by Don Vialoux, EquityClock.com

Technical Notes released yesterday at StockTwits.com@EquityClock

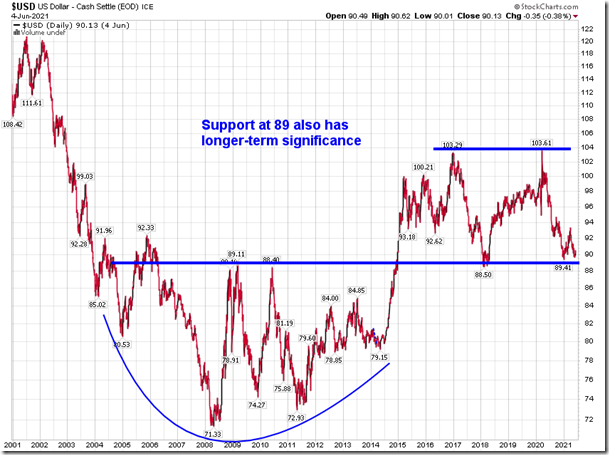

US Dollar has approached a significant zone of support, which could have an impact on stocks and commodities ahead. equityclock.com/2021/06/07/… $USDX $UUP $DXY

S&P 500 SPDRs $SPY moved above $422.82 to an all-time high extending an intermediate uptrend.

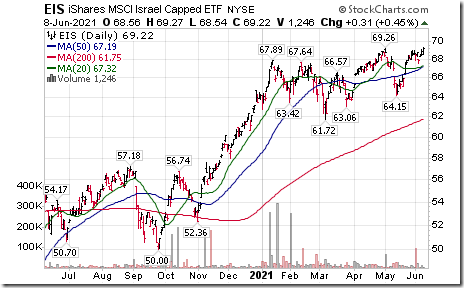

Israel iShares $EIS moved above $69.26 to an all-time high extending an intermediate uptrend.

Xcel Energy $XEL a NASDAQ 100 stock moved below $69.50 and $69.42 completing a Head & Shoulders pattern.

Loblaw Companies $L.CA a TSX 60 stock moved above $75.50 to an all-time high extending a long term uptrend.

Commodity Notes

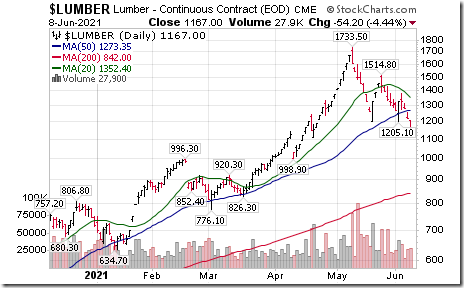

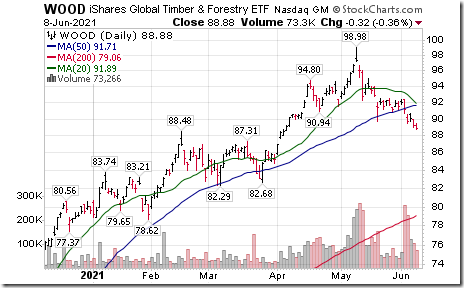

Lumber futures moved below $1,201 yesterday, completing a double top pattern.

Lumber and forest product stocks/ETFs on both sides of the border have a similar technical pattern.

Trader’s Corner

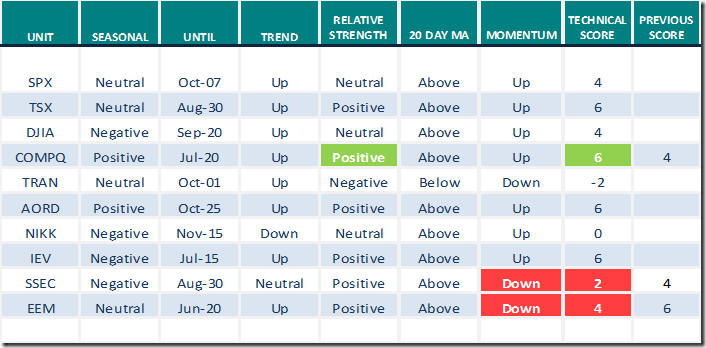

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

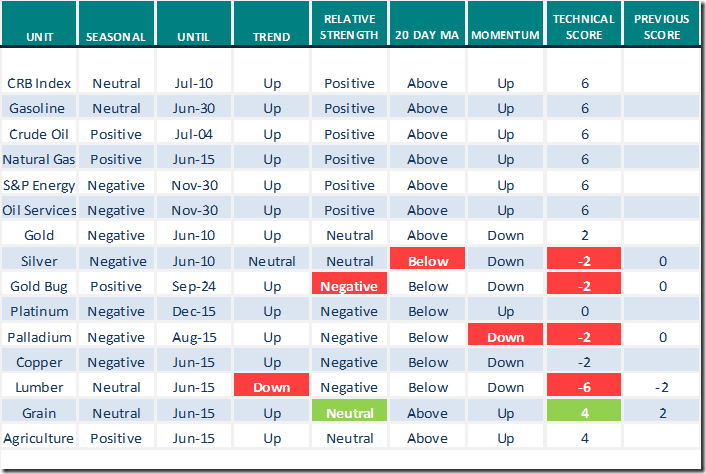

Commodities

Daily Seasonal/Technical Commodities Trends for June 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

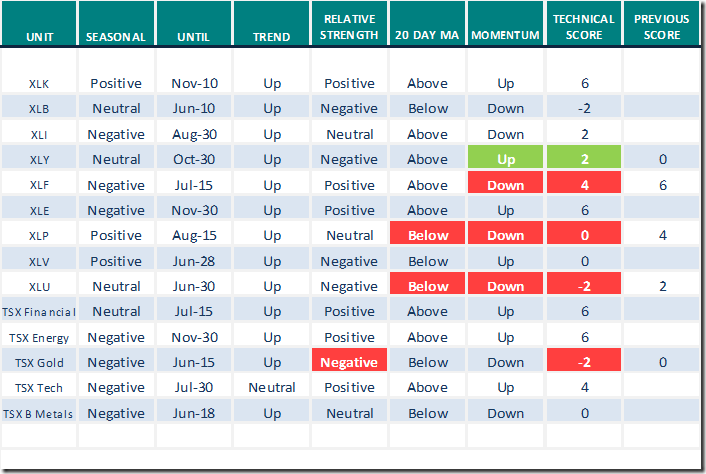

Sectors

Daily Seasonal/Technical Sector Trends for June 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

S&P 500 Momentum Barometers

The intermediate Barometer slipped 1.41 to 68.07 yesterday. It remains Overbought.

The long term Barometer was unchanged at 90.96 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer was unchanged at 71.76 yesterday. It remains Overbought.

The long term Barometer slipped 0.46 to 81.02 yesterday. It remains Extremely Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2021/06/clip_image0015_thumb-2.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2021/06/clip_image0025_thumb-2.png)

![clip_image003[5] clip_image003[5]](https://advisoranalyst.com/wp-content/uploads/2021/06/clip_image0035_thumb-2.png)

![clip_image004[5] clip_image004[5]](https://advisoranalyst.com/wp-content/uploads/2021/06/clip_image0045_thumb.png)