by Donald Huber, CFA, Senior Vice President, Portfolio Manager, and John Remmert, Senior Vice President, Portfolio Manager, Franklin Equity Group, Franklin Templeton Investments

From cloud computing and e-commerce to clean technology and self-driving cars, technology has been one of the world’s hottest stock-market sectors in the past few years. Technology investing typically leads one to think of California’s Silicon Valley, home to both some of the world’s best- known technology behemoths and the many innovative early-stage companies hoping to one day join their ranks. In recent years, the Chinese tech giants have also come into their own. Often overlooked, we believe, are the many innovative international technology companies that lack either the name recognition or the sheer size of their US and Chinese counterparts, but are at the forefront of growing technological change across the global economy.

The Market-Cap Gap

Because of their increasing size and interest from investors in recent years, mega-capitalisation US technology companies have come to dominate not only the world’s attention, but also the US and global equity benchmarks. Meanwhile, Chinese technology and internet companies are an increasing part of the emerging market indices.

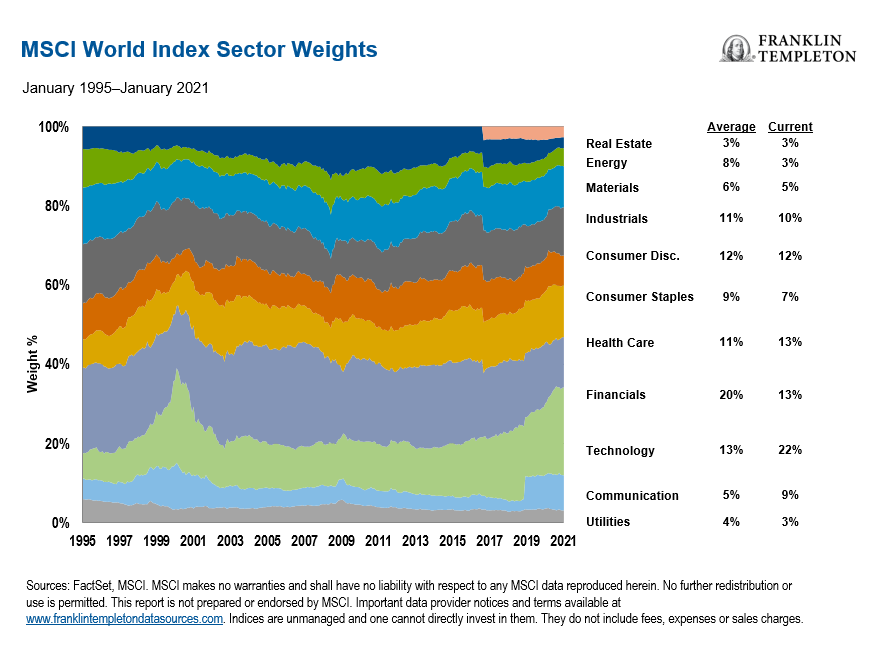

Underscoring just how dominant the US technology sector has become, as at 31 December 2020, it made up more than 29% for the MSCI USA Index and more than a fifth of the MSCI World Index, according to data from MSCI.1 Moreover, the weighting of information technology stocks in the global benchmark is the highest it has been over the past 25 years. However, while this is an easy guide to showing just how dominant US technology stocks have become, the size of the information technology sector does not quite begin to provide the full picture of technology’s dominance, as internet retailers and social media companies can be found in the consumer discretionary and communication services sectors, respectively. The story is similar in emerging markets, where the technology sector is about 20% of the MSCI Emerging Markets Index, and that does not include many of the Chinese internet giants.

The story is much different in developed markets outside the United States. In the international equity markets, the technology sector is not even among the five biggest, making up only about 9% of the MSCI EAFE Index at the end of 2020, according to MSCI. While they may not be dominant from a market-cap perspective, we have found a significant number of smaller, high-quality technology companies to invest in that are just as innovative and fast-growing as the US companies that have garnered much of the focus in recent years.

Small, but Mighty

Despite the low weighting of technology stocks in the non-US developed stock market benchmarks, well-established and emerging international companies have been at the forefront of cybersecurity, artificial intelligence, cloud-based computing, advanced auto components, payments technology, 5G and e-commerce.

These technology companies are helping drive—and benefitting from—major long-term secular trends such as remote work, e-commerce adoption, autonomous driving and vehicle electrification, and the proliferation of ‘smart devices’ that underpin the internet of things.

These trends know no geographic boundaries. While the United States remains a significant player in technology worldwide, Europe is home to market leaders in financial payments and online travel services, while Israel has some of the world’s best cybersecurity companies, in our view. In e-commerce, we have also found that locally grown companies tend to have a better understanding of consumers’ needs in their home markets than their bigger, more recognisable US counterparts.

Moreover, technology is reshaping old-line industries. Industrial, materials and energy firms are increasingly adopting software and automation solutions to help them better manage their businesses in a rapidly changing global economy. These software companies are helping old-line companies make better use of their resources, assets and manufacturing facilities through data and analytics. Meanwhile, materials companies are using scientific data and analytic tools to help address global needs in health and nutrition, and sustainability.

The global pandemic has only accelerated these trends over the past year, but we expect these trends to persist long after it is over. And in all these areas, many non-US companies have continued to help drive this innovation through services, software, and advanced semiconductors.

A Focus on Growth and Quality

With a pool of potential non-US technology opportunities that is deeper than the equity benchmarks would suggest, we have continued to find technology opportunities outside the United States. In doing so, we have focused on companies that not only have robust growth tied to these long-term secular trends but also have a distinct competitive advantage and meet a high bar for quality, such as a strong management team and healthy balance sheet. It requires taking a rigorous bottom-up investment approach to uncover these opportunities—particularly given the underrepresentation of technology companies in the standard stock market benchmarks. Our analysts are encouraged to spend the time to do the in-depth research needed to uncover technology stocks that are less widely known.

We focus on technology firms that have a clear business concentration to allow us to better understand what will drive their sales and earnings, compared with large companies that have quite a few different business lines. This approach leads us down the market-cap spectrum to mid- and large-cap companies that tend to be a bit earlier in their growth cycles, but with proven business models, and that are usually not benchmark members.

We may see some near-term market volatility, given the greater economic uncertainty surrounding the pandemic and vaccination efforts worldwide in early 2021. But, we believe that as technological innovation continues apace across the global economy, international companies that can take advantage of these emerging and well-established secular growth trends can stand out over the long run. Technology and innovation are more than just a US story.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. Asset types mentioned herein are used solely for illustrative purposes, and any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The opinions are intended solely to provide insight into how securities are analysed. The information provided is not an indication of the trading intent of any Franklin Templeton managed portfolio. These opinions may not be relied upon as investment advice or as an offer for any particular security.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton Institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton’s’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. The technology industry can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants as well as general economic conditions. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile.

____________________________________

1. Indices are unmanaged and one cannot invest in an index. They do not include fees, expenses or sales charges.

This post was first published at the official blog of Franklin Templeton Investments.