by Craig Basinger, Chris Kerlow, Alexander Tjiang, Derek Benedet, Richardson GMP

Everyone likes the sound of something that is unique or even exotic. Would you rather own a fund that invests in equities or one that invests in equities with a call option writing overlay strategy to enhance the yield? Marketers know the second option sounds more appealing and rarely will they mention there is a trade-off as some market environments favour the first option. That is certainly one of the appeals of alternative investments – they are more complex and sophisticated. Implementing strategies that are more complex does have the ability to change the performance and risk metrics, often trading some exposures for others. For example, a long/short strategy reduces overall market exposure but increases the exposure to stock selection. This opens the door to an invaluable tool for portfolio construction/management – as you can generate very different performance streams – and that is diversification.

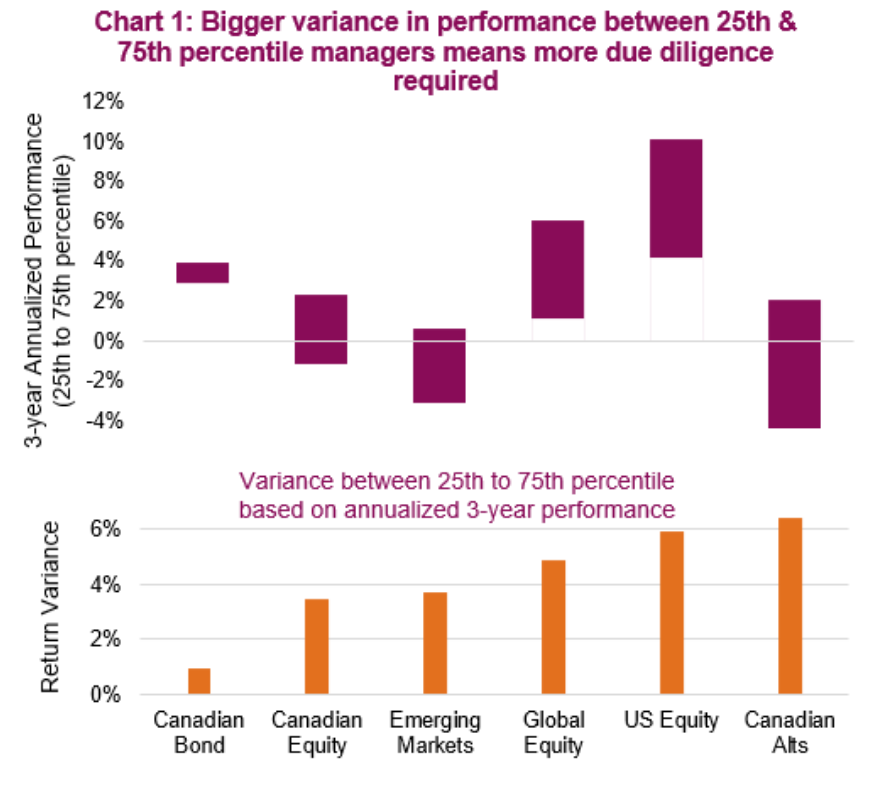

However, with this complexity comes the need for more due diligence, not just on the individual manager/strategy, but also in terms of how it fits with other investments in the portfolio. The fact is, manager due diligence when selecting a bond manager is not that important. The variance of return between the better managers and the less successful managers, isn’t that much (Chart 1). For equity managers, in Canada the variance is slightly bigger but less so than for emerging, global and U.S. equity. Perhaps this is due to the limited equity universe in Canada. However, alternatives (See the bar on the far right within the chart) have a much higher variance between top and bottom managers. Part of this variance comes from such diverse strategies, but this also highlights the importance of picking the right managers.

The higher variance in returns among alternative managers or hedge funds is also due to the variety of strategies. Equity market neutral, long/short, global macro, distressed, event driven, multi strategy and managed futures are some of the sub-categories of this diverse asset class. And even among these buckets, the variance in returns tends to be higher than most other asset classes. The benefit of this variance is of course the prospect of better diversification for a portfolio. Often this is the primary selling feature on why adding alts can benefit a portfolio.

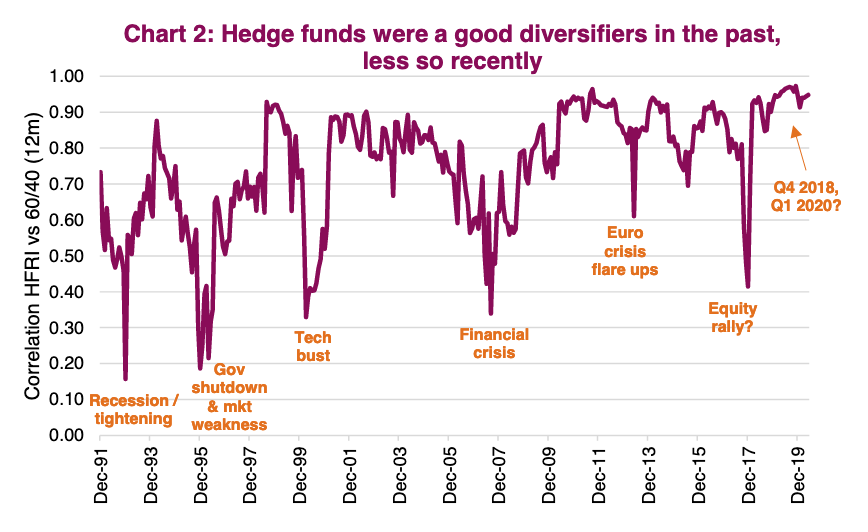

However, this diversification is not as easily found as it once was. Chart 2 is the rolling one-year correlation between the HFR Index (proxy for the hedge fund universe) and a 60% equity/40% bond portfolio clearly shows the benefits of a low correlation during past periods of market turmoil in the 1990s, tech bust and financial crisis. That is when you need your alts to shine. Unfortunately, this has not occurred in the past few years. The dip in correlation in late 2017 was due to a strong equity/bond market. In other words, the correlation dropped because the hedge fund index did not keep up. Worse, there was no drop in correlation to the 60/40 portfolio during the correction in late 2018, nor during the bear of Q1 2020.

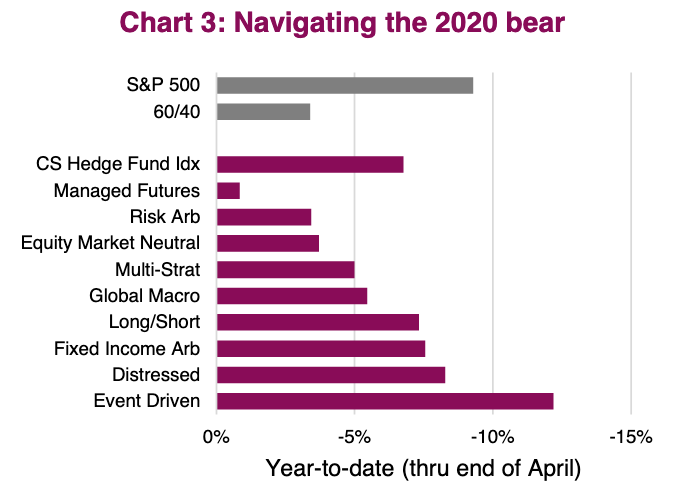

Year-to-date performance of the Credit Suisse Hedge fund index and its sub-categories can be seen in Chart 3 (through end of April as May data is not available yet). As a reminder, 2020 saw strong equity markets in January, very negative markets in February and March with a big bounce in April. While most strategies did better than an all-equity strategy, not by a lot; and clearly not from a diversification perspective compared to a simple 60/40.

Indices & averages can be misleading

Back to the “more homework and due diligence required” advice. Indices are an average, or weighted average, of the performance of its constituents. For the S&P 500, which was down 5% year-to-date through the end of May, many stocks were up while more were down. Similarly, within the hedge fund or alternative universe, the variance is high with some doing better and some doing worse.

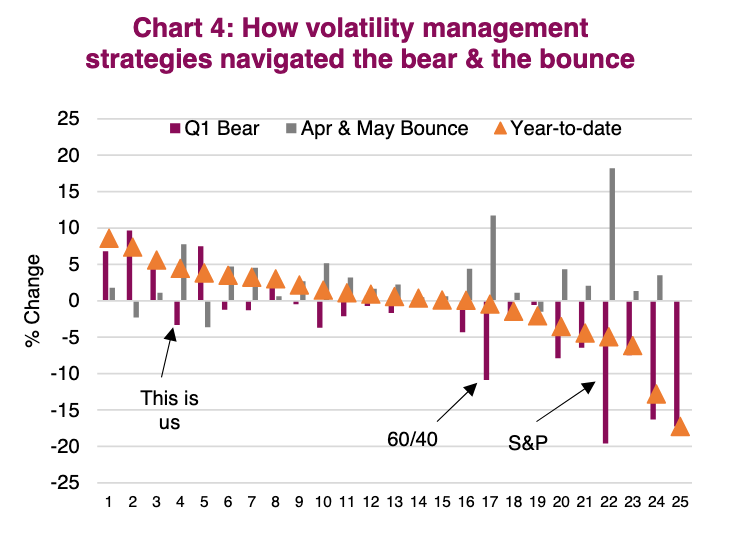

In the summer of 2019, we penned an Ethos entitled “Did alternatives get an F in 2018?” providing some analysis on how poorly many of the more popular volatility-management alts managed the correction of Q4 2018 and subsequent recovery in early 2019. (Click HERE to see this report). We conducted a similar analysis to see how these strategies have faired in 2020.

Chart 4 includes these managers, with the specific names removed, plus we added the 60/40 portfolio and the S&P 500. The good news is that the vast majority of the volatility-management strategies were much less volatile than the equity market and the 60/40 balanced proxy. In fact, many enjoyed positive performance in Q1 or dropped much less than the market. Q1 was the quarter that contained the big market declines. More good news: many captured some of the upside from the bounce back in April and May. Some did not. In fact, some rode the market down and then didn’t enjoy any of the bounce (poor #25).

This further highlights the need to understand a strategy – including how it works, when it will work and when it won’t – during the due diligence process. We can safely say, Alts did not get an F in 2020. Let’s call it a solid B+, with a few that may need summer school.

*****