by Scott Brown, Ph. D., Chief Economist, Raymond James

Consumer attitude measures are divided by political affiliations. That’s nothing new. Sentiment readings have long depended partly on which party occupies the White House. Republicans currently rate economic conditions better, just as Democrats did during the Obama years (Independents fall somewhere in the middle). What’s different is that, no surprise, these ratings are even more sharply divided now. There is another sharp division that matters more. Business sentiment is decidedly pessimistic, while consumer sentiment is generally more robust. How that difference gets resolved will be key in 2020.

Financial market participants have a lot of interest in consumer attitude measures. However, given income, wealth, and the ability to borrow, confidence adds little to the consumer spending equation. That’s not to say that confidence doesn’t matter. Rather, slow or declining income growth will almost certainly coincide with declining consumer attitudes. If consumer confidence was all you had, then it would be helpful in gauging spending. Note that there is a fair amount of noise in the monthly surveys. Changes of a couple of points in either direction are usually not meaningful. The trend is what matters.

Consumer attitude measures have generally remained strong this year, supported by job gains and wage growth, and we should see consumer spending trend at a moderately strong pace in 2020. However, core retail sales growth was weak into October and unit motor vehicle sales were reported lower. That’s not necessarily troublesome. Consumer spending growth tends to be lumpy – a string of strong months followed by some soft months is not unusual.

As one might expect, business attitude measures have weakened steadily this year. The Conference Board’s CEO Confidence Index has fallen to its lowest level in a decade, reflecting tariffs, trade tensions, and slower global growth (factors repeatedly mentioned by the Fed in cutting rates in recent months). Uncertainty is a dampening factor for business fixed investment, and firms have curtailed capital spending plans. As readers are well aware, tariffs are a tax on U.S. consumers and businesses. They raise costs, invite retaliation, disrupt supply chains, and undermine business investment. As the trade conflict drags on, it will have a more lasting impact on business.

The key question is whether continued strength in consumer spending will help to turn around business attitudes and capital spending – or will poor business attitudes feed through to labor market weakness, reducing income and spending? Consumer spending accounts for 68% of GDP. Business fixed investment is a little over 13% of GDP. However, it’s called “the business cycle” for a reason. Recessions are driven mostly by swings in business investment rather than consumer spending (consumer spending never declined in the 2001 recession).

A correction in energy exploration, problems at Boeing, and the GM strike have been contributing factors to recent manufacturing weakness. Beyond that, trade issues and slower global growth have had a dampening effect, but the weakness does not appear to be “recessionary.” Of course, trade tensions could escalate and the global economy could weaken further in 2020.

The danger is that the factors that have affected business investment may feed through to the job market, leading to reduced hiring and eventual job cuts, which will lead to reduced spending, and so on. That’s really hard to predict.

Predicting recessions is a lot like forecasting hurricanes. From July to November, conditions are supportive for hurricane development, and weather forecasters keep an eye on conditions off the coast of Africa. It’s difficult to tell whether disturbances will grow into a hurricane, and if so, where they will make landfall, but hurricanes are easier to forecast as they get closer.

Looking ahead, the broad range of labor market indicators – not just nonfarm payroll – will be key. By construction, the nonfarm payroll data are likely to miss turning points. Weekly jobless claims, corporate layoff announcements, and job openings should provide early indications. However, the job market data are subject to significant distortions from November to March.

Debt is rarely a catalyst for economic weakness, but could become a contributing factor in a recession. Here, the story is also mixed. As the Fed noted in its semi-annual Financial Stability Report, “debt loads of business are historically high, with the most rapid increases in debt concentrated among the riskiest firms amid weak credit standards.” By contrast, “household borrowing remains at a modest level relative to income, and the amount of debt owed by borrowers with credit scores below prime has remained flat.” Consumer debt would become more problematic amid broad labor market weakness, but that’s not the most likely scenario.

Data Recap – Shifting trade policy perceptions remained the dominant factor for the stock market. There were no surprises in the FOMC minutes. While the economic reports were largely ignored, the data remained consistent with a mixed outlook – continued support for consumer spending growth, but ongoing weakness in business investment (this will be a key theme as we head into 2020).

FOMC Minutes from the October 29-30 policy meeting noted that “most participants judged that the stance of policy, after a 25 basis point reduction at this meeting, would be well calibrated to support the outlook of moderate growth, a strong labor market, and inflation near the Committee's symmetric 2% objective and likely would remain so as long as incoming information about the economy did not result in a material reassessment of the economic outlook.” As expected, “some participants favored maintaining the existing target range for the federal funds rate at this meeting.”

The Index of Leading Economic Indicators fell 0.1% in October, the third consecutive monthly decline. The Conference Board emphasizes the six-month percentage change, which has now dipped (slightly) into negative territory: “the current behavior of the composite indexes suggest that the economy will end the year on a weak note.”

The UM Consumer Sentiment Index edged up to 96.8 in the full-month reading for November, vs. 95.7 at mid-month and 95.5 in October. The report noted more pronounced partisan differences among consumers, but there is also a sharp divide between business and consumer sentiment: “one side anticipates a recession, while the other side expects an uninterrupted expansion in the year ahead – there is ample reason for both optimism as well as pessimism, but not the extreme differences voiced by these groups.”

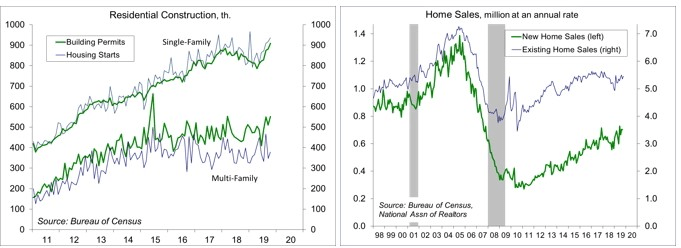

Building Permits rose 5.0% (±1.7%) in October, to a 1.461 million seasonally adjusted annual rate (+14.1% y/y). Single-family permits rose 3.2% (±1.0%), up 7.4% from a year ago. Unadjusted single-family permits for August-October rose 5.4% y/y (-9.7% in the Northeast, +1.2% in the Midwest, +9.4% in the South, and +2.9% in the West). Housing Starts rose 3.8% (±8.7%), with single-family starts up 2.0% (±6.3%), up 8.5% y/y.

Existing Home Sales rebounded 1.4% in October, to a 5.46 million seasonally adjusted annual rate (+4.6% y/y). Unadjusted sales for August- October were up 2.8% from the same period in 2018 (Northwest 0.0%, Midwest +0.9%, South +4.7%, West +3.1%)

Jobless Claims held steady at 227,000 for the week ending November 16, with the four-week average moving up to 221,000, vs. 215,000 at the end of October. Seasonal adjustment is more challenging in November, so the increase does not necessarily represent a meaningful change in job market conditions.

Homebuilder Sentiment edged down to 70 in November, from 71 in October, as a further gain in the West offset a decline in the South. Housing demand remains strong, but supply constraints and affordability issues continue.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report's conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Copyright © Raymond James