by Craig Basinger, Alexander Tjiang, Derek Benedet, Chris Kerlow, Brett Gustafson, Richardson GMP

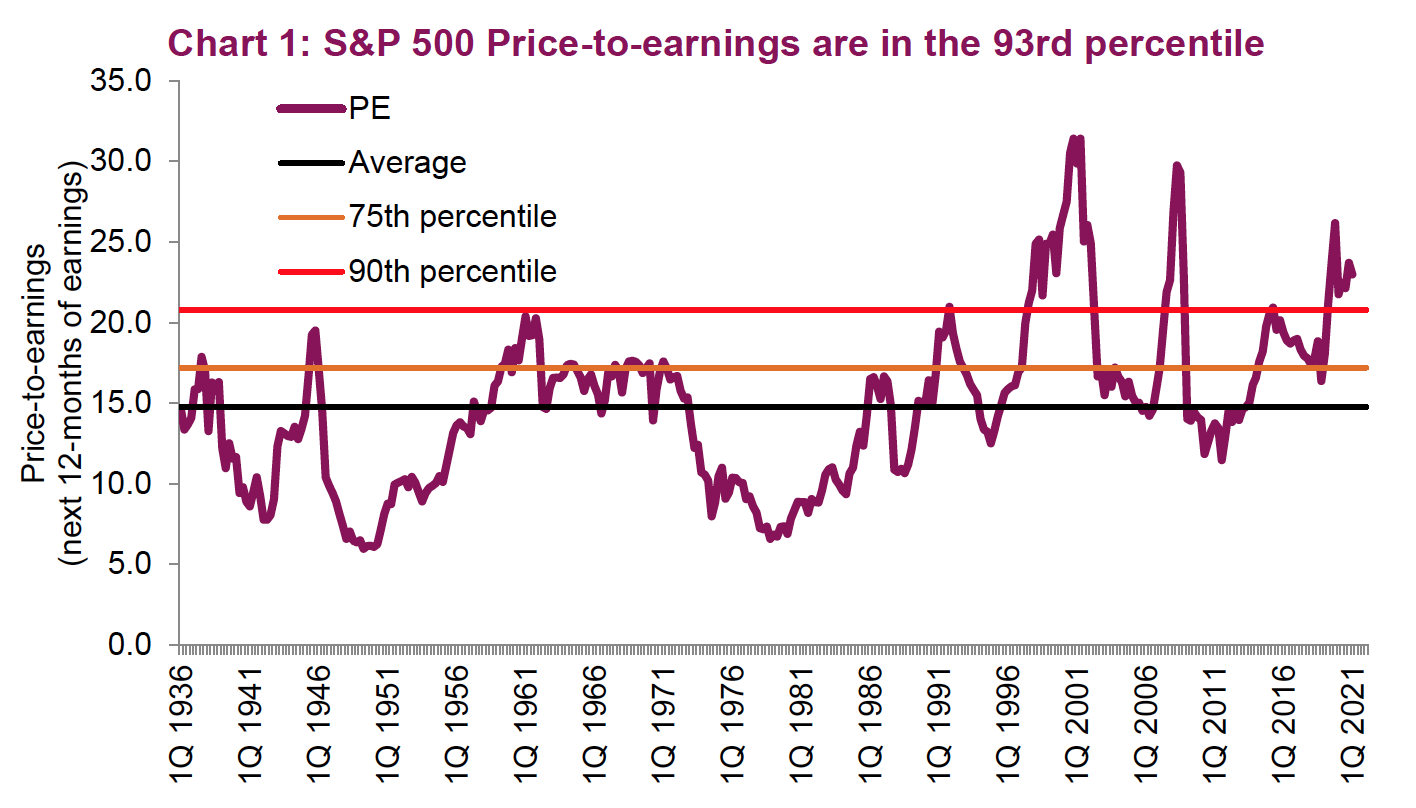

There is no denying the U.S. equity market is expensive. Even based on consensus forward-earnings estimates, the S&P 500 trades at a lofty 23x. And this market is not expensive for a lack of earnings. The Price- to-Earnings (PE) ratio of 23 (Chart 1) is based on forward estimates for the next 12 months, which has the S&P 500 earning $176.35—only about $1 shy of the previous peak earnings before the onset of the pandemic. This market is expensive mainly due to rising prices. At 23x, this puts current valuations in the 93rd percentile based on quarterly data going back to the 1930s.

There is some good news though. As Q4 earnings season nears its end, the trend of companies beating estimates has continued. To be fair, companies typically exceed estimates but normally by an average of about 5% based on the past 60 earnings seasons for the S&P 500. However, in the past three earnings seasons, the average has been about +19%. If the magnitude of positive surprises continues, then perhaps the market is not as expensive. That is a BIG if though.

The other good news is that earnings are steadily growing. And this could accelerate as the vaccine rollout allows industries most impacted by the pandemic to join the road to recovery. This may be partially reflected in 2021 estimates, but we would expect the trend to carry into 2022.

Do valuations matter?

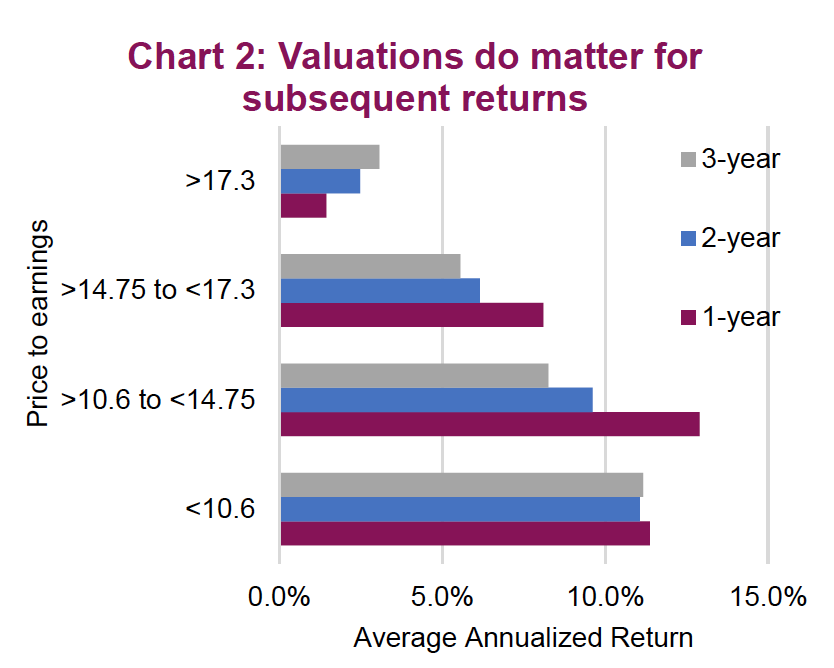

This is a fair question. Valuations have been at these elevated levels for six months now and in case you hadn’t noticed, the market has continued to trend higher. In Q1 of 1998, S&P 500 valuations moved above the 90th percentile. Two years later the market was up 36%. Valuations do not mark tops or bottoms, however they do have an impact on returns expectations. Looking at the data back to the 1930s, if you buy when the S&P 500 is in the bottom quartile of valuations, you did much better than if you bought at the top valuation quartile (Chart 2). Given the PE ratio is 23x, valuations are well in the top quartile of over 17.3x.

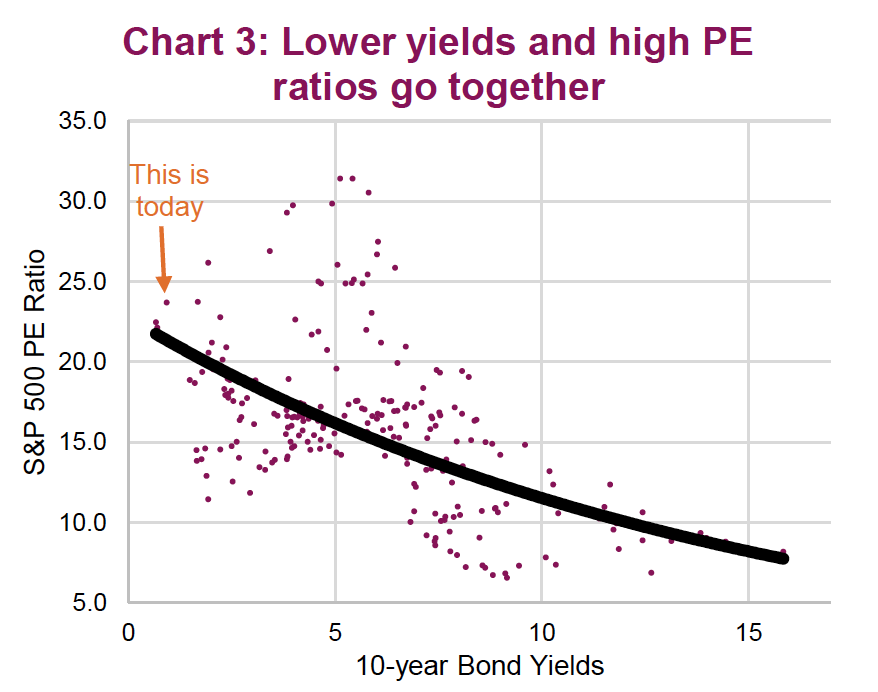

Of course, a very popular argument that attempts to justify the current high valuations is the super-low yield environment. That does hold some credence, and there is a long-term relationship between the PE ratio of the market and bond yields (Chart 3). The risk for this relationship is becoming increasingly clear: yields have started to rise. The U.S. 10-year yields spent months sitting around 0.8% once the pandemic hit. But in October 2020, yields started to rise and are now at 1.34%. If this continues, at some point and likely without warning, this will weigh heavily on the current elevated valuations. In other words, the price of the market will fall.

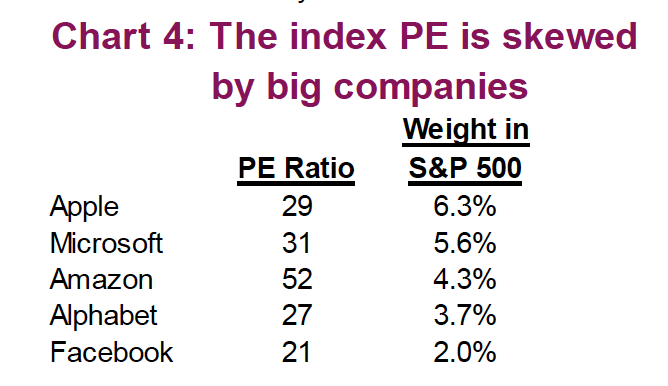

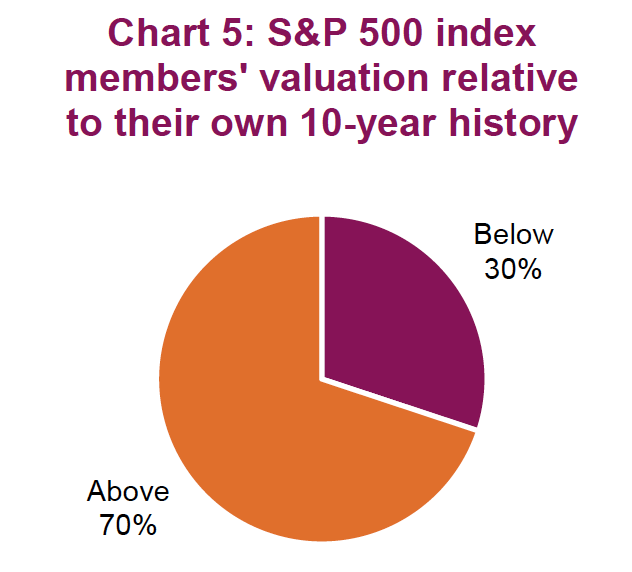

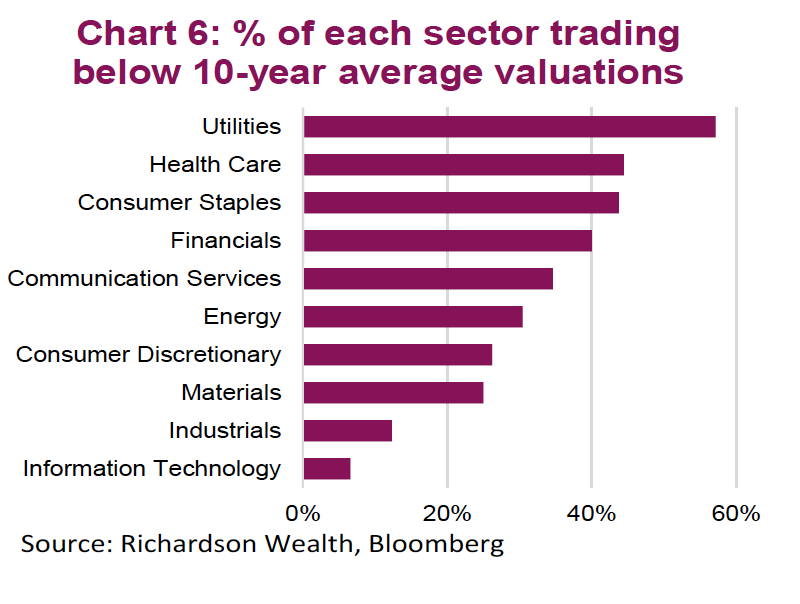

It is also worth considering exactly what a market valuation measure may be indicating. The PE of the S&P 500 is the aggregate of all the member companies, which means companies with large weights in the index have a bigger impact on the overall PE. So, Apple at 29x earnings has a huge impact. Digging beneath the aggregate or headline number paints a much different picture. About 30% of constituent members are trading below their individual 10-year average PE ratio (Chart 5). Utilities, Health Care, Consumer Staples and Financials offer more value at the moment. Industrials and Technology do not (Chart 6). The market may be expensive, but beneath the surface there are many pockets that are not.

High valuations and rising bond yields are not a friendly environment for investors. And while that likely means correction risk is elevated, bond yields and earnings growth are moving higher for good reason. The economy is recovering and in the longer term that is very good news. Also, once you look beyond the mega caps, valuations start to look more reasonable—not cheap, but not as expensive as the headline implies.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Insurance services are offered through Richardson Wealth Insurance Services Limited in BC, AB, SK, MB, NWT, ON, QC, NB, NS, NL and PEI. Additional administrative support and policy management are provided by PPI Partners. Insurance products are not covered by the Canadian Investor Protection Fund.

Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.