by Brooks Ritchey, Franklin Templeton Investments

Strategy Highlights

Discretionary Macro

The opportunity set remains attractive with major elections, geopolitical negotiations and policy decisions likely to play an important role in absolute and relative market moves over the medium term.Long/Short Equity Generalist

Dispersion and volatility created by COVID-19 disruptions and US election uncertainty should be advantageous to long/short equity managers who have the ability to capitalise on both improving and weakening trends.Long/Short Credit

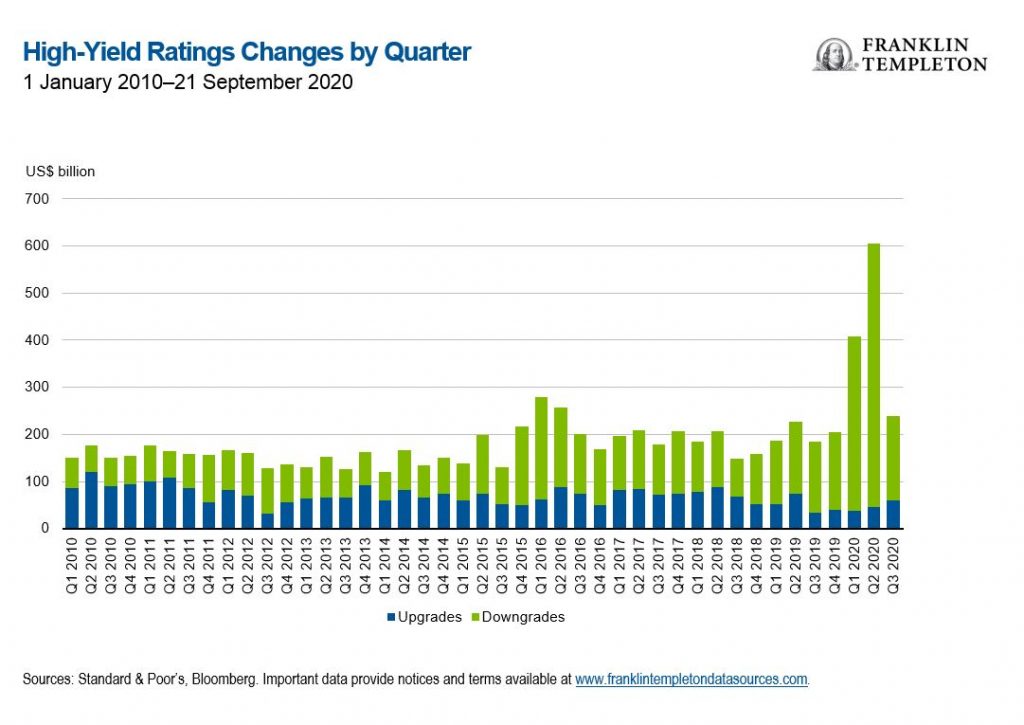

Managers often target a change in credit rating as a catalyst to realise an investment thesis. While the high absolute number of changes this year is a positive in general, the spike in downgrades favours managers that can generate alpha on the short side in particular.

Macro Themes We Are Discussing

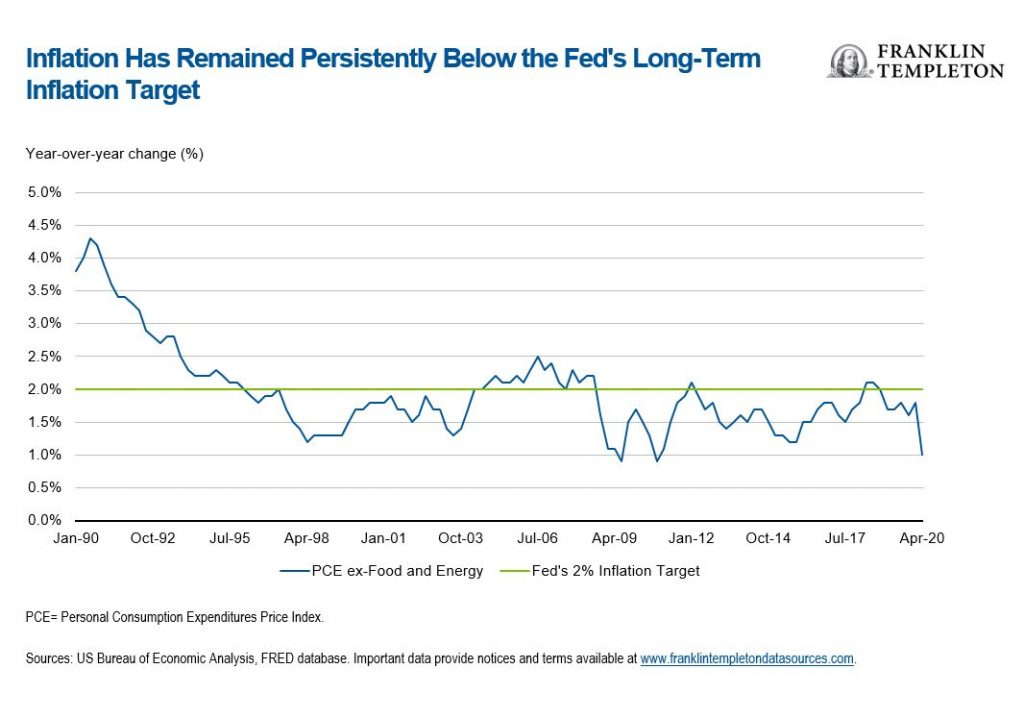

Might inflation expectations continue to rise given recent fiscal and monetary stimulus?

Recent comments from the US Federal Reserve (Fed) and other central banks refer to the potential for inflation targets to be shifted to an average level instead of being capped at a specific target. This implies that policymakers may allow inflation to overshoot past inflation levels for a period of time. This policy shift comes at a time when interest rates are down to historically low levels, money supply growth has been strong, and indications are that rates will remain lower for years. Additionally, governments are talking about increasing fiscal spending, progress is being made on a vaccine to stem the risk of a COVID-19 resurgence, and economies are trying to reopen.

These and other factors may lead to market participants to ratchet up expectations for future inflation. As a result, yield curves may steepen, the US dollar may weaken, non-US equities may outperform and sector dispersion may increase. Hedged strategies able to pivot to this new regime should see increased long versus short alpha-driven opportunities. Specifically, the discretionary macro, long/short equity generalist, and long/short credit managers may see improved return-to-risk characteristics.

Will global growth continue to recover, or will a COVID-19 resurgence cap economic gains?

While we and the world wait for a safe COVID-19 vaccine, we are discussing which areas of economies and markets will continue to benefit from (or be hurt by) the shift in working and consumer behaviour driven by the health crisis. A portion of the remote-work population may never return to an office environment on a permanent basis. Will air travel and other mass transit services return to prior volumes? How will the hospitality and onsite entertainment industries adapt to this new culture? Clearly this theme has been somewhat priced in, but we believe the effects on growth outlooks for various sectors and balance-sheet quality will linger for some time. As many have noted, the beneficiaries in this environment include software and hardware producers, non-contact delivery and payment services, and online retailing and educational services.

Areas that may need to further cut costs and adapt to the new normal might include mass transit, commercial real estate, and those operating onsite entertainment, educational and retail facilities. While hedged strategies looking for long/short trades in the equity and fixed income markets should better capture relative value trades in this environment, other areas less impacted by the pandemic might also perform well. These strategies include insurance-linked securities, volatility arbitrage and commodities programmes.

How might the upcoming US election and other geopolitical events affect markets?

Global geopolitics will likely drive market action during the fourth quarter of 2020 (and probably early in 2021), particularly the direction and timeliness of the results from the 3 November US elections. As at late September, the polls are indicating a tight race for president. Will we have a clear winner on 4 November, or will the United States repeat the contested election scenario seen in the November 2000 election that led to investor uncertainty?

Recent headlines have also centred on various scenarios as to which party might control Congress. The appointment of an open seat on the Supreme Court is also a hot topic, as the new potential justice may lead to more conservative court decisions that would impact business, consumer and governmental policies for decades.

Adding to these new elements of uncertainty are the ongoing trade tensions between China and the United States, limited progress in the Brexit negotiations and continuing civil protests in various regions of the world. Typically, uncertainty creates above-average market volatility and a heightened shift to safe-haven investments (and portfolio hedges) until more clarity is evident.

We have heard from our hedge-fund managers and strategists that hedge positions have recently ticked up. This is prudent as the policy positions being discussed by both US presidential candidates are far apart. President Donald Trump’s policies tend to be pro-business and beneficial to the energy, consumer, and US domestic supplier and production areas. Democratic nominee Joe Biden’s policies might lead to higher corporate and individual taxes, enhanced regulations on fossil fuel exploration and production, and tighter regulations on technology and health care.

As a result, we believe it is prudent to remain conservative in our portfolio positioning, with a positive outlook for those hedged alternative investments that exhibit a low correlation to the general direction of broader risk assets.

Fourth-Quarter 2020 Outlook: Strategy Highlights

Discretionary Macro

The Fed concluded its policy framework review in August, announcing an awaited shift towards Average Inflation Targeting (AIT). Under the new policy, the Fed will tolerate inflation overshooting the 2% target. While questions remain over the Fed’s ability to generate inflation following several years of undershooting the target, its seemingly structural commitment to accommodative policy may send a clear dovish message to market participants. Against a somewhat conflicted backdrop of lingering economic uncertainty and growing calls for fiscal support, managers focused on macro factors may find attractive trading opportunities over the medium term.

Long/Short Equity Generalist

In months of higher volatility levels, long/short equity funds have generally outperformed the S&P 500 Index.1 The last several years were characterised by relatively low volatility, which challenged long/short equity managers. However, since early 2020, the CBOE Volatility Index (VIX), a measure of the stock market’s expectation of volatility based on S&P 500 Index options, has remained elevated, which could lead to improved returns and alpha against broader benchmarks as managers can take advantage of stock price swings.

Long/Short Credit

The COVID-19 crisis has created both significant challenges for many businesses and, to a lesser degree, new opportunities for others. One way in which these changing conditions manifest is in the outlook for debt issuers and the ability to meet their obligations. The chart below demonstrates the count of ratings changes in the high-yield bond universe made by S&P on a quarterly basis. Credit managers often target ratings changes as a catalyst to realise a thesis on a particular issuer.

An upgrade, for example, can attract a new ratings-sensitive buyer base, allow a company to issue debt at a lower cost of capital, or satisfy criteria for inclusion in an index. Downgrades, of course, can mean the opposite. Given these implications, the absolute number of ratings changes represents a positive for active credit managers, but this particular setup in which downgrades are far more prevalent than upgrades favours those that can also benefit on the short side. In our experience, that ability to generate alpha from a short credit portfolio is a rare skill and therefore requires careful manager selection.

What Are the Risks?

All investments involve risks, including possible loss or principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Investments in alternative investment strategies and hedge funds (collectively, “alternative investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in alternative investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from alternative investments may not adequately compensate investors for the business and financial risks assumed. An investment in alternative investments is subject to those market risks common to entities investing in all types of securities, including market volatility.

Also, certain trading techniques employed by alternative investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, alternative investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in alternative investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these alternative investments invest.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of the publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the US by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Investments are not FDIC insured; may lose value; and are not bank guaranteed.

____________

1. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

This post was first published at the official blog of Franklin Templeton Investments.