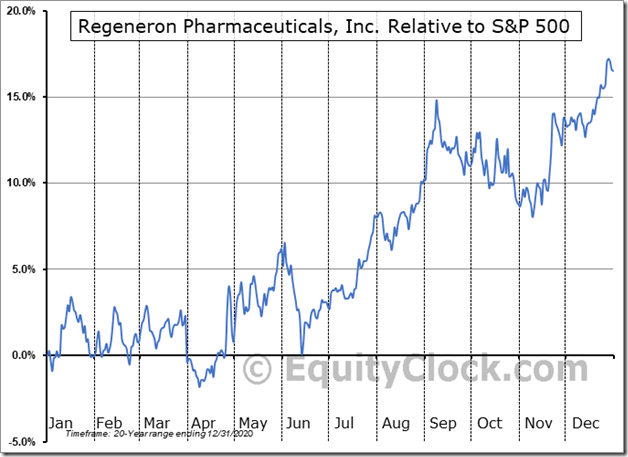

Regeneron $REGN a NASDAQ 100 stock moved above $525.96 extending an intermediate uptrend.

Seasonal influences are positive on Regeneron $REGN on a real and relative basis (relative to the S&P 500 Index from June 11th to September 8th

U.S. bank stocks and related ETFs $KBE and $KRE are under technical pressure due to narrowing interest rate spreads. US Bancorp $USB moved below $58.90 completing a double top pattern.

Another bank stock breakdown! Wells Fargo $WFC an S&P 100 stock moved below $45.27 completing a double top pattern.

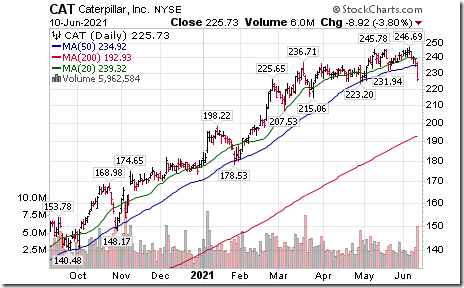

Caterpillar $CAT a Dow Jones Industrial Average stock moved below $231.94 completing a double top pattern.

CSX $CSX a NASDAQ 100 stock moved below $96.80 completing a modified Head & Shoulders pattern.

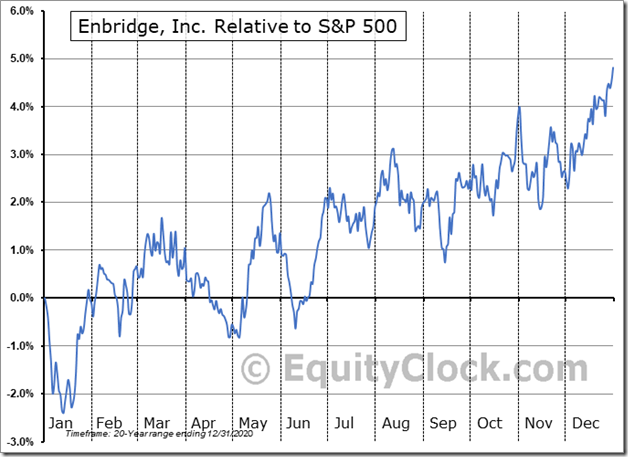

Enbridge $ENB.CA a TSX 60 stock moved above Cdn$48.28 extending an intermediate uptrend.

Seasonal influences are positive for Enbridge $ENB.CA on a real and relative basis (relative to the S&P 500 Index) from June 11 until at least mid-August and frequently to the end of October.

Trader’s Corner

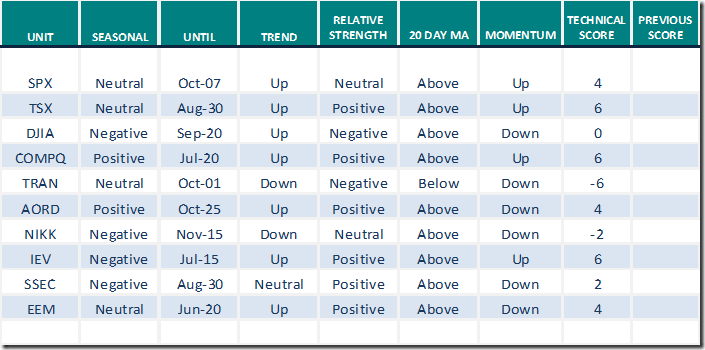

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

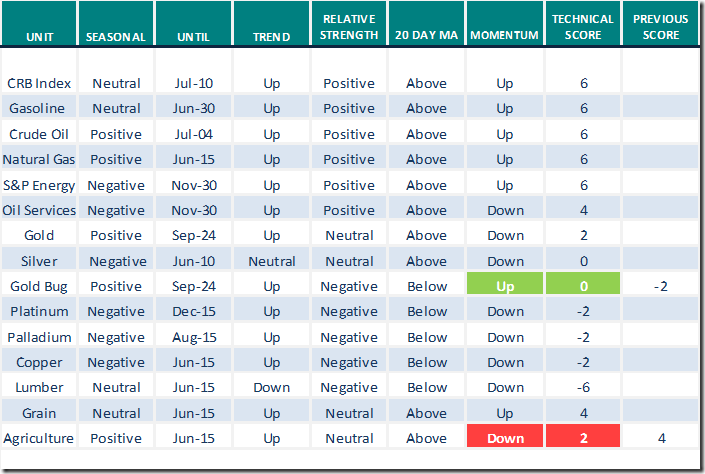

Commodities

Daily Seasonal/Technical Commodities Trends for June 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

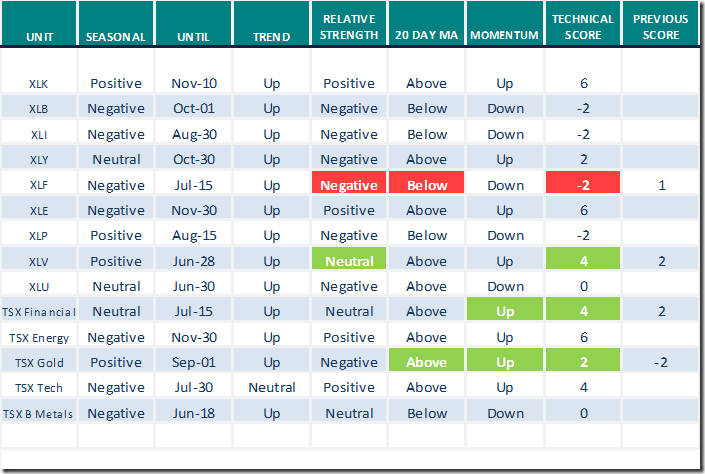

Sectors

Daily Seasonal/Technical Sector Trends for June 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

The Canadian Technician

Greg Schnell asks, “Is Financial Love Over”? Following is a link:

“Is Financial Love Over? | The Canadian Technician | StockCharts.com

S&P 500 Momentum Barometers

The intermediate Barometer added 0.40 to 65.46 yesterday. It remains Overbought.

The long term Barometer added 2.21 to 92.57 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 2.20 to 73.36 yesterday. It remains Overbought.

The long term Barometer added 0.84 to 80.84 yesterday. It remains Extremely Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.